Days cash on hand is the number of days a company can keep up with its operating expenses using the cash available in the business.

The key assumption with days cash on hand is that there no current cash flow from sales. It will show you how many days the company would have left to operate if there were no sales revenue.

This calculation is vital to medical establishments like clinics and hospitals. It’s also helpful to nonprofit organizations and startup firms. They keep track of cash on hand which gives perspective to a business. It also looks at how they are managing expenses and how much time they have in case of a shutdown or crisis. It can also help organizations decide if there is a need to make cutbacks on expenditures. The lower it is, the more the need to reduce expenses.

Days cash on hand is exactly as it sounds, it is the amount of money a business has on hand if they stop selling or making profit from their proceeds. When a business is at its infancy or yet to get enough customer base to cover expenses, cash on hand becomes its main source of expenditure. Businesses that are also switching products, targeting a new customer base or seasonal products may also be required to have substantial days cash on hand.

Having a healthy amount of money reserved is the best strategy to protect a business from any unexpected occurrences like a pandemic that puts everything on hold. The current ongoing global pandemic and the restrictions imposed on most if not all companies is a perfect example of that. Companies with stronger reserves of cash will still be able to carry on like online services and come out on top after the pandemic. Companies with low days cash on hand might have to get loans or debts to cover up the cost of operations.

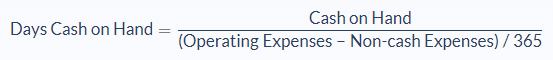

Days Cash On Hand Formula

This formula simply divides the cash available by the amount of cash outflow per day. To find out the operating expenses, check in the business’s financial statements for the operating expenses subtotal. Then, check for other expenses that do not directly involve cash like depreciation and amortization.

The formula subtracts the cashless expenses from the operating expenses. It then divides the answer by the number of days in a year (which is 365 days). This gives the cash outflow figure for each day.

Days Cash On Hand Example

Jane works in a software development firm as a programmer. Due to the COVID-19 outbreak, all staff are mandated to stay and work from home. Because of the economic shutdown, no funds are coming in and the company is not making any sales. Her manager decides to calculate the days cash on hand to find out how long the company could operate without taking on any debt. Here are the statistics he found:

The company had $90m in cash and cash equivalents available. It also had operating expenses of $450m and a total of $80m non-cash or depreciation expenses.

- Cash available = $90m

- Operating expenses = $450m

- Non-cash expenses = $80m

Now let’s use our formula:

.png?width=365&name=Screenshot%20(3).png)

In this case, the days cash on hand would be 88.7. This means that Jane’s firm has 88 days cash on hand and can operate without profits for three months before going bankrupt. This number is amazing because it gives the business time to plan a way to serve customers or get a loan and raise more money. For a well-run business, you would want a minimum of 30 days cash on hand, but 90 days would be preferable to ensure you have time to deal with unexpected changes in circumstances.

Days Cash On Hand Analysis

When dealing with days cash on hand, you should consider the fact it’s a calculation based on the average cash that is spent every day. In reality, most businesses spend cash in huge amounts at once and then spend little to nothing daily. Like a company that may be spending about 1000 dollars daily, but he spends 500,000 dollars for rent and salary at the end of every month. It is mostly used for infant businesses that are just starting up or for a new brand or branch being expanded and is yet to start bringing in any profit.

Days cash on hand is not just about having money as a plan b for when hard times strike. It’s is also an excellent way not to let opportunities pass us by. If you have substantial days cash on hand, it means that anytime there arises a time to invest like a company folding and leaving, acquiring it will be fast and easy if there is money in your reserves.

But apart from regular business, days cash on hand is very crucial to hospitals and non-profit organizations. For places like hospitals, they do not allocate higher funds to departments that are generating more funds. Departments that have lower returns may even require more funding so days cash on hand is very important in such an environment. But as much as it is recommended to have a strong days cash on hand, management has to be careful so as not to let money that should be invested kept as days cash on hand. It is good to know when money should be kept and when it used to be used to make more money as it won’t be beneficial to have lots of money in the bank while your business is dwindling.

Normally, most businesses rarely rely on days cash on hand and instead take its expenses out of the returns made but in an unpredicted unfortunate situation, days cash on hand plays a vital role. It is important because disaster rarely hits when it’s expected.

Days Cash On Hand Conclusion

- The days' cash on hand is the duration that a company can survive and keep up with its everyday operations while covering costs with the money they have available at the moment.

- It symbolizes the number of days that a company, for whatever reason, would have to keep operating and paying all its expenses if its current source of daily income was on hold.

- This formula requires three variables: cash available, operating expenses, and cashless expenses.

- Days cash on hand is very important when disaster strikes and companies can no longer generate profit.

- While a healthy day's cash on hand is good, having too much money on the reserve is not necessarily a good thing. It could be that you are keeping money that should be used to make more money.

Days Cash On Hand Calculator

You can use the days cash on hand calculator below to quickly find the days cash on hand by entering the required numbers.

FAQs

1. What does days cash on hand mean?

Days cash on hand is the duration that a company can survive and keep up with its everyday operations while covering costs with the money they have available at the moment.

2. How do you calculate days cash on hand?

The formula requires three variables: cash available, operating expenses, and cashless expenses.

Cash Available / Operating Expenses = Cashless Expenses

Cashless expenses/days of month= Days of Cash on Hand.

The formula looks like this:

Days Cash on Hand = Cash on Hand / (Operating Expenses − Non-cash Expenses) / 365

3. How many days cash on hand should a business have?

In general, businesses should not keep more than 90 days of cash on hand as it is unnecessary and the extra money could be used to make more money.

4. Does days cash on hand include investments?

Days cash on hand includes investments in that you can use the money for emergencies or anything else.

For example, if you have $10,000 in your emergency fund and need to buy an expensive machine that is worth $8,500, you can take the money from your emergency funds as it would be used for emergencies.

5. Why is days cash on hand important for hospitals?

Days cash on hand is important for hospitals because they do not allocate higher funds to departments that are generating more returns. Departments that have lower returns may even require more funding so days cash on hand is very important in such an environment.