The equity multiplier is a ratio that determines how much of a company’s assets are funded or owed by its shareholders, by comparing its total assets against total shareholder’s equity. On the other hand, the ratio also indicates how much debt financing is being used for asset acquisitions and day-to-day operations.

As with all liquidity and financial leverage ratios, the equity multiplier shows how risky a company is to creditors. Businesses that depend significantly on debt financing pay high service costs and thus need to generate more cash flows to cover their operations as well as obligations. This ratio is therefore used by banks and lenders, and even investors to assess a company’s financial leverage.

Asset investment is at the core of any successful business. Companies usually fund their assets through equity and debt. The equity multiplier shows how much of a company’s total assets is provided by equity and how much comes from debt. Basically, this ratio is a risk indicator since it speaks of a company’s leverage as far as investors and creditors are concerned.

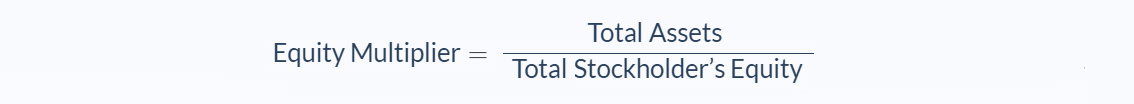

Equity Multiplier Formula

In this formula, Total Assets refers to the sum total of all of a company’s assets or the sum total of all its liabilities plus equity capital. Common Shareholder’s Equity covers no more than the common shareholder’s funds (preference shares should not be included as it comes with a fixed obligation). Either way, both values can be taken straight out of the balance sheet.

There are different ways of interpreting the equity multiplier ratio. For example, a high ratio could mean that the company is too dependent on debt, increasing the risk associated with the investment. On the flip side, because a high ratio translates to high financial leverage, the company’s growth prospects could be attractive.

When a company’s equity multiplier is low, it shows that a company a generally financed by stockholders, so debt financing is low and the investment is fairly conservative. This may seem to be positive, but its downside is the company will have low growth prospects and therefore low financial leverage.

The solution is to find a company that offers a middle ground where equity and debt are well-balanced enough that it becomes a market leader. Although it depends on the specific sector and industry, a 2:1 equity multiplier is considered optimal, where a company’s debt and equity are in perfect balance.

Equity Multiplier Example

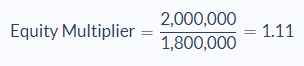

Harlitz is an insurance provider that plans to go public in two years’ time. To assess its financial leverage, it intends to use several financial ratios, including the equity multiplier. Based on Harlitz’ financial statements, the company’s Total Assets are worth $2,000,000 and its Total Equity is equivalent to $1,800,000. What is Harlitz’ equity multiplier?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Equity Multiplier: unknown

- Total Assets: 2,000,000

- Total Stockholder’s Equity: 1,800,000

Now let’s use our formula and apply the values to our variables to calculate the equity multiplier:

In this case, Harlitz would have an equity multiplier of 1.11.

An equity multiplier of 1.11 indicates that Harlitz has very low debt levels. Specifically, a mere 10% of his assets are debt-funded and the remaining 90% is financed by investors. Creditors would view the company as too conservative, and the low ratio can have an unfavorable impact on the firm’s return on equity.

Equity Multiplier Analysis

When a company’s equity multiplier increases, it means a bigger portion of its total assets is sourced from debt. This raises their financial leverage. The bigger their debt, the more they pay in debt servicing costs. This means they need to step up their cash flows to maintain optimal operations. The equity multiplier is thus a variation of the debt ratio.

On the other hand, a low equity multiplier indicates the company is not keen on taking on debt. This automatically means it pays less in debt servicing costs. However, this could also make the company less likely to get a loan if needed.

The equity multiplier ratio offers investors a glimpse of a company’s capital structure, which can help them make investment decisions. It can be used to compare a company against its competition or against itself.

In the DuPont factor analysis, a financial assessment system created by the DuPont Corp., the equity multiplier also plays an important role. In the model, return on equity (ROE) is split up into its common financial ratio and metric components, namely, net profit margin, asset turnover, and the equity multiplier.

By dividing ROE into different pieces, analysts can study the unique impact that each of them makes. Should ROE evolve or deviate from acceptable levels for the peer group, the DuPont analysis will determine the portion that can be explained by financial leverage. When the equity multiplier fluctuates, the ROE can be considerably affected: higher financial leverage also means a higher ROE, provided all other factors are unchanged.

Like many other financial metrics, the equity multiplier has a few limitations. For example, total assets can be reduced because of this, leading to a skewed metric. Also, in a negative working capital scenario, some assets are funded by capital with zero cost, so general interpretations are immediately false. And if management decides not to distribute heavy dividends and use the profit to finance most assets instead, the ratio becomes totally useless.

Equity Multiplier Conclusion

- The equity multiplier is a financial leverage ratio that determines the percentage of a company’s assets that is financed by stockholder’s equity and that which is funded by debt.

- The equity multiplier formula requires two variables: Total Assets and Total Shareholder’s Equity.

- The result is usually expressed as a plain decimal number.

- The equity multiplier is a risk indicator since it indicates a company’s financial leverage to investors and creditors.

- This is an important part of the DuPont analysis, a financial assessment model.

Equity Multiplier Calculator

You can use the equity multiplier calculator below to quickly measure how much of a company’s total assets are funded by debt and by equity, by entering the required numbers.

FAQs

1. What is an equity multiplier?

The equity multiplier is a financial leverage ratio that determines the percentage of a company’s assets that is financed by stockholder’s equity rather than by debt.

2. What is the equity multiplier formula?

The formula for equity multiplier is total assets divided by stockholder's equity.

The formula is:

Equity Multiplier = Total Assets / Total Stockholder's Equity

3. Which equity multiplier is better, high or low?

A high equity multiplier is generally seen as riskier because it means the company has more debt. A low equity multiplier is less risky, but it may be harder for the company to get a loan if it needs one.

4. What are the advantages and disadvantages of equity multiplier?

The advantages of an equity multiplier are that it offers a glimpse of a company's capital structure, which can help investors make investment decisions. It can also be used to compare a company against its competition or against itself.

The disadvantages of equity multiplier are that it can lead to a skewed metric and that it is not always accurate because total assets can be reduced and because in a negative working capital scenario some assets are funded by capital with zero cost.

5. Why is the equity multiplier important for investors?

The equity multiplier is important for investors because it offers a glimpse of a company's capital structure and how much debt the company has. This can help investors decide if they want to invest in the company and what level of risk, they are willing to take on.