The cash flow coverage ratio represents the relationship between a company’s operating cash flow and its total debt. It serves as a metric that determines a company’s ability to pay its liabilities within a certain period.

When computing the cash flow coverage ratio, analysts rarely use cash flow from financing or investing. A business with a well-leveraged capital structure often has a fair volume of debt to settle. That it would use its debt capital to wipe out its debt is unlikely; hence, financing cash flow is never involved in the calculation. Investing cash flow is not typically used in calculating the ratio either, considering investing activities are outside a business’ key cash-yielding processes.

Experts advise using a cash flow value that most accurately reflects the business’ fiscal position, and that is none other than cash flow derived from the company’s actual daily operations. Needless to say, accuracy in calculating this value is critical as errors can lead to wrong decisions that can complicate the company’s financial position, especially if it is already struggling with debt.

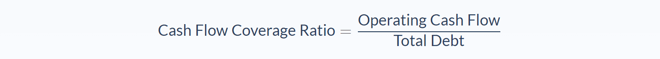

Cash Flow Coverage Ratio Formula

To obtain this metric, the sum of the company’s non-expense costs is divided by the cash flow for the same period. This includes debt repayment, stock dividends, and capital expenditures.

The cash flow would include the sum of the business’ net income. You can also use EBITDA (earnings before interest, taxes, depreciation, and amortization) in place of operating cash flows.

The ideal ratio is anything above 1.0. However, the types of debt payments involved in the computation should also be taken into account. This is especially true if the company’s debt for the studied period is extraordinarily large. Conversely, a ratio lower than 1.0 shows that the business is generating less money than it needs to cover its liabilities and that refinancing or restructuring its operations could be an option to increase cash flow.

In some cases, other versions of the ratio may be used for other debt types. For example, to compute for short-term debt ratio, operating cash flow is divided by short-term debt; to calculate dividend coverage ratio, operating cash flows are divided by cash dividends; and so on. For the cash flow coverage ratio, only cash flow from operations should be used for maximum accuracy.

Cash Flow Coverage Ratio Example

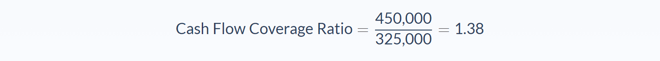

Let’s say a retail company is planning to expand with two new outlets and would like to know if they are financially ready for it. They review their books and find that in the last fiscal year, they had an operational cash flow of $450,000 and a total debt of $325,000. What is their cash flow coverage ratio?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Operating Cash Flow: 450,000

- Total Debts: 325,000

We can apply the values to our variables and calculate the cash flow coverage ratio using the formula:

In this case, the retail company would have a cash flow coverage ratio of 1.38.

A cash flow coverage ratio of 1.38 means the company’s operating cash flow is 1.38 times more than its total debt. This is more or less acceptable and may not pose issues if the business were to operate as-is and at least sustain its current position. But expansion is far too risky at this point, considering the company makes only 1.38 times more money than it owes.

With a greater ratio, given its higher operating cash flow against its total debt, the company could be financially stronger to increase its debt repayments. Otherwise, it will have to put off any expansion plans until its numbers improve.

Cash Flow Coverage Ratio Analysis

The Cash Flow Coverage Ratio is a good metric that companies can use to help assess their fiscal position. They can check it before making crucial decisions like when to pursue or hold off expansion plans; how to improve their debt management strategies; or to determine whether or not resources are used properly for maximum cash flow.

A company needs to monitor its cash flow for long-term fiscal health. One of the ways to do that is by calculating its cash flow coverage ratio. This metric can be used alongside other indicators, such as fixed charge coverage, and can be crucial for companies that are mired in debt or undergoing rapid growth.

In any case, when the cash flow coverage ratio is high, that means the business is financially solid and has the capacity to fast-track its debt repayments if needed. Accelerating debt repayments allows the company to use more of its profits sooner for added capital and increased cash flow. Conversely, a low ratio means there is a good chance the business will fail with interest payments. This generally means the business is financially weak.

A cash flow coverage ratio serves more purposes in the world of business. Aside from being a good indicator of a company’s ability to pay off its liabilities, bankers and lenders may also use it to assess a business entity’s credit-worthiness. For investors and creditors, it helps determine whether or not dividends and loans will likely be paid on time. Usually considered last during business liquidation, shareholders can refer to this number to calculate dividends and decide if they should receive more. A higher ratio usually means more dividends for distribution).

Overall, the cash flow coverage ratio examines a company’s income and whether or not resources are being maximized to produce the best potential operating cash flow. This insight also helps decision-makers weigh factors that affect both their short-term and long-term operations and goals. In addition, it provides a historical perspective on the business. For instance, how its debt-payment ability has improved over time, or what can be done to improve it.

Cash Flow Coverage Ratio Conclusion

- The cash flow coverage ratio measures a company’s ability to pay its liabilities over a certain period.

- This formula requires two variables: operating cash flow and total debt.

- The cash flow coverage ratio is expressed as a number that represents how much more income a company has with respect to its total debt for a certain period.

Cash Flow Coverage Ratio Calculator

You can use the cash flow coverage ratio calculator below to quickly determine your company’s ability to pay off your debts by entering the required numbers.

FAQs

1. What is the cash flow coverage ratio?

The cash flow coverage ratio is a financial metric that calculates the amount of net income available to cover debt payments.

In other words, it can be used as a measure of a company’s ability to make its interest payments.

2. How do you calculate the cash flow coverage ratio?

The cash flow coverage ratio is calculated as the following:

Cash Flow Coverage Ratio = Operating Cash Flow / Total Debt

3. What is a good cash flow coverage ratio?

Typically, the cash flow coverage ratio for most businesses should be at least 1.5x. This means that there is at least $1.50 in operating cash flows to pay off every $1 of interest payments.

If the ratio falls below this, then it may indicate that a company is struggling to finance its debt or underperforming when it comes to its debt management.

4. Is the cash flow coverage ratio the same as the debt service coverage ratio?

No, the cash flow coverage ratio is different from the debt service coverage ratio.

The latter measures a company’s ability to cover its interest payments or principal repayment obligations. To do this, it also considers information about how much interest expenses are relative to its income.

5. Is a high cash coverage ratio good or bad?

A high cash coverage ratio is usually good for a company. Having more income available to make interest payments means that it has the capacity to pay off its debt faster.

It also suggests that the company can reinvest in itself or acquire other entities without facing liquidity issues. On the flip side, low ratios are bad because they indicate that there is not enough income to cover the debt.