The equity ratio is an indicator that gauges the amount of leverage that a company uses to finance its operation by using debt instead of its own capital or equity. The ratio does this by measuring the proportion of the equity inside the company’s total assets, the resources a company uses to run its business.

Total assets are the sum of equity plus liabilities. If a company has higher equity among its assets, it means that the company is relatively better at managing the risk to supply its assets requirements. On the contrary, if the debt has a higher percentage, it means the company is taking more risk and could be in danger of insolvency or bankruptcy.

The equity ratio is one of many instruments investors use to judge how much leverage a business use to be invested in capital or assets. Sometimes, people call the equity ratio as “shareholders’ equity ratio”. In the context of business, equity ratio and shareholders’ equity ratio means the same thing. Basically, these ratios present how much equity shares are being funded into the company’s assets.

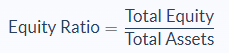

Equity Ratio Formula

To calculate the equity ratio, you will need to know the total equity and total assets. Both numbers can be found on the balance sheet. Total equity can also be referred to as “shareholders’ equity”. There are two ways of figuring out the total equity. You can either calculate the difference between total assets minus total liabilities or the sum of contributed capital (assets from stocks) and retained earnings (net income leftover after dividend payout).

A company with a low equity ratio is using more debts than equity, meaning it uses more borrowed capital as funding. Needless to say, such companies are taking more risks in the hope of generating more returns in the long run. Ideally, companies should not unwittingly rely on too many debts to finance their operation in order to gain investors’ trust.

On the other hand, corporations in the higher equity spectrum are conducting their business more conservatively. This type of business is considered less risky thus attracting more investors. Potential lending institutions such as banks are also more likely to lend money or extend credit to these companies.

Equity ratios are usually expressed as a percentage. Companies with an equity ratio of more than 50% are often preferred by investors and creditors.

Equity Ratio Example

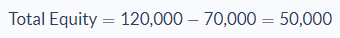

Michelle, an investor, wishes to know if a startup company she interested in can be trusted to manage its assets. Michelle decided to evaluate this using the equity ratio based on last year’s results. From the balance sheet, she found out that the company’s total assets were $120,000. The total liabilities for that period was $70,000. Can we calculate the company’s equity ratio based on this data?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Total liabilities: 70,000

- Total assets: 120,000

To calculate total equity, we can subtract the total liabilities from the total assets.

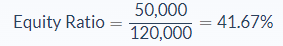

We can now apply the values to our variables and calculate the equity ratio:

In this case, the Equity Ratio would be 0.4167 or 41.67%.

From the result, we can see that the startup company has considerably leveraged its capital using debts. This is apparent since the company has less than 50% of the equity ratio. Michelle may want to look for another option to invest her money into in order to avoid large risks.

Equity Ratio Analysis

The equity ratio can tell us how leveraged a company is. Leverage is a strategy that companies use by using loaned money to increase capital in the hope of more potential earning, while also increasing the risks. Companies that have less than 50% of equity ratio are considered leveraged companies. Conversely, companies with an equity ratio of more than 50% are often labelled as conservative companies.

Investors and creditors tend to turn to ratios that measure how much debts a company is using. Companies that rely more on the capital they truly own—in the form of equity—are more attractive since they don’t have as much risk. If a company has more equity than debts, investors will have less worry in times of financial crisis while creditors are more inclined to trust the company with their money.

A high equity ratio is a strong indication that the company is managing its assets effectively and will have an easier time paying off its debts promptly. The equity ratio goes hand in hand with the company’s solvency or its ability to meet its long-term liabilities. Should the company choose to have its assets liquidated, all of the company’s remaining debts would be able to be paid off, while the creditors and shareholders can claim the leftover assets.

Keep in mind, however, that a very high equity ratio compared to the competitors is not a sole indicator of good business. Having too high of equity ratio means the company is having less risk. But at the same time, the company may suffer from insufficient funds to run its business effectively. Thus, it has a harder time growing and investors may suffer from fewer returns in the future. If possible, investors should find a balance between risks and safety to gain the maximum amount of profit.

Equity Ratio Conclusion

- The equity ratio indicates how much equity a company uses to fund its assets. Equity ratio sometimes can be referred to as shareholders’ equity ratio.

- The formula for equity ratio requires two variables: total equity and total assets.

- The results of the equity ratio are usually expressed as a percentage.

- Companies that have fewer than 50% of equity ratio are considered leveraged companies, while those that have bigger than 50% ratio are called conservative companies.

- The higher the equity ratio the company has, the easier it will be for shareholders and creditors to gain the company assets in case it’s liquidated.

Equity Ratio Calculator

You can use the equity ratio calculator below to quickly calculate how much equity a company uses to fund its assets by entering the required numbers.

FAQs

1. What is equity ratio?

The equity ratio is a calculation that determines the percentage of a company's assets that are funded by equity. The ratio does this by measuring the proportion of the equity inside the company’s total assets, and the resources a company uses to run its business.

2. How is the equity ratio calculated?

The equity ratio calculation is done by dividing a company’s equity by its assets. Equity is made up of the money that shareholders have put into the company, while assets are everything a company owns and uses to make money.

The formula for the equity ratio calculation is:

Equity Ratio = Total Equity / Total Assets

3. What is a good equity ratio?

Generally, a business wants an equity ratio that is high enough to show that it is not overly leveraged, but also low enough so as not to limit its growth. Many sources agree that a healthy equity ratio hovers around 50%.

This indicates that the company is using a good amount of its equity to finance its business, but still has room to grow.

4. Is a high equity ratio good?

A high equity ratio is good because it means the company is using less debt to finance its assets. This makes the company safer in times of financial crisis and more likely to be able to pay off its debts quickly. It also shows that the company is managing its assets effectively.

5. What is an example calculation of the equity ratio?

Let's say a company has $10,000 in total equity and $50,000 in total assets.

The equity ratio for this company would be 20% ($10,000 / $50,000).