Holding period return (HPR), also known as holding period yield, is the total return earned by an investment throughout its entire holding period. There are two possible sources of returns for investments like bonds, stocks and real estate: capital gain and income.

The capital gain or loss is the difference between the investment’s value when it was purchased and its value after a certain holding period. Meanwhile, income comes from dividends, rents, and the like.

Holding period return, however, is a non-standardized return metric. It could be true for a day or a decade, and directly comparing holding period returns on various investments is not useful. Instead, the total time involved in calculating the return must first be determined, and the value obtained will have to be converted to annualized holding period return.

But holding period returns for several periods may be linked using either the time-weighted or the money-weighted rate of return.

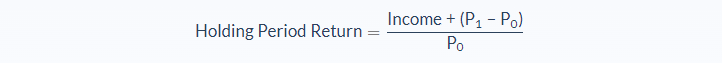

Holding Period Return Formula

- P0 = Initial value

- P1 = End-of-period value

Holding period returns are the simplest and quickest route in terms of return computations. They are determined by simply by adding the investment’s income and the difference between its end-of-period value (P1) and initial value (P0), and then dividing this sum by the end-of-period value (P0).

As the investment earns more and more income, the holding period return formula can simply be expanded by adding to the numerator the net income earned.

Holding period returns do not work when comparing returns on different investments though. Instead, the HPR should be divided by each of their own investment horizons. The annual percentage rate (APR) obtained measures every asset’s annual return.

In addition, the APR does not take an interest that compounds into account, so the HPR has to be aligned again.

Effective annual rate (EAR) refers to an asset’s yearly rate of return and considered all potential interest compounding. It is the most complex method of determining a security’s return but also usually the most correct.

Clearly, a security’s return on investment can be determined using various methods, but investors should be careful when deciding on the particular method to be used for each case. Return misrepresentation is tantamount to misleading unsuspecting investors. In any case, HPR, APR and EAR are three of the best ways to calculate returns.

Holding Period Return Example

If Eddie sold his shares for $48,000 after six years, when he would have earned an income of $1200, his HPR would be around 146%. This means that his investment would more than double by the end of that period, provided there were no significant changes in the values in the formula (stock prices and dividends).

Take note that HPR forecasts are never exact because of constantly volatile conditions in the market. But a higher HPR forecast means an investment is likely to gain profit, while a negative HPR means a loss should be expected.

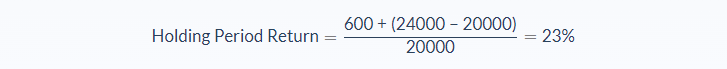

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Income: 600

- Initial value (P0): 20,000

- End-of-period value (P1): 24,000

We can apply the values to our variables and calculate the holding period return:

In this case, Eddie would have a HPR of 23%.

If Eddie sold his shares for $48,000 after six years, when he would have earned an income of $1200, his HPR would be around 146% (meaning his investment would be more than double) by the end of that period, provided there were no significant changes in the values in the formula (stock prices and dividends). Take note that HPR forecasts are never exact because of constantly volatile conditions in the market.

Holding Period Return Analysis

All kinds of investments come with risk, and there is no way to determine risk levels exactly since so many variables are involved, from past and current performance to micro and macro-economic factors, and so on rest. There is also no way to eliminate risk completely, which is why investors are always better off diversifying their portfolios for better risk management.

Another good way to manage risk is to calculate the investment’s HPR within its holding period. But while higher-risk investments bring higher returns, few people will invest in assets with the highest risk just for that promise. It is simply unwise to do so, and people have varying appetites and tolerance levels for risk.

Investors with lower risk tolerance go for lower shares of stocks, but asset values grow bigger as holding periods get longer. Over time, lower-risk stocks often prove to give better overall returns. To increase their returns, investors with lower risk tolerance can increase their stock allocations as long as the holding period is reasonable.

It may be observed that overall risk decreases with time and increases in equity exposure. As soon as the minimum risk point is reached, more equity exposure can mean more return and, unfortunately, increased risk.

It is a must to consider an investment portfolio’s holding period when calculating returns and assessing risk. In the long run, holding only instruments based on bonds or debt will not be enough to maintain purchasing power, while stocks will always be the better option for beating inflation, although promised returns will also be lower.

Also, when determining an asset’s HPR to decide whether or not to invest, it is important to do an annualized HPR calculation, which means HPRs of several years need to be considered. This is because returns can fluctuate wildly, and values obtained from a single-year computation will not be accurate.

Clearly, HPR plays a significant role in understanding risk-related investment issues, but that is not all the purpose it serves. This metric can also be used to assess the value of an investment, compare the values of different investments, and determine tax implications.

Holding Period Return Conclusion

- The holding period return is a metric that indicates how much return an asset or portfolio of assets has earned over its holding period.

- The HPR formula requires three variables: income, initial value and end-of-period value.

- The holding period return ratio is usually expressed as a percentage.

- The holding period return serves four common uses, namely, to assess investment risk, determine investment value, compare multiple investment values, and understand tax implications.

Holding Period Return Calculator

You can use the holding period return calculator below to quickly calculate how much return your investment has earned during its holding period by entering the required numbers.

FAQs

1. What is the holding period return?

The holding period return is a metric that indicates how much return an asset or portfolio of assets has earned over its holding period.

2. How do you calculate holding period return?

The holding period return can be calculated using the following formula: HPR = (End-of-Period Value - Initial Value) / Initial Value * 100%

3. Why is the holding period return important?

The holding period return is important because it helps investors understand the risks and rewards associated with an investment. It can also be used to assess the value of an investment, compare multiple investment values, and understand tax implications.

4. What is the difference between an expected return and a total holding period return?

The expected return is the rate of return that is anticipated from an investment, while the total holding period return is the actual rate of return that the investment has earned.

5. How would you interpret the meaning of a holding period return?

A holding period return of 0% indicates that the investment has not generated any income over its holding period. A negative holding period return indicates that the investment has generated less income than the initial investment. A positive holding period return indicates that the investment has generated more income than the initial investment.