FIFO is an acronym for first in, first out. This method has been in play since the beginning of services and stocking. Today, it is still applied in situations when you’re waiting in line for an order, when performing computational equations, and various financing methods.

In finance, the FIFO calculation assumes two things:

- Goods that were bought first were also the ones that sold first.

- Those items bought last were the ones that were sold last.

A great way to understand the FIFO method is by visualizing it. When arranging items, you can stack them, arrange them on top of each other, or place them in a row. When you stack items, the first one you put in also tends to be the last one to come out. In FIFO’s case, you want the first one you put in to be the first one you take out. To do this, you will have to change the orientation of the stack of plates. Instead of the first one being on the bottom, you have to put the stack upside-down so it is at the top.

What is the FIFO Method?

In accounting, the FIFO method assumes that the first goods being bought are the ones that will be sold first. This usually applies to perishable items or goods with a limited expiration date. You will most likely sell a product manufactured in January 2019 before the one made in August 2019.

FIFO is used to calculate the costs of goods sold (COGS). When calculating something using FIFO, you must account for fluctuating prices, the cost of producing products — including labor costs — and overhead costs. Products that have not been sold cannot be used in the FIFO method. Only sold goods are considered usable.

Examples

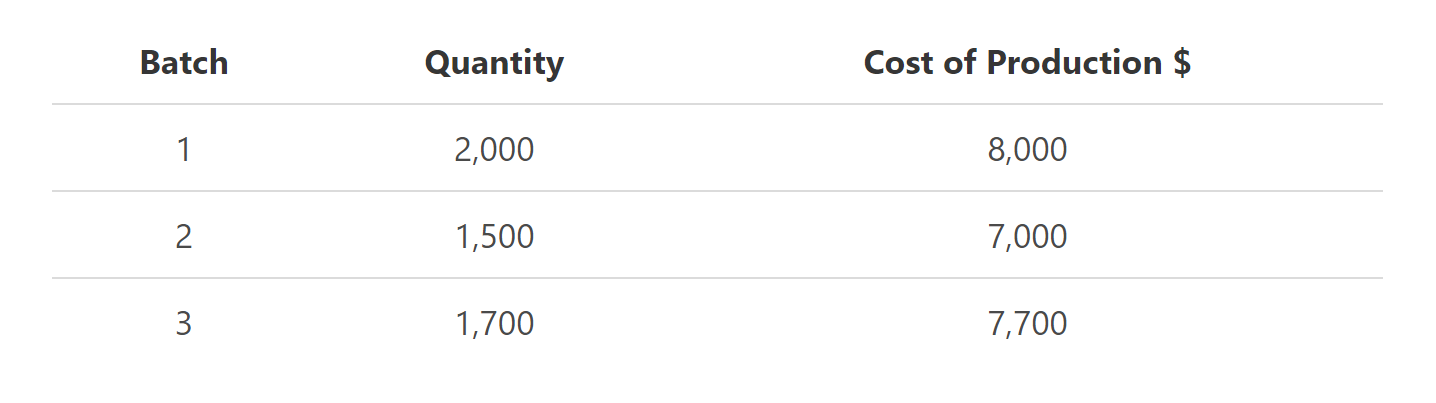

Company A manufactures the goods it takes to make the product you sell in your store about three times a year. Each time Company A makes those products you purchase some and make a batch of your product. The cost of production would be how much you spend on those products to make a batch of your product. It fluctuates with each batch. The quantity is how much of the product you are making. The Batch indicates the order of inventory.

Over the year, you have produced 5,200 products. The total cost to make these products is $22,700. It costs an average of $4.37 to make one product.

The next step would be to calculate the cost of each unit for each batch. Do this by diving the cost of production by your quantity.

Batch 1: $8,000/2,000 = $4

Batch 2: $7,000/1,500 = $4.67

Batch 3: $7,700/1,700 = $4.53

Once you have done this, you need to look at how much product you sold during the year. Let’s say you sold 4,000 out of 5,200 products in your inventory. In FIFO, it doesn’t matter if these products were sold from batch 1, 2, or 3. You are going under the assumption that your first inventory was the inventory that sold first. Therefore, you will be going by those numbers.

Since you sold 4,000 products, you can consider all of batches 1 and 2 as sold. That leaves a remaining 500, which you can subtract from batch 3.* According to FIFO, you have 1,200 products leftover in your inventory from batch 3.

Your calculations would be as follows:

Batch 1: $4 x 2,000 = $8,000

Batch 2: $4.67 x 1,500 = $7,005

Batch 3: $4.53 x 500* = $2,265.

You will now add up these totals to find out the total amount of goods sold: $17,270.

This is a general method that doesn’t take into consideration the batch from which these goods were sold. It simply works its way down to give you a number with which you can work.

Why Use FIFO?

When and why should you use the FIFO method? This method is quite easy to understand, and it is a universally accepted method of calculating the cost of goods sold. It is trusted to be generally fair, and it follows the natural flow of cost and production. Because the oldest inventory is recorded first there is little to no room for mistakes.

Especially when dealing with perishable goods, using this method minimizes waste. Physically, a business, even if sales are moving slowly, will see that they aren’t having to throw away expired products as often. Not to mention, the flow of FIFO in perishable goods keeps consumers happier — fresher products, and better consumer ratings.

Using FIFO also acts as a decent reflection of the product market and makes it hard for anyone to mess with the financial report. You can use the information ascertained from the FIFO method to determine how well or unwell a product is performing and make adjustments accordingly. For instance, if you see that Week One’s vanilla cupcakes did not bring in as much money as Week Two’s raspberry-filled cupcakes — and you still have Week One’s inventory on the shelf — you may consider producing fewer vanilla cupcakes and increasing raspberry-filled cupcake production.

But be warned! Using this method reveals the gap between profit and cost increases, and this might open you up to higher taxes. Revealing fluctuating production costs might also make it look like you are making more money than you are. When you eventually burn through all your products, you may realize that you did not make as much money as the reports showed initially.

Conclusion

The FIFO method is an accounting technique that calculates the cost of inventory based on which stock came in first. Goods that have not been sold are assumed to be part of the new inventory. However, using the FIFO method can also be a poor reflection of your actual profit. Since it does not take into account specific sales from inventory batches, you never know if you actually made that big a profit or if it is significantly smaller.

FAQs

1. What is First In, First Out (FIFO)?

FIFO is an accounting technique that calculates the cost of inventory based on which stock came in first. Goods that have not been sold are assumed to be part of the new inventory.

The FIFO method can also be a poor reflection of your actual profit. Since it does not take into account specific sales from inventory batches, you never know if you actually made that big a profit or if it is significantly smaller.

2. What are the disadvantages of the First In, First Out (FIFO) method?

The main disadvantage of using the FIFO method is that it does not consider specific sales from inventory batches. This can make it difficult to accurately calculate your profits, as you never know if you are making more money than what the reports show. Additionally, using the FIFO method can make your business appear more profitable than it is, which can lead to higher taxes. When all the inventory has been sold, you may realize that you did not make as much money as initially reported.

3. What are the 5 benefits of First In, First Out (FIFO)?

There are several benefits of using the FIFO first in first out accounting method. These benefits include: It is a universally accepted method of calculating the cost of goods sold. It is trusted to be generally fair. It follows the natural flow of cost and production. Because the oldest inventory is recorded first there is little to no room for mistakes. Especially when dealing with perishable goods, using this method minimizes waste. Physically, a business, even if sales are moving slowly, will see that they aren’t having to throw away expired products as often.

4. Why is First In, First Out (FIFO) the best method?

FIFO is considered the best method of accounting for inventory because it is a universally accepted standard, it is seen as being fair, and it follows the natural flow of cost and production. Additionally, since the oldest inventory is recorded first, there is little chance of mistakes when using this method.

5. How is First In, First Out (FIFO) implemented in stores?

In stores, FIFO is usually implemented by using the oldest receipts to calculate the cost of goods sold. This ensures that the most recent inventory is always counted as the newest stock. This method also helps to prevent expired products from being sold and encourages businesses to sell older products before newer ones.