A classified balance sheet is a financial statement that reports the assets, liabilities, and equity of a company. It breaks each account into smaller sub-categories to provide more value for the user of this report.

There are no set criteria on how many sub-categories can be created and it will ultimately depend on what level of detail is required by the management. The two most common categories that are used in a classified balance sheet are current and long-term.

Classified Balance Sheet Template

Throughout this series of financial statements, you can download the Excel template below for free to see how Bob’s Donut Shoppe uses financial statements to evaluate the performance of his business.

Purpose of a Classified Balance Sheet

Some of the advantages include:

- The investors and creditors can use the classified balance sheet for ratio analysis purposes. Since the assets and liabilities are broken down into current and long-term, therefore ratios like the current ratio can provide a lot of insights into understanding the current financial position of a company.

- A classified balance sheet also provides a clear and crisp view to the user.

- Easier for the auditors and regulators to review the statements as well.

- Traditional balance sheets only list down the assets, liabilities, and equity without any classification or breakdowns. The classified balance sheet is more dynamic and detailed in this regard.

Classifications

There is no specific requirement for the amount of classifications that can be included in this type of balance sheet. The most common classifications are as follows:

Current Assets

These are short-term resources that are utilized within the operating period, usually a year. They are required for the daily operations of the company. They can vary in their liquidity as some items will be more liquid than others. For instance, short-term securities held for sale will most likely be more than liquid than accounts receivable or inventory. However, overall, current asset items are still relatively more liquid in nature than fixed assets or intangible assets.

- Cash and cash equivalents

- Inventory

- Accounts receivable

- Prepaid expenses

- Investments

- Short-term assets held for sale

Long-Term Investments

If a company has surplus cash available and it sees a valuable investment opportunity in some other business, it can decide to buy a stake in it.

- Investments and stakes in other companies

Fixed Assets

These have a longer useful life than the current assets and are expected to not only be utilized in the current financial period but also in the years thereafter. They are usually reported on their book value which is calculated by subtracting accumulated depreciation from the gross purchase value. There are different methodologies for determining depreciation expense for the period, amongst which the most used are straight line and declining balance methods. Some examples of fixed assets include:

- Plant, property and equipment (PP&E)

- Furniture and fixtures

- Renovations and leasehold improvements

- Machines

- Computer software

- Computer hardware infrastructure

- Accumulated depreciation

Intangible Assets

This is the third category of assets and has a multi-period life. They are different from fixed assets in two ways. Firstly, intangible assets do not have a physical structure or substance. Secondly, intangible assets do not usually get depreciated over time like the fixed assets. Many companies have seen the value of their intangible assets grow over time. Some common items are:

- Goodwill

- Trademarks

- Patents

- Tradenames

Current Liabilities

Like current assets, the current liabilities only have a life span of one accounting period, usually a year. These are short term debt obligations that need to be paid back either by utilizing the current assets or by taking on new current or long-term liabilities. The current liabilities can be of interest and non- interest bearing nature.

- Accounts payable

- Accrued expenses

- Current portion of long-term debt

- Current tax liabilities

- Other financial liabilities and obligations

- Liabilities held for sale

Long-term Liabilities

Longer-term debt obligations have a full repayment period of more than a year. Usually these can vary somewhere between 3 to 20 years. Long term liabilities are also mostly interest-bearing obligations. Companies prefer to take on high levels of long-term debt for reasons including longer payback period, lower cost of debt and potential to raise larger amounts of capital. The internal capital structure policy/decisions of a company will determine how much of long-term debt is raised by a company. The one major downside of high debt levels in the accompanying higher levels of financial leverage which could severely amplify a company’s losses during an economic downturn.

- Loans payable

- Notes payable

- Mortgage payable

- Deferred tax liabilities

- Other non-current liabilities

Shareholder’s Equity

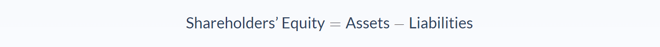

If we rearrange the original accounting equation, we can get the following result:

This simple equation does a lot in demonstrating that shareholders’ equity is the residual value of assets minus liabilities. Alternatively, equity can also be directly calculated as the combination of contributed capital (commons stock + preferred stock – treasury stock) and retained earnings (net income + other comprehensive income – dividends paid).

The classifications for a balance sheet will at a minimum include:

- Capital stock

- Retained earnings

Classified Balance Sheet Example

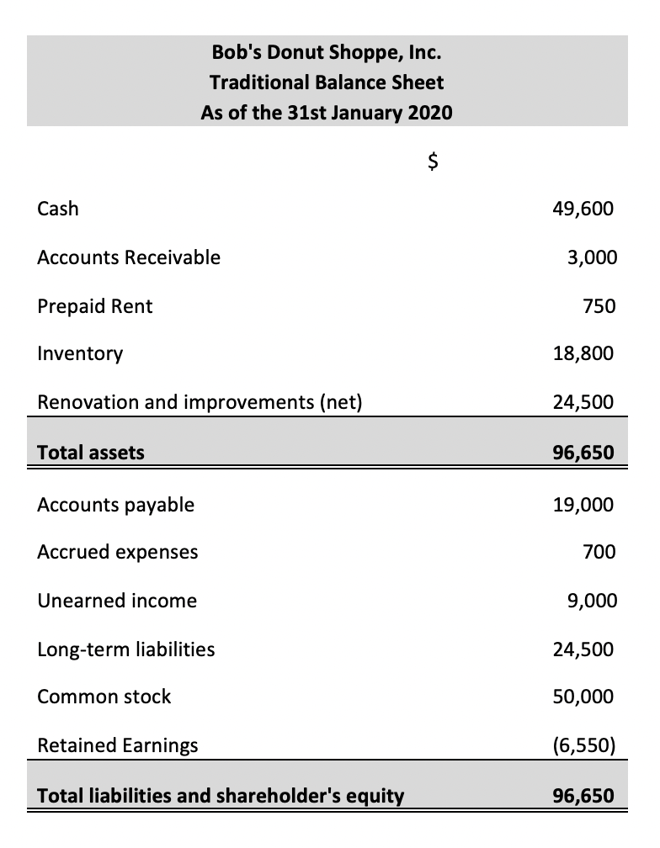

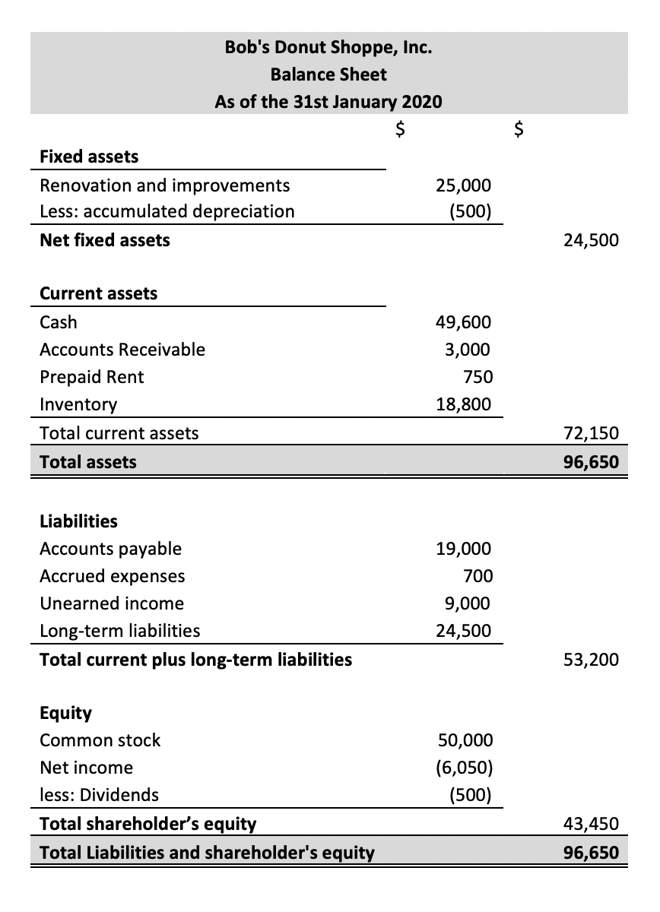

Continuing with Bob and his donut shop example, we can see how his traditional balance sheet and his classified balance sheet would look at the end of his financial period, i.e. month-end.

Traditional Balance Sheet Format

Classified Balance Sheet Format

FAQs

1. What is a classified balance sheet?

A classified balance sheet is a financial statement that separates a company's assets and liabilities into different categories. This allows investors, creditors, and other interested parties to quickly see how much debt the company has its liquidity position and the value of its assets. The most common classifications are current assets, fixed assets, intangible assets, and shareholders' equity.

2. What are the common balance sheet classifications?

The most common classifications are: current assets, fixed assets, intangible assets, and shareholders' equity.

3. What is the difference between a classified balance sheet and a balance sheet?

The difference between a classified balance sheet and a balance sheet is that a classified balance sheet separates a company's assets and liabilities into different categories. This allows investors, creditors, and other interested parties to quickly see how much debt the company has its liquidity, position, and the value of its assets.

4. What are some examples of classified balance sheet items?

Some examples of classified balance sheet items include cash, accounts receivable, inventory, property, plant, and equipment, trademarks, copyrights, and patents.

5. Why is a classified balance sheet important?

A classified balance sheet is important because it provides a snapshot of a company's financial position. This information can be used by investors, creditors, and other interested parties to make informed decisions about whether to invest in or lend to the company. It can also help them determine the value of the company's assets.