The Average Cost Method, also commonly referred to as the AVCO method, is a method used to find the average cost of items recorded in an inventory. As it is with any average method, AVCO takes the total costs of all goods in your inventory and divides it by the total number of items in the inventory at that time.

You can find the total cost of goods available for sale by multiplying the price of each product by the number of that product available and adding everything up.

Learn why investing is the only realistic path to solving climate change.

The Average Cost Method is only applicable when conducting an inventory of products that are both minor and distinct, like in property business. You cannot use this method when dealing with important or very costly items. In that case, you would use the actual unit cost method.

The weighted average cost is also used when dealing with the AVCO method. It is calculated by dividing the total cost of inventory by the total number of items in inventory.

AVCO in Perpetual and Periodic Inventory Systems

The AVCO method can be used in two inventory systems, periodic and perpetual. It works differently with each system. In a periodic inventory system, the evaluation of inventory is done periodically or at specific intervals. With the perpetual inventory system, sales records are done as soon as the goods are acquired or produced.

When dealing with a periodic inventory system, you have to first calculate the weighted average for the whole inventory. You can find the result by multiplying the weighted average cost per unit and the number of units sold to get the COGS (cost of goods). Then, multiply the weighted average cost per unit by the number of units in ending inventory to get the value of ending inventory.

Because each purchase is recorded immediately in a perpetual inventory system, we also calculate the weighted average cost per unit before we make a new sale.

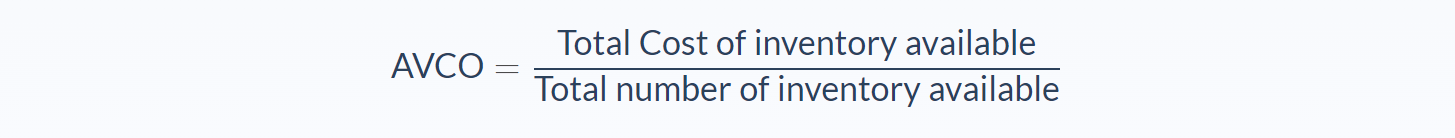

AVCO method uses the formula below

In this method, we assume that there is a collective inventory, and there is no unique price for each batch. This is why the average cost is taken instead of individual costs.

Examples of AVCO

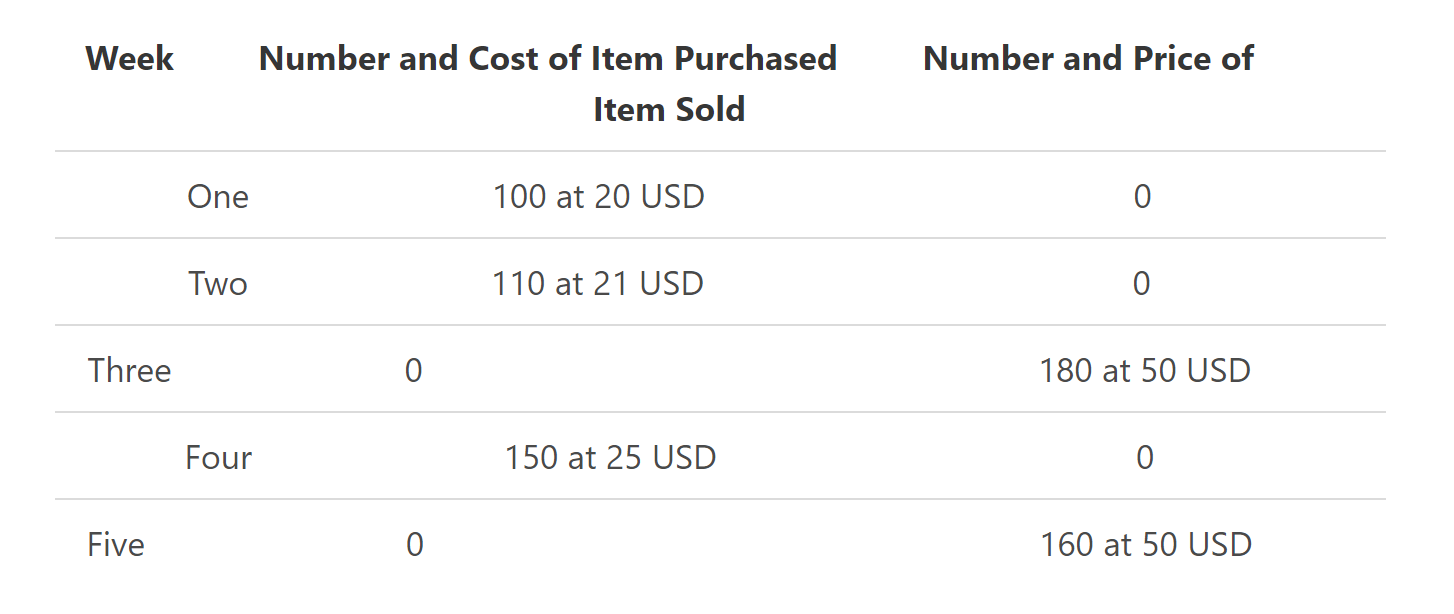

Using the data available in the table below, find the COGS and ending inventory after five weeks.

Solution

- Total number of items in inventory = 100 + 110 + 150 = 360 items

- Total number of items sold = 180 + 160 = 340 items

- Total number of items in Ending inventory = 360 -340 = 20 items.

Weighted average unit cost is calculated periodically:

- Week one is 100 x 20 = 2,000

- Week two is 110 x 21 = 2,310

- Week four is 150 x 25 = 3,750

Total Weighted average:

- 8060/360 = 22.39

The total cost of goods sold (COGS):

- 340 x 22.39 =7,612.6.

Ending inventory:

- 20 x 22.39 = 447.8

Perpetual Inventory System Calculation

Now, let’s find the COGS and ending inventory using the perpetual inventory system. The average cost is calculated based on the assumption that each purchase and sale is recorded every two weeks.

Week One is 100 x 20 = 2,000

Week Two is 110 x 21 = 2,310

Total units purchased for week one and two is 210, the average unit cost is 20.52 USD, and the total cost is 4,310USD. In week three, we sold 180 items at 50 USD, which means we are left with 30 items.

For Week Three, the total COGS is 180 x 20.52. The total cost of what was left was 30 x 20.52 = 615.71USD.

For Week Four, we see that 150 x 25 = 3,750. The total items available for sale in week four will be 30 + 150 =180. The total cost will be 3,750 + 615.71 = 4,365.71. The average unit cost for the week will be 4,365.71/180 = 24.25.

In Week Five, 160 items are sold. 20 items are left. The total cost of the goods will be 20 x 24.25 485.08. The total COGS is 160 x 24.25 = 3,880.

AVCO Usage and Implications

When using the AVCO method, factors like economy, quality, and quantity of goods produced or purchased, among others, have to be taken into consideration. In an inflating economy, the price of products will keep rising, and large purchases are made closer to the end; the average cost will be very high. If items are produced or purchased at the beginning of the calculation, the average cost will be lower.

But, in an economy experiencing deflation, making a large purchase at the end of the calculation will give a much lower average that making a large purchase at the beginning of the calculation.

As you may have deduced, the periodic inventory system and the perpetual inventory system both yield slightly different results when calculating the average cost of items. A company may choose to work with any of the inventory systems when using the AVCO method.

In a periodic inventory system, the inventory is done at specified intervals. It is faster to calculate in bulk. The average cost uses all the items that are available for sale and calculates the average cost of all of them at once. With the perpetual inventory system, each time a transaction occurs, the average cost is recorded. Automated systems can figure this out for you, as it is a repetitive process.

Conclusion

The Average Cost Method is an accounting technique used to find the average cost of items recorded in the inventory. As it is with any method using averages, AVCO takes the total costs of all goods in your inventory and divides it by the total number of items in the inventory at the time of the calculation.

You find the total cost of goods available for sale by multiplying the price of each product by the number of that product available and adding everything up.

When solving an accounting problem using the AVCO method, check for the perpetual or periodic inventory system. If the value of items sold and inventory balance has to be calculated every time a new purchase is made, then you are dealing with a perpetual inventory system.

If the value of items sold and inventory balance has to be calculated after a certain period of time, then use the AVCO method for periodic inventory.

FAQs

1. What is the average cost method?

The average cost method is an accounting technique used to find the average cost of items recorded in the inventory. This is done by using the average cost of all goods in the inventory.

2. How do you calculate the average cost method?

AVCO method uses the formula below:

AVCO = Total number of inventory available / Total cost of inventory available

3. Why use the average cost method?

This method is best used to figure out the average cost of items that have been recorded in a perpetual inventory system. With this, each transaction would be recorded, and the formula will calculate the average cost of all goods.

In addition, the average cost method is a very easy way to calculate the cost of goods sold or inventory turnover. This method can be used for both simple and complex transactions.

4. When to use the average cost method?

The average cost method is best used when figuring out the amount of inventory remaining. This will be useful if you are trying to prepare your company's year-end income statement, especially for businesses using a perpetual inventory system.

5. What is the average cost example?

Let's say you own a company that makes cupcakes. You want to figure out the cost of goods sold for this month, so you use the AVCO method with the following data:

TOTAL number of cupcakes available = 3,000

The total cost is $120,000.

The average cost would be calculated as follows:

3,000/120,000 = 0.025 or 2.5 cents per cupcake