Cash to current assets is a liquidity ratio that measures how much of the current assets in a company are made up of cash and cash equivalents.

The current assets of a company refer to any asset that can quickly be sold or consumed in less than twelve months. Companies depend on such assets to pay for their day-to-day operations, such as employees’ salaries and other short-term liabilities.

Current assets include cash and cash equivalents, short-term investments such as marketable securities, accounts receivable, inventories, and prepaid expenses. Cash and cash equivalents and marketable securities form the most liquid current assets and can generally be referred to as “cash”. When we compare cash to the total current assets of a company, we get cash to current asset ratio.

This ratio allows investors or analysts to understand exactly what percentage of cash resides in current assets. This ratio is considered the most conservative measure of a company’s ability to pay off liabilities.

A high or increasing ratio implies that a higher percentage of the company’s current assets are in the form of cash and other highly liquid assets. This is always a good sign of efficient operations.

Low cash to current assets ratio means that the company has a small amount of highly liquid assets hence might depend on other forms of current assets like accounts receivable to pay off its debts

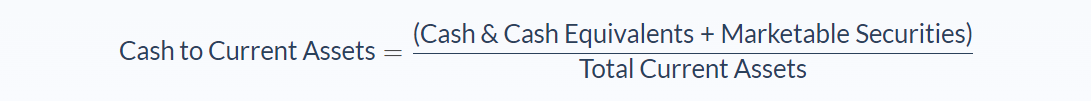

Cash to Current Assets Ratio Formula

Cash and cash equivalents are the most liquid assets of a company which can be converted into cash within three months or less.

Marketable securities are those temporary investments of a company which can be converted into cash in less than three months.

All of the information required to calculate the cash to current asset ratio can be found on the company’s balance sheet.

Cash to Current Assets Ratio Example

HOH Company Limited has been working on increasing its ability to meet its short-term obligations with cash while reducing its over-dependence on the sales inventory and accounts receivable. After working on this for two years, the company published a balance sheet with the following information:

They have cash and cash equivalents of $900,000. They have short-term marketable securities of $250,000. Their accounts receivable amount is $506,000 with an inventory of $440,000. Use the information to compute cash to the current asset ratio of the company.

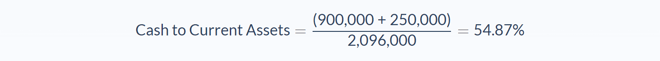

Now let’s break it down and identify the values of different variables in the problem.

- Cash and cash equivalents = $900,000

- Short-term marketable securities = $250,000

- Total Current Asset = $2,096,000

Next, we can apply those variables and use the formula below:

This ratio tells us that about 55% of HOH Company’s total current assets are in the form of cash and other highly liquid assets.

Cash to Current Assets Ratio Analysis

Current assets of the company are made up of cash and cash equivalents, marketable securities, inventories, accounts receivable, and prepaid expenses. Out of all these current assets, cash and cash equivalents and short-term marketable securities are always termed as the most liquid assets. They can always be turned into cash within a maximum period of three months.

When you decide to compare these most liquid current asset instruments against the total current assets, we get the cash to current asset ratio. Therefore, the cash to current asset ratio shows what proportion of the total assets is constituted by the most liquid assets. Computing this ratio is considered an extremely conservative view of current assets. This is because it eliminates the need to rely on sales of inventory or the collection of accounts receivable from customers. Be watchful not to include marketable securities which mature within more than three months.

This ratio allows an investor or analyst to understand what percentage of cash resides in current assets, allowing investors to understand the ability of the company to pay off its accounts payable.

A low ratio means that the company has a small amount of liquid assets. As a result, it might depend on other forms of current assets like accounts receivable to pay off its debts. In contrast, a high ratio, implies that a higher percentage of the company’s current assets are liquid assets. And depending on the industry, a high ratio is an indicator of the effectiveness of a company in converting its non-liquid assets, such as inventory, into cash.

Generally speaking, a high ratio means that the company is generating enough cash flow from ongoing operations to keep the company in a financially sound position in the future. However, too high of a ratio might indicate that the firm is not allocating sufficient resources to grow its business, exposing the company to financial risk in the future.

Cash to Current Assets Ratio Conclusion

- Cash to current asset ratio is a liquidity measure used by companies to compare available cash to its current assets

- This ratio is an extremely conservative view of current assets as it doesn’t rely on sales of inventory or the collection of accounts receivable.

- High ratios mean a higher percentage of the company’s current assets are liquid assets which is a sign of efficiency.

- Low ratios imply that the company has a small amount of liquid assets and might depend on other current assets to pay off its debts.

- The cash to current asset ratio requires only current assets which vary depending on the industry.

Cash to Current Assets Ratio Calculator

You can use the cash to current asset ratio calculator below to quickly calculate the current asset to cash ratio by entering the required numbers.

FAQs

1. What is cash to current assets ratio?

The cash to current assets ratio is a liquidity measure used by companies to compare available cash and its current assets.

2. What is the formula for the cash to current assets ratio?

The cash to current assets ratio can be calculated by dividing the cash and marketable securities by total current assets.

3. What is a good cash to current assets ratio?

Generally, the cash to current assets ratio should be high in order to show that the company has enough cash available to pay its short-term liabilities.

4. What is the difference between the cash asset ratio and the current ratio?

The cash to current assets ratio is the liquid measure of the company's ability to pay off its debts while the current ratio looks at all important current assets and liabilities.

5. What is a bad cash to current assets ratio?

A low cash to current asset ratio signifies that there isn't enough money in the business for paying off debts when they become due. Looking at the cash to current assets ratio can help you determine if this is a problem.