Capital is the financial resource that a company utilizes to fund its operations. Capital allows you to produce products or sell services to your customers.

What Does Capital Mean?

Capital is a resource that all businesses need to operate. A company can raise capital by issuing stocks or bonds to the market. Capital is usually held in deposit accounts, or it is the physical assets of the company.

Capital can be raised through debt or equity financing or by holding financial assets. The balance sheet shows a business capital in the current assets or long-term assets capital assets include:

- Cash

- Cash equivalents

- Marketable securities

- Manufacturing equipment

- Production facilities

- Storage facilities

Capital is a crucial part of operating and growing a business. The growth of the company will be determined by how they manage their working capital and invest other capital

Business Capital Structure

To be profitable, businesses use capital to operate daily. The balance sheet gives you a review of the business capital that is split out between assets, liabilities, and equity. The balance sheet can be used as a metric to analyze the capital structure of a company.

Debt financing is a capital asset that needs to be repaid over time. Debt capital comes with lower rates of return.

Equity Financing is displayed in the equity section of the balance sheet.

You can determine a business’s capital structure by working out the weighted average cost of capital, debt to equity ratio, debt to capital ratio, and the return on equity.

Types of Capital

The top four types of capital are listed below:

Debt Capital

Definition: Debt capital is when a company acquires debt through private or government sources to fund and invest. Sources of debt capital include family, friends, banks, insurance companies, and other companies that lend money.

To apply for debt capital, you need to have a credit history. Debt capital requires regular payment with interest to repay the debt. The interest rate will be based on your credit history.

Equity Capital

Equity could have different forms like private, public, and real estate equity. Public and private equity comes in the form of shares, public capital comes from stocks issued on the open market, and private capital comes from investors or owners.

Working Capital

Working capital is the liquid assets of the company. The working capital measure how liquid the company is in the short-term with regards to covering their debit accounts payable and any other obligations that could arise in that year.

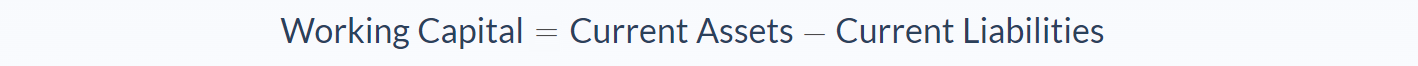

The formula to work out the working capital is:

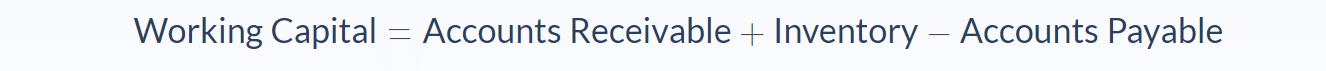

You can also calculate it by using:

Trading Capital

Trading capital is capital that is traded daily.

Capital vs. Money

Money and capital are not the same things. Capital is a longer-lasting resource, for example, equipment, buildings, machinery, and land, where money can be used to produce a product or build wealth. Capital usually comes with a cost; it is, however, deployed to assist with a company’s development and growth.

Example

Sandy is the owner of a large business with different product lines in the steel industry. Sandy wants to build a new factory that needs to be funded by the end of 2021. The managers submitted various proposals amounting to $100,000. This considerable expense needs to be supported to expand the operations. Sandy needs to find different sources to fund the capital; the options are cash and short-term investments such as company stock.

The business needs to consider the cost of the capital and what would be the best way forward. The accountants suggested the following capital structure to fund the project. $20,000 of cash available in the company, $40,000 of the company bonds should be used, and they need to issue an amount of $40,000 in new stock to their investors

In utilizing these capital resources, Sandy will be able to raise the funds needed to build the new factory and produce more income in the future.

Conclusion

- Capital is the financial resource that a company utilizes to fund its operations.

- Capital is a resource that all businesses need to operate

- Capital can be raised through debt or equity financing or by holding financial assets.

- To be profitable businesses needs capital to operate and create returns

- Types of capital are debt, equity, working and trading capital

- Money and capital are not the same things. Capital is a longer-lasting resource, for example, equipment, buildings, machinery, and land, where money can be used to produce a product or build wealth.

FAQs

1. What is capital?

Capital is a resource that all businesses need to operate. It can be raised through debt or equity financing or by holding financial assets. To be profitable, businesses need capital to operate and create returns. Types of capital are debt, equity, working, and trading capital.

2. How is capital used?

Capital is used to finance a company's operations. This can include purchasing assets, expanding the business, or covering expenses. Capital is also important for generating returns and building wealth over time.

3. What are the types of capital?

There are three types of capital: debt, equity, and private.

Debt capital is money that is lent to a company and must be repaid with interest. Equity capital is money that is invested in a company in exchange for shares of ownership. And private capital is money that comes from investors or owners.

4. What are the sources of capital?

There are three primary sources of capital: debt, equity, and private.

5. Is capital the same as money?

Money and capital are not the same things. Money is a medium of exchange that can be used to purchase goods and services. Capital is a longer-lasting resource, for example, equipment, buildings, machinery, and land. It usually comes with a cost; it is, however, deployed to assist with a company's development and growth.