Also known as current accounts, Current Assets (CA) refers to all of a company’s assets that can be sold, consumed, used, or be exhausted within one fiscal year of a standard business operation. These assets appear in the company’s balance sheet, and they include cash, marketable securities, accounts receivable, cash, cash equivalents, stock inventory, other liquid assets, and prepaid liabilities. These assets can be converted during a sale, consumption, utilization, and exhaustion through standard operations. Due to their liquidity in nature (can easily be transformed into cash in less than a year), companies and businesses have been depending on their CA to cover short term expenses such as the purchase of raw materials, employees’ salaries, among others to keep their activities moving.

Understanding Current Assets

The term current asset is relative depending on the nature of the business and the products it markets. What is called a current asset in one company can appear to be a long-term asset in the other company. For instance, there are some products a business can sell in one year while to another business it can take slightly more than a year. Depending on the business in question, CA can widely range from raw materials, fabricated goods, and work-in-progress inventory to foreign currencies.

Categories of Current Assets

In most company’s balance sheets, current assets are generally grouped into five categories, sorted from most to least liquid.

Cash and Cash Equivalents

These are short-term commitments that are easily convertible into known cash amounts. Examples include currency, treasury bills, checking account balances, treasury bills, and short-term government bonds, which take three months or less to mature.

Marketable Securities

These include the company’s short-term investments that can mature and be transformed into cash within 12 months. Examples of marketable securities include the company’s money market accounts, certificates of deposit, and high-yield savings accounts.

Accounts Receivable

These include any monies owed by customers for purchases made on credit. Examples include electricity and wireless phone plans.

Inventory and Supplies

Inventory and supplies are considered raw materials like steel, units in production like car parts, and finished goods like the car itself.

Prepaid Expenses

These are expenditures paid for within one accounting period but consumed in a future period. Examples include prepaid rent and insurance.

Formula to calculate Current Assets

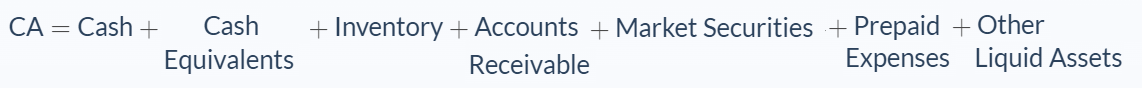

There are several ways through which the current assets of a company or a business can be computed. These formulas depend on the information available. Conventionally, when the balance sheet of a company is available, then the formula below can be used to compute the value of a company’s CA.

Alternatively, when the balance sheet is not available, but the value of the Current Liabilities (CL), Net-Working Capital, Current Ratio, Quick Ratio, Inventory, and Prepaid Expenses are available. The formulae for CA are as follows:

OR

OR

Importance of Current Assets to a Company/Business

Current Assets have been used in the past by companies in so many ways to ensure the business is in operation. Below are some of the critical importance of CA to a business operation.

- Current assets are a crucial indicator of a company’s short-term financial health. They can tell a company how much potential cash it has on hand and if this is enough to meet its financial obligations.

- Through current assets, financial analysts can establish the liquidity of a company and its capability to fund its day-to-day, short-term activities to ensure it is operating well.

- Through the company’s current assets, company managers can evaluate the value and risk of an operation by determining its liquidity position.

Besides the importance mentioned above, CA has also aided in computing various liquidity ratios, which are essential financial metrics widely used by companies to gauge the ability of a company to cover its short term debts without depending on external capital such as loans.

Ratios That Use Current Assets

Below is a list of the most commonly-used useful liquidity-measuring ratios:

- Cash Ratio – This ratio is referred to as a conservative debt ratio as it is only concerned with the company’s cash and cash equivalents. It entails dividing cash and cash equivalents by current liabilities. The resulting value will be interpreted in terms of the ability of the company to cover its short-term liabilities without liquidating any of its assets. It’s purely dealing with the company’s cash and cash equivalents.

- Quick Ratio – This ratio is called the acid-test ratio. It establishes the company’s ability to repay its short-term debts using its most liquid assets (which can be liquidated within 90 days). Here the summation of cash and cash equivalents, marketable securities, and accounts receivable are divided by the company’s CL (current liabilities).

- Current Ratio – This ratio divides a company’s total CA by its total CL. The result is an estimation of the ability of the company’s CA to offset its CL.

Note

Current ratio can overstate how quickly an asset can be converted. The current ratio uses inventory, which may or may not is easily converted to cash within a year (this is the case for many retailers and other inventory-intensive businesses).

Limitations of Current Assets

Despite being an effective measure of a company’s liquidity and its ability to meet financial obligations, current assets, and some limitations associated with it.

Inventory

Inventory should be easy to convert into cash through regular sales. But if inventory cannot be sold, the company may be forced to sell at a loss. This results in reduced current assets.

Accounts Receivable

Overdue or uncollected invoices reduce current assets and cause a pull-down on cash flows.

Working Capital

Current assets are used to calculate working capital. Working capital determines how much money a company can put toward its financial obligations and its financing of operations.

Complications

Uncollectible accounts or obsolete inventory can reduce current assets and therefore working capital. The company may then require another source of funds, such as external capital. This may create a liquidity risk and impede operations in the long-term.

Conclusion

Remember, a current asset to one business may not be a current asset to another. It all depends on how quickly it can be liquidated, or turned into cash.