When you invest, earn returns on your investments, but haven’t received the returns yet, you have an accrued income. The returns on your investment are “accrued” because you are entitled to the earnings. For example, when you invest in a mutual fund, you may earn money on your investments from a few other investments. However, the mutual fund will hold on to your earnings and pay you only at the end of an accounting period. This accounting period could be anytime from a month to a year. Accrued income also applies to fixed deposits and savings accounts with banks where your savings earn interest at the end of the year.

What Accounting Method is Used For Accrued Income?

Individual investors aren’t the only ones that can earn accrued income. Companies and other investing entities also receive them. Accrual accounting is an accounting method used by companies when they handle accrued income. The accrued income is recorded on an income statement, regardless of whether the company received it or not. The company’s accountant will record the revenue as interest receivable in the accounting book.

Accountants record accrued income is recorded as an asset (from which debits are made) in the balance sheet. On the other hand, they record accrued expenses as a liability.

When is Accrual Accounting Used?

Under the United States’ accounting principles, accrual accounting is used at any point revenue is earned but not received. Revenue is recognized as earned at the time an individual or business creates a contract, regardless of the time it will be received. Therefore, if you sell an item to a customer in January on credit and the person is supposed to pay in February, you will record the revenue from the sale in January, not February. If you are the seller, the income which you have yet to receive will be called accrued revenue.

How to Handle Accrued Income and Accrued Expense

Assume another scenario. In this case, you produce and distribute bathing soap. A customer placed an order for a dozen units of the soap. They placed the order on July 28th. A dozen units of soap were shipped on July 30th but will be delivered to the customer on August 6th. The order is not prepaid, so the customer will pay only after the goods are delivered.

The delivery agent will also earn a commission from you if the items are delivered successfully. The Generally Accepted Accounting Principles, or GAAP, dictates that you will record the revenue from the soap sale as income in July, even though you’ll be paid in August. Also, the commission which the delivery agent will earn is recorded as an accrued expense.

So, the rule is that revenue should be recognized at the time it is made, even though you haven’t received payment. On the same note, expenses are recognized between companies and individuals at the time they are made, even though you haven’t paid out the money.

Accrued Income Examples

Let us use the few examples below to demonstrate the different applications of accrued income in accounting.

Example 1

Green Housing is a real estate company that builds and rents houses both for commercial and residential use. Depending on the contracts, tenants may pay their rents monthly, quarterly, mid-yearly, or yearly. Assume that Green Housing has a deal with Mr. Jack. Mr. Jack is a bricklayer who has agreed to pay yearly for his rent. His annual rent is $1,200. In the contract, Green Housing recognizes that Mr. Jack will pay at the end of the year – after he has used the house. Let us also assume that this contract was signed in January, and Jack’s rent will be due in December.

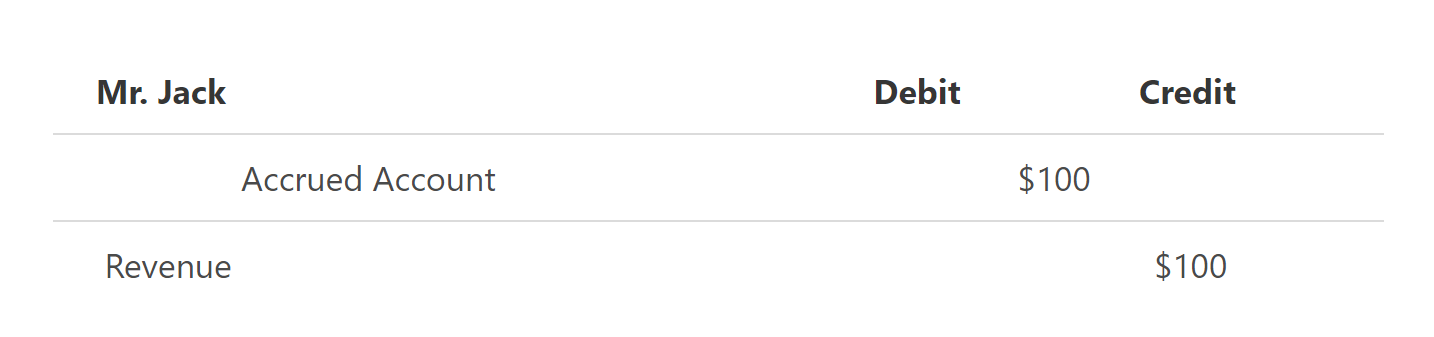

Since Green Housing’s accounting period is one month, it will charge Mr. Jack every month for the months in which he has used the house, although they will not send the invoices to him. At the end of each month, Green Housing will debit $100 from its accrued income account, and credit its revenue account with $100. (Since the yearly rent is $1,200, the monthly rent will be $1,200 / 12 = $100)

Green Housing will bill Jack $1,200 at the end of the year to collect its accrued income. When Jack makes the $1,200 payment, Green Housing will record it as a credit to the Accrued Account, and as a debit to the Cash Account. The Accrued Account will now reset to zero.

Note that at the end of each month, Green Housing earns $100 from Jack for his use of the house, although he is yet to pay Green Housing for the usage. This is the reason Jack will still pay even if he decides to terminate the contract after six months. Jack will have to pay the revenue, which Green Housing has already earned in the six months he used the house.

Example 2

Let us illustrate how accrued income also applies to individuals.

Let’s say you work for a shoe manufacturing company, and they pay you $300/week. For each day you go to work, you earn an accrued income. The company can decide to pay you your wages daily. However, the company delays your income and pays you at the end of the week. If you choose to work three days a week, the company will still pay you for the three days because you earned it on the days you came to work. After your payment at the end of the week, your accrued income will reset to zero.

Summary

- Accrued income is income that is recognized even though a company or individual has not received it yet.

- An accrued expense is an expense made even though a company or individual has yet to make the payment.

- Accrued income is recorded as a debit in the Accrued Account and as a credit in the Revenue Account.

- When accrued income is finally received, it becomes a credit in the Accrued Account and a debit to the Cash Account.

FAQs

1. What is accrued income?

Accrued income is a term used in accounting to describe income that has been earned, but not yet received. The returns on your investment are “accrued” because you are entitled to the earnings.

2. Why is it important to record accrued income?

Recording accrued income is important because it allows companies and individuals to track their income more accurately. This information is important for budgeting and cash flow projections. Also, if a company or individual decides to terminate a contract early, they will still have to pay for the services or goods that were already provided.

3.How is accrued income recorded in accounting?

Accrued income is recorded as receivables in the Accounts Receivable (AR) section of the Balance Sheet to reflect the money that is owed to the company or individual. It is also recorded as income in the Revenue section of the Income Statement.

4. Is accrued income a current asset?

Accrued income is a current asset because it is owed to the company or individual in the near future.

5. What are examples of accrued income?

Examples of accrued income can include wages earned but not yet paid, rent earned but not yet paid, and interest earned on a bond but not yet received.