Earnings per share is a profitability ratio that determines the net earnings of each share of stock in a company outstanding at the end of a given year. Put simply, earnings per share (EPS) is the sum of money that could be allocated to each outstanding share of stock a company has at the end of a given year if it decides to distribute all of its profits to the available outstanding shares.

This means that the earnings per share provide us with information on how a company could be profitable when measured in terms of the number of shareholders it has and the earnings per share. It also enables us to compare larger and smaller companies by their profit per share values. The higher the EPS of a company, the more profitable it is considered.

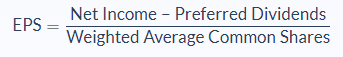

Earnings Per Share Formula

EPS is calculated by subtracting a company’s preferred dividend from its net income and dividing that by the weighted average common shares outstanding.

Preferred dividends are subtracted from the net income because earnings per share only measure income that is available to the common stockholders and it eliminates preferred ones who hold voting rights of the company.

This formula is sometimes written with end-of-period common shares outstanding instead of using weighted average common shares. The latter is preferred because the number of shares over the reporting term can change over time. Using the weighted average common shares gives a true reflection of outstanding shares for common stockholders.

A company’s income statement and balance sheet list the net income, the end of the year common shares outstanding, as well as the dividends the company has paid on preferred stock. This means you can find the values of the preferred stock as well as net income directly from the financial statements and use them to calculate the EPS ratio.

The weighted average number of shares is calculated by taking the number of outstanding shares and multiplying them by the portion of the reporting period the shares covered, doing this for each portion and finally summing up the total.

So let’s say the company had 100,000 shares outstanding at the beginning of the year, and halfway through the year, they needed to issue an extra 100,000 shares for a total of 200,000 shares. At the end of the year, the company has earnings of $300,000.

Which amount of shares should be used to calculate the EPS? 100,000 or 200,000? If you use 200,000 shares the EPS is $1.50 and if you use 100,000 shares the EPS is $3, which is a very big difference from $1.50.

To work out the weighted average, you would take each portion of shares (which in this case is 0.5) and work out the weighted amount:

So in this example, you’d use 150,000 shares to work out the EPS by dividing the earnings by the weighted average ($300,000/150,000) for earnings per share of $2.

Earnings Per Share Analysis

The value of the earnings per share of a particular company determines if investors would buy their shares once they are open for sale. Therefore, investors would purchase shares from a company with higher earnings per share ratio and vice versa because such companies have more money available to reinvest in the business or distribute to shareholders in the form of dividend payments.

Aside from providing the profitability of a company, the EPS is a vital measure that would tell a potential investor how like it is that a company would be to increase its dividends from the ratio you can determine a company’s net income, preferred dividends, as well as weighted average common shares outstanding. Combined, these numbers can determine how likely it is for the business to continue growing and increase its EPS.

Just as with any other financial ratio, EPS comes with its limitations. The first one is that a company could manipulate the ratio by purchasing back its shares to increase the EPS value, which could make it appear to investors that the business is in a better financial position than it is.

EPS also does not factor in the company’s outstanding debt, and if a company decides to settle the debt, the ratio could decrease drastically.

Earnings Per Share Example

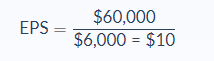

Brandon’s bakery recorded a net income of $60,000 on its income statement for the year that ended in 2017. The company had no preferred shares outstanding during the period, but a weighted average shares outstanding of $6,000. Brandon’s earning per share ratio would be calculated as follows:

From the calculation, the earnings per share ratio for the bakery is $10. If Brandon distributed these earnings to shareholders, they would receive $10 for every share owned.

Earnings Per Share Conclusion

The earnings per share ratio is a vital measure of the profitability of a company, and the below points are worth bearing in mind as a quick recap of what it is, why it’s used, and how to use it:

- Earnings per share is a profitability ratio that determines the net income earnings per each share of stock in a company outstanding at the end of a given year

- The ratio is calculated by subtracting a company’s preferred dividend from its Net income and dividing the answer by the weighted average common shares outstanding

- Weighted average common shares outstanding would yield a better EPS ratio compared to using outstanding share stock at the end of a given year

- A higher EPS value attracts investments and vice versa

- Earning per share ratio could be manipulated by organizations for their own benefit

- The ratio does not factor in outstanding company debt

Earnings Per Share Calculator

You can use this calculator to calculate the earnings per share for a company by entering the net income, any preferred dividends, and the weighted average outstanding shares.

FAQs

1. What is Earnings Per Share (EPS)?

Earnings per share, often shortened to EPS, is a profitability ratio that determines the net income earnings generated on each outstanding share of stock in a company at the end of a given year.

2. How do you calculate the Earnings Per Share (EPS)?

To calculate EPS, you would subtract a company's preferred dividend from its net income and divide that answer by the weighted average common shares outstanding.

The formula is:

EPS = Net Income−Preferred Dividends / Weighted Average Common Shares

3. What is a good Earnings Per Share (EPS)?

A good EPS ratio is relative and depends on what the company plans on using the money for.

A high EPS value would be beneficial to a company that wants to reinvest in the business, while a low EPS value might be more beneficial to a company that wants to pay out dividends to its shareholders.

4. What is the difference between the Earnings Per Share (EPS) and the adjusted EPS?

Adjusted EPS is a metric that attempts to remove the effects of one-time events on a company's earnings. This could be anything from discontinued operations to extraordinary items, to the accounting effects of changes in foreign exchange rates. On the other hand, EPS does not consider any one-time events and simply looks at the net income generated on each outstanding share of stock.

5. How is the Earnings Per Share (EPS)?

Earnings per share are used as a measure of a company's profitability and attractiveness to potential investors. A high EPS value would signal that the company is in good financial shape, while a low EPS value might suggest the opposite.