The expense ratio is a way for a potential investor to quickly see how effectively an investment portfolio is being run. It takes into account how much of the fund’s assets will go towards the fund’s administrative expenses.

Simply put, investment has a certain amount of operating expenses to cover day-to-day business expenses and administration fees. How much of the total investment amount is swallowed by these expenses?

Expense ratios can be affected by several different factors from the size of the fund to the style of management employed. And although the average expense ratio is around 1% because of the varying factors a mutual fund may have a ratio as low as 0.2% or in some cases as high as 2.5% although anything over 1.5% is considered a high expense ratio.

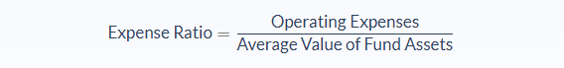

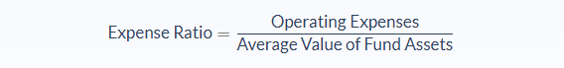

Expense Ratio Formula

Operating expenses for a mutual fund are considered any of the costs that are required for administrating the fund. This would be the firm’s operating costs, management fees, marketing fees, etc. that the fund incurred throughout the year. However, one-time costs such as sales commissions and trading activity fees are not included in operating expenses.

The average value of fund assets is just a fancy way of saying all the money that is in the fund. Because a mutual fund is a collection of stocks, bonds, or other securities the amount will be constantly changing. This along with people buying into or selling to exit the fund make it necessary to use the average value.

Expense Ratio Example

For a real-world application of this principle, let’s say that you have $20,000 that you want to invest in a mutual fund. You have narrowed your search down to three options but want to know which fund would be best to choose.

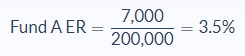

- Fund A. The first is a small fund with a total investment of $200,000 that is actively managed, so it has operating expenses of $7,000.

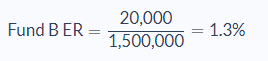

- Fund B. The second fund includes a total investment of $1,500,000 that is also actively managed and has an annual operating expense of $20,000

- Fund C. The third fund has a $500,000 total investment that is very passively managed with a yearly operating expense of $3,000.

Now let’s use our formula:

We can apply the values to our variables and calculate the expense ratio:

Now that you have calculated the expense ratio for each of the funds you can see that Fund A is the least efficient of the chosen funds, costing you $700 annually.

Fund B is slightly above the average for actively managed funds and would cost you $260.

Fund C is the most efficiently ran fund and your share of the annual operating expenses would be $120.

What this translates into for you as the investor is that Fund A should be disregarded due to the high expense ratio and even though it is an actively managed fund, Fund B will give you the same aggressive management for a much lower cost to you.

If you don’t want the higher risk of an actively managed fund then Fund C is the one that you should choose as it has a low expense ratio and is passively managed.

Expense Ratio Analysis

The expense ratio allows a potential investor to see a snapshot of how efficiently a mutual fund is being managed and also allows them to determine how much money they will have to pay to cover their portion of the fund’s annual operating expenses.

This can be beneficial as it allows an investor to choose the fund that will match your investment style, as well as keep more of their investment available as a return to you. The amount that your share of the operating expenses will be can be calculated by taking the expense ratio and multiplying it by the total amount of investment that you are putting into that fund.

Meaning that if you have $100,000 invested into a fund with an expense ratio of 1.2% you will pay $1,200 a year to cover your share of the operating costs. But if you were to find a fund with a 1% expense ratio you would save $200 each year in expenses with the same investment.

If you are an investor that is ok having a higher-risk portfolio then you will want to look for an actively managed fund that has a lower expense ratio. Keep in mind that the average expense ratio for actively managed funds is 1%.

If on the other hand, if you want to limit your risk, you will want to choose a passively managed portfolio. This would have a much lower expense ratio. The average, in this case, would be around 0.2%.

Whether an expense ratio is considered good or bad depends on the management style of the fund. For instance, a passively managed fund with an expense ratio of 0.9% wouldn’t be ideal as it is almost five times higher than the average. However, an actively managed fund with the same expense ratio of 0.9% would be considered good.

Expense Ratio Conclusion

- The expense ratio is a snapshot view of how efficiently a mutual fund is being run.

- The formula for expense ratio requires two variables: operating expenses and the average value of fund assets

- One time costs such as sales commissions and trading fees are not included

- How the fund is managed either actively or passively will have a large effect on the ratio

Expense Ratio Calculator

You can use the expense ratio calculator below to quickly find the expense ratio of a fund by entering the required numbers.

FAQs

1. What is an expense ratio (ER)?

An expense ratio (ER) is the percentage of a mutual fund's assets that are used to cover its annual operating expenses. This ratio helps investors compare the cost efficiency of different funds. Operating expenses include management and administrative fees, advertising costs, and the cost of maintaining a fund's shareholder records.

2. How is the expense ratio calculated?

The formula for the expense ratio is Operating Expenses / Average Value of Fund Assets. This calculates the percentage of a mutual fund's assets that are used to cover its annual operating expenses.

3. What is a good expense ratio?

A good expense ratio is one that is lower than the average for its category. For example, an actively managed fund with an expense ratio of 1% would be considered good, while a passively managed fund with an expense ratio of 0.5% would be considered excellent.

4. How are expense ratios paid?

Expense ratios are paid by the investor, not the mutual fund. This means that the cost of a fund's operating expenses is deducted from the returns that investors earn on their investments. The higher a fund's expense ratio, the lower the returns an investor can expect to receive.

5. Why is the expense ratio important?

The expense ratio is one of the most important factors to consider when choosing a mutual fund. This ratio tells investors how much of their returns will be used to cover the fund's operating expenses. A high expense ratio can significantly reduce an investor's earnings, while a low expense ratio can improve an investor's returns.