Accounts payable turnover ratio (APTR) is a financial ratio of the net credit purchases of a business to its average accounts payable for one year. Accounts payable turnover is simply the number of times a company pays its suppliers in one year.

It can also be used to evaluate how fast or slow a company is paying off its suppliers. Accounts payable turnover is sometimes referred to as the creditor’s velocity or creditor’s turnover ratio. The amounts from average accounts payable and the number of times suppliers are paid a good measure of the short term liquidity of a business.

Accounts payable turnover is expressed in terms of times, and it shows how many times accounts payable are paid over a given period. These average accounts payable a company has in a typical period of one year. Depending on the cash situation of the company, suppliers can either receive their pay faster or slow.

Accounts payable turnover, therefore, can be used to judge the company’s financial status as well as the creditworthiness of a company. Also, we can accounts payable turnover ratio as an indicator of efficient delivery of supplier’s short term debts.

A high accounts payable turnover shows that the company has a desirable policy in its dealings and is probably not taking advantage of its suppliers while a low payable turnover is an indicator of financial distress and it signals that the company has a cash flow problem such that it is not able to pay its bills.

Accounts payable turnover also varies across different companies and industries. To compute accounts payable turnover in days you can use days payable outstanding.

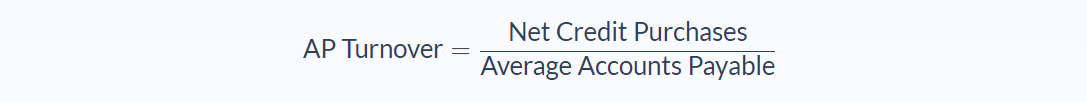

Accounts Payable Turnover Ratio Formula

The figure for net credit purchases is often not very easy to discover because such information is not always available in the financial statements. You should be able to find it in the annual reports of the company.

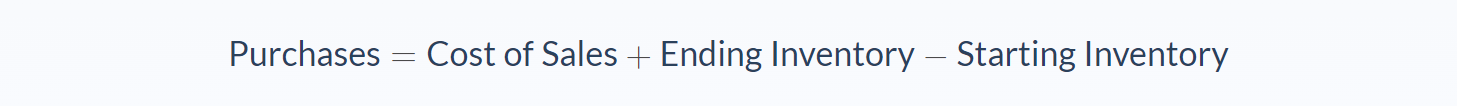

But if the figure for net purchase is missing, the total net purchase can be used instead of credit purchases assuming that for that given period, the company purchased everything on credit. Different authors have stated that the cost of goods sold can as well be used, but how? The cost of goods sold can be used to arrive at net purchases for a company by adjusting it using the begging and ending inventories.

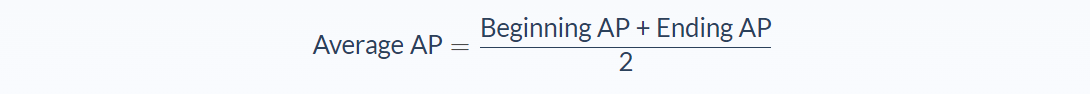

Average accounts payable is found by summing the beginning and ending accounts payable figures, then divide by two. When the opening stock is not given, then only the closing accounts. Notes payable are considered as part of accounts payable, so any time the average of the two is being computed, notes payable are always added to them.

A high APTR shows that the company has a desirable policy in its dealings and is probably not taking advantage of its suppliers, and it is also working so hard to take advantage of the discounts suppliers offer for early payments. A low payable turnover is an indicator of financial distress, and it signals that the company has a cash flow problem such that it is not able to pay its bills. The accounts payable turnover ratio should only be compared with others in the same industry.

Accounts Payable Turnover Ratio Example

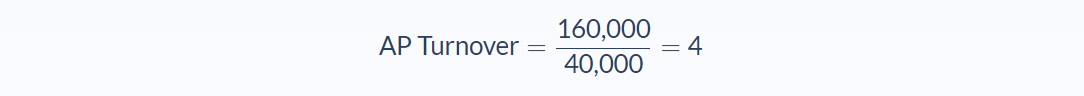

Sarah works for a company in Italy. They published a total of $187,000 as annual credit purchases. They had returns of inventory worth $27,000 for the 2018 fiscal year. Accounts payable for the beginning and end of the year were $30,000 and $ 50,000, respectively. What is the company’s accounts payable turnover ratio?

Now let’s break it down and identify the values of different variables in the problem.

- Net credit purchases = $160,000

- Average Accounts Payable = Unknown

- Though missing, we can calculate the average accounts payable from what we learned above. Upon combining the starting and ending accounts payable, we can divide it by two.

- So, the average accounts payable would be $40,000.

Finally, we can use our formula:

The company was paying its suppliers 4 times annually.

From the examples above, XYZ company has a APTR of 4. If a competitor, ABC Company has APTR of 17, then the one with 17 is said to be paying its suppliers well as compared to the other one with APTR of 4.

Accounts Payable Turnover Excel Template

This accounts payable turnover Excel template lets you quickly calculate the accounts payable turnover ratio and measure the number of times a company pays its suppliers in one year.

Accounts payable turnover ratio is a financial ratio of the net credit purchases of a business to its average accounts payable for one year. Accounts payable turnover is simply the number of times a company pays its suppliers in one year.

It can also be used to evaluate how fast or slow a company is paying off its suppliers. Accounts payable turnover is sometimes referred to as the creditor’s velocity or creditor’s turnover ratio. The amounts from average accounts payable and the number of times suppliers are paid a good measure of the short term liquidity of a business.

How to Use the Excel Spreadsheet

This is a model for beginners to learn how the A/P turnover ratio works. Simply input the following information:

- The net credit sales for the period

- The amount of product returns for the period

- Accounts payable at the beginning of the period

- Accounts payable at the end of the period

- The number of days in a period (usually 365)

The template will then calculate the accounts payable turnover ratio and show you the payable turnover in days value as well.

Accounts Payable Turnover Ratio Analysis

The accounts payable turnover ratio indicates how fast or slows a company pays off its creditors within a specified period. It helps in assessing the creditworthiness of a company. The accounts payable turnover ratio measures how a company is effectively managing its supplier’s bills.

For instance, APTR of 20 means the company has managed to pay its suppliers 20 times in one year. A solid understanding of APTR is of utmost importance, and the need for it is universal for any business person who wants to prosper in dealings with the suppliers.

Apart from the conventionally accepted net credit purchases, some analysts have used several assumptions depending on the information available to use different figures such as the cost of goods sold, total purchases, among others in the numerator of the formula as a proxy to net credit purchases to compute the APTR. This direction is incorrect as several things may be omitted, such as administrative expenses, which also be included; hence this leads to a high turnover ratio.

Different analysts explain a low accounts payable turnover differently, arguing that maybe XYZ Company has a high bargaining power to successfully negotiate for better payment terms with their suppliers, which allows them to make payments less frequently, without any penalty. Therefore, we can assume that XYZ Company is taking advantage of the favorable credit terms extended them by suppliers. This might help them maintain a comfortable cash flow position.

Similarly, high APTR shown by it’s competitor, ABC Company, could mean they’re not reinvesting their earnings into the business to take advantage of the opportunity to increase their growth for future cash flows. In other words, a high or low ratio shouldn’t be taken on face value. Instead, lead investors to investigate further as to the reason for the high or low ratio.

Accounts Payable Turnover Ratio Conclusion

- Accounts payable turnover ratio is the average number of times it takes for a company to pay its suppliers in one year.

- A high result can indicate that the company is paying its suppliers fast and vice versa

- If a company has high bargaining power, then chances of having low result are very high.

- It is important to realize that a financial ratio will vary between industries. You should be comparing to your ratio to the ratios of companies within its industry.

- This formula requires two variables: Net credit purchase and Average accounts payable.

Accounts Payable Turnover Ratio Calculator

You can use the accounts payable turnover ratio calculator below to quickly calculate the number of times in a year a company able to pay its creditors/suppliers by entering the required numbers.

FAQs

1. What is accounts payable turnover ratio?

The accounts payable turnover ratio indicates how fast or slow a company pays off its creditors within a specified period. It helps in assessing the creditworthiness of a company. The accounts payable turnover ratio measures how a company is effectively managing its supplier’s bills.

2. How do you calculate the accounts payable turnover ratio?

The accounts payable turnover ratio is calculated by dividing the net credit purchase (cost of goods sold) by the average accounts payable.

3. What is an ideal accounts payable turnover ratio?

There is no industry-specific answer to this question since the ideal accounts payable turnover ratio varies depending on the type of business. However, a general rule of thumb is that a higher number is better as it indicates that the company is paying its suppliers quickly.

4. Is higher accounts payable turnover better?

There is no definite answer as to whether a high or low accounts payable turnover ratio is better. However, it is generally agreed that a higher number is preferable as it indicates that the company is paying its suppliers quickly.

5. How can you analyze your accounts payable turnover ratio?

The accounts payable turnover ratio should be analyzed in comparison to the ratios of other companies in the same industry. Additionally, it is important to investigate the reasons behind any abnormally high or low ratios in order to determine whether they are indicative of a problem.