The geometric average return formula (also known as geometric mean return) is a way to calculate the average rate of return on an investment that is compounded over multiple periods. Put simply, the geometric average return takes into account the compound interest over the number of periods.

What this means is that the geometric mean return is a better measure of the average return on investment than the arithmetic average return which simply adds the returns for each period together and divides them by the number of periods.

The arithmetic average return will overstate the true return of the investment and should only be used for shorter time periods.

If you need to compare returns over an extended period of time the geometric average return (GAR) is the better formula which accounts for the order of the return and the compounding effect.

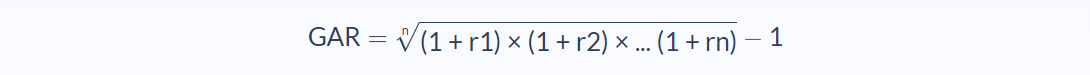

Geometric Average Return Formula

- r = rate of return

- n = number of periods

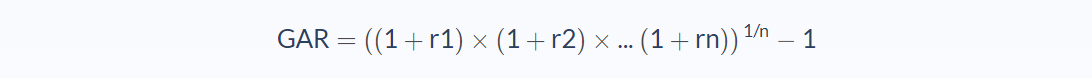

The above is the most commonly used geometric average formula, using the square root symbol with the nth root of the rates. Personally, I find it difficult to use the nth root when calculating GAR, and prefer the following formula expression:

The geometric mean return formula is useful for investors looking for an “apples to apples” comparison when they are considering multiple similar investment options and is specifically used for investments that are compounded.

It allows you to calculate the holding period return, which is the total return of the investment across multiple periods.

Geometric Average Return Example

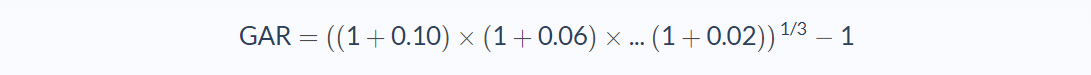

Jennifer has invested $5,000 into a money market that earns 10% in year one, 6% in year two, and 2% in year three.

If you were to calculate this using the arithmetic mean return, you would add the rates together and divide them by three, giving you an average of 6%. Using this method the ending balance of 6% a year for three years would be $5,955.08.

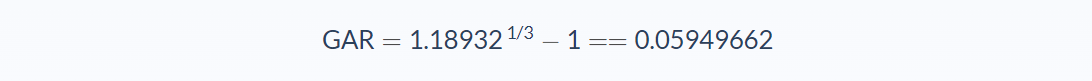

Let’s take a look at the geometric average return formula and see how it compares:

Using the geometric average return formula, the rate is actually 5.95% and not 6% as stated by the arithmetic mean return method. The total return using the more accurate method would be $5,946.66, which is a difference of -$8.42.

Now, this may be a trivial amount in the example shown, but it’s easy to see that with larger investments and a greater number of compounding periods, the difference can be considerably larger between the two methods.

Geometric Average Return Analysis

The geometric mean can be referred to as the geometric average, the compounded annual growth rate, or the time-weighted rate of return. It’s the average return rate for a set of values that is calculated using the products of the terms.

In other words, the geometric average takes several values (the return rates), multiplies them all together, and sets them to the 1/nth power.

Without getting too deep into the weeds with math, the calculation is fairly simple to understand with small numbers.

Let’s say the rates are 2% and 8%. If you multiply 2 and 8 together (16) then take the square root (which in this case is the 1/2 power because there are only 2 numbers) the square root is 4.

However, the best use of geometric mean return is over longer time periods, which means a lot more rates that are compounding. This makes the calculation quite complex without the use of a specific calculator or Excel spreadsheet.

One of the main benefits of using geometric average return is that it doesn’t require the investment amounts. The calculation works using the return figures themselves.

This is why it’s known as an “apples-to-apples” comparison when looking at different investment options.

Geometric Average Return Conclusion

When working with the geometric mean return, the below points are worth bearing in mind as a quick recap of what it is, why it’s used, and how to use it:

- It’s an average rate of return for a series of values using the products of the terms

- Over longer periods of time, it is a much better measure than arithmetic mean return because it considers compounding

- Arithmetic mean return will overstate the average

- It presents an “apples-to-apples” comparison when looking at different investment options

Geometric Average Return Calculator

You can use the geometric average return calculator below to work out your own averages for up to 10 periods.

FAQs

1. What is Geometric Average Return?

The Geometric Average Return is a rate of return that is calculated by taking the product of all rates and then setting it to the 1/nth power. This allows for periods of compounding without requiring the investment amount.

2. Why is Geometric Average Return useful?

The Geometric Average Return is useful for comparing different investment options without the need to know the value of each. It also provides an “apples-to-apples” comparison, which is helpful when looking at foreign currency investments where it’s not possible to express all values in US dollars.

3. What are the differences between the arithmetic mean return and Geometric Average Return?

The main difference is that the arithmetic mean return will overstate the average rate of return when compounding occurs. This means that it does not provide an accurate representation of returns in a time where there are several periods of compounding. It also doesn’t consider negative returns which can impact the total averages.

4. When should I use the Geometric Average Return?

The Geometric Average Return is best used over several years where there are periods of compounding. It’s not suitable for short-term investment properties that don’t have any periods of compounding, so using the arithmetic mean would be more appropriate.

5. How is the Geometric Average Return calculated?

The Geometric Average Return can be found using a specific calculator or Excel spreadsheet. The calculation requires that the term values are multiplied together and then set to the 1/nth power.

The formula for a Geometric Average Return is:

GAR=((1+r1)×(1+r2)×...(1+rn)) 1/n −1