A check register, also known as a cash disbursement journal, is the journal that records all the checks, cash and cash outlay during an accounting period. A check register usually includes the dates, check number, the person that paid, account names, and the credit and debit associated with the transaction.

What is a Check Register?

Transactions are recorded in the check register before any business transactions are recorded in the general ledger. The most common accounts in the check register depend on the type of company.

Retailers will make payments to inventory, accounts payable and salary expenses. Manufactures will have entries for raw materials purchases and production costs. The journal shows the accounts that are debited and credited in each transaction. It also shows the overall effect on the cash balance.

Advantages of a Check Register

- A check register will usually show a running balance in the checking account. In that way, it’s like a real-time record of the bank account. The bookkeeper can check the total bank balance as well as the check register to ensure that they align.

- Management uses the journal to track what the cash has been used for. It is also used to see how much money was spent. Management can use the data to determine the ratio of cash that is spent on inventory compared to the amount of money being spent on paying other bills.

- The check register includes the check numbers, management can look at the journal to see if there are any missing or incorrectly written checks.

Disadvantages of a Check Register

- Digital payments and receipts – technology has advanced in the past three decades making, the chequebook increasingly redundant. Transactions are mostly secured online, and it is effortless to access the records of those transactions. All files are stored electronically, and you have access to is all year around.

- The check register does not consider any transactions that are happing outside of the chequebook. Even though the check register presents you with a final balance, this balance needs to be reconciled with the bank to get an accurate figure.

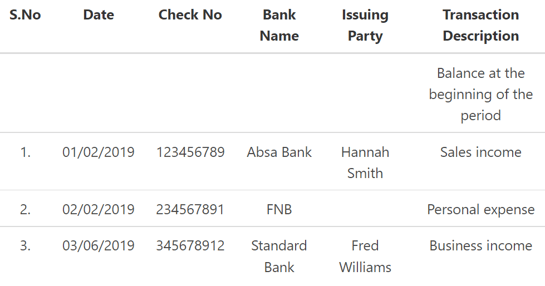

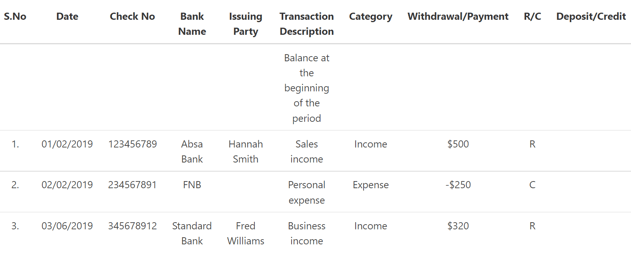

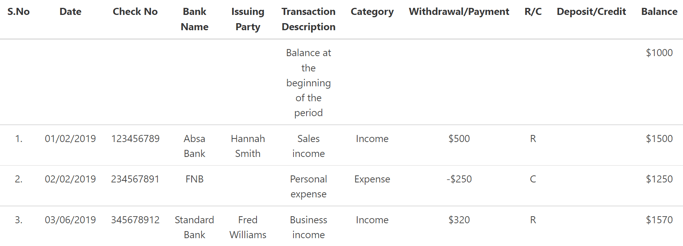

Check Register Example

A Chequebook Register Template can keep track of any funds that come into or leave the bank account through checks.

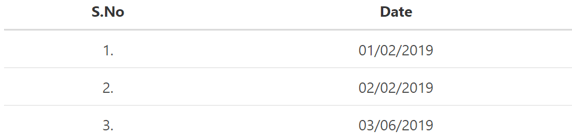

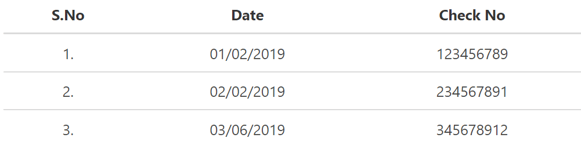

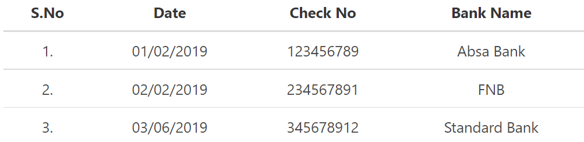

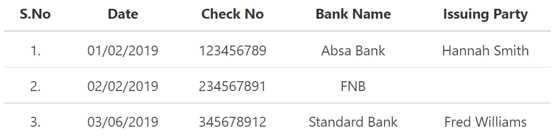

Let’s look at the essential elements on the check register.

- Date – is a field where the user will enter the date

- Check No – the user will fill in the check number for incoming or outgoing checks. The check number is a unique identifier. This unique identifier makes it easier to track transactions.

- Bank Name – the field needs to contain the bank that the check belongs to.

- Issuing Party – this field is used for incoming checks. The name of the issuing party of the check is filled in. Outgoing checks should be left blank.

- Transaction Description – this field is critical because it shows the nature of the transactions that are happening. It could be a sale, expense or another business or personal income or expense.

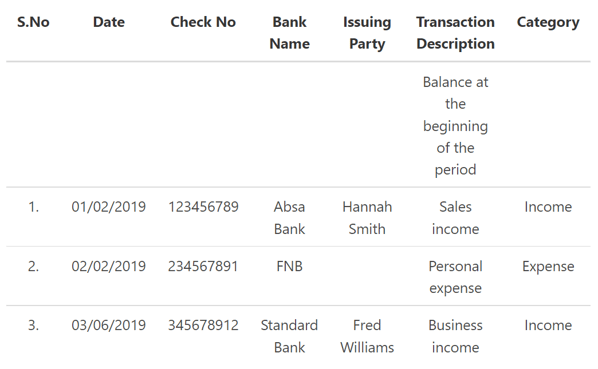

- Category – every payment or income is defined by a category which is filled into this field. The categories can be broad or specific. You can specify the categories based on your business size and the nature of the transactions.

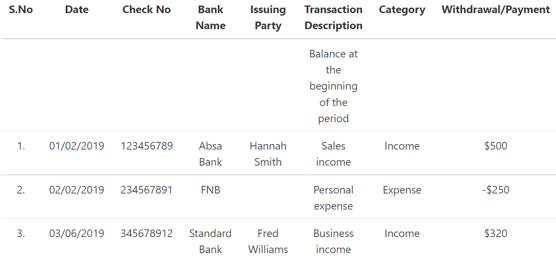

- Withdrawal/Payment – this field will be populated with amounts of the income or expenses of the company.

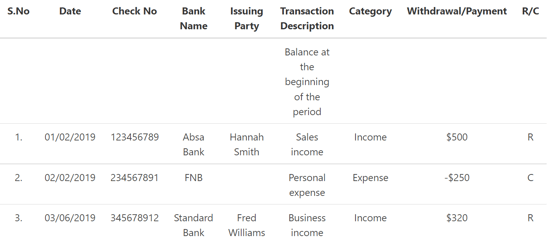

- Reconciled/Cleared – Cleared means that a transaction has been settled in the banks. Reconciled implies that the user has verified the account against his records. Use the words cleared or reconciled in the column.

- Deposit/Credit – this field is used for incoming checks, and it will be a credit in the bank account.

- Balance – The balance is set at each date of the transaction. Leave the field blank if there is no withdrawal/payment and deposit/credit field.

Check Register Conclusion

- A check register, also known as a cash disbursement journal, is the journal that records all the checks, cash payment and cash outlay during an accounting period.

- Transactions are recorded in the check register before any business transactions are recorded in the general ledger.

- Advantages include a running balance of all check payments, managers can use the date to track cash, and reconciliation of check numbers.

- Disadvantages includes a system that is outdated due to technology advance in online banking, check registers do not contain any transactions outside of the chequebook.

FAQs

1. What is a check register?

A check register, also known as a cash disbursement journal, is the journal that records all the checks, cash payment and cash outlay during an accounting period.

2. What are the benefits of using a check register?

Some benefits of using a check register include the following: a running balance of all check payments, managers can use the date to track cash, and reconciliation of check numbers.

3. When do you use a check register?

A check register is generally used when recording transactions before any business transactions are recorded in the general ledger. For example, a business may use a check register to track cash payments for inventory or other expenses.

4. How do you fill out a check register?

To fill out a check register, you first need to record the date of the transaction. Next, you need to record the name of the bank where the check was written. After that, you need to list the name of the person or company who received the payment. Finally, you need to list the description of what the payment was for (e.g. rent, inventory, etc.).

You should also include the category of the transaction (e.g. income, expense, etc.) and whether it was a withdrawal or payment. You can also include a column for the balance at the beginning of the accounting period. This will help you track the changes in your account balance over time.

5. Where can I buy a check register?

You can purchase a check register at most office supply stores. You can also find them online.