The inflation rate is the percentage increase in the average level of prices of a basket of selected goods over time. It indicates a decrease in the purchasing power of currency and results in an increased consumer price index (CPI). Put simply, the inflation rate is the rate at which the general prices of consumer goods increase when the currency purchase power is falling.

The most common cause of inflation is an increase in the money supply, though it can be caused by many different circumstances and events. The value of the floating currency starts to decline when it becomes abundant. What this means is that the currency is not as scarce and, as a result, not as valuable.

By comparing a list of standard products (the CPI), the change in price over time will be measured by the inflation rate. The prices of products such as milk, bread, and gas will be tracked over time after they are grouped. Inflation shows that the money used to buy these products is not worth as much as it used to be when there is an increase in these products’ prices over time.

The inflation rate is the rate at which money loses its value when compared to the basket of selected goods – which is a fixed set of consumer products and services that are valued on an annual basis.

Inflation Rate Excel Template

Want to calculate the inflation rate in Excel? Download the free simple inflation rate calculator template below.

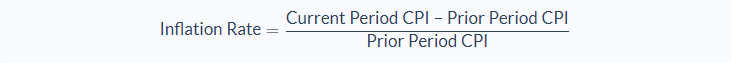

Inflation Rate Formula

Using this formula, the general economy-wide inflation rate over a period is calculated as the rate of change in the consumer price index (CPI).

There are other, more specific, inflation rates you can use depending on what your intention is. The producer price index would be more applicable for producers (also as domestic producers or manufacturing) and a university endowment fund could calculate an inflation rate that was more relevant based on changes in research costs, professor salaries, and so on.

Inflation Rate Example

Sarah wants to calculate the inflation rate for the next two years. She works at the Bureau of Labor Statistics as an economist. As follows, the base year (current year), year one, and year two data is collected by her:

Sarah estimates each good or service’s total annual cost. Then, to calculate the annual consumption, she sums it all up. Respectively, $10,160, $10,455, and $10,704 are the total consumption for the base year, year one, and year two.

Sarah then divides the total consumption of each year by the price of the products in the base year for her to get the price index per year. When she gets the answer, she then multiplies it by 100.

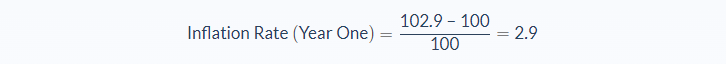

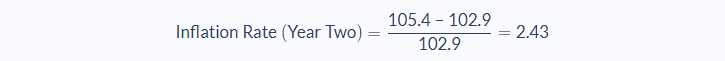

Therefore, the price index is:

- $10,455 / $10,160 x 100 = 102.9 in year 1

- $10,704 / $10,160 x 100 = 105.4 in year 2

Then, by calculating the change in the price index, Sarah calculates the inflation rate for year 1 and for year 2. In year 1, 2.9% is the inflation rate and in year 2 is 2.43%.

Annualizing the Rate of Inflation Formula

You can’t annualize the monthly rate of inflation by multiplying by 12 for the same reason you can’t annualize any monthly rate: it doesn’t account for compounding.

To annualize the rate, you either need to know the starting and ending CPI for the year to use the above formula, or add each monthly percentage change in the consumer price index to try and find the total annual percentage change.

Inflation Rate Conclusion

When calculating inflation, the below points are worth bearing in mind as a quick recap of what it is, why it’s used, and how to use it:

- The inflation rate is the percentage increase in the average level of prices of a basket of selected goods over time

- A basket of goods is a fixed set of consumer products and services that are valued on an annual basis

- Consumer index period (CPI) increases during this period

- Consumer goods prices increase because of the inflation rate

- The most common cause of inflation is an increase in the money supply

- The list of standard products is compared to get the change in the currency value over time

- The rate of the group of product’s value compared to the money it lost is the inflation rate

- Depends on what your intention is, you have several ways to calculate the inflation rate

- Using the year’s initial and ending CPI in the formula, you can properly calculate the annual rate of inflation

Inflation Rate Calculator

There are more complicated inflation rate calculators out there, but if you have the current and prior CPI values, then all you need to do is enter them below to get the inflation rate.

FAQs

1. What is the inflation rate?

2. Is Inflation good or bad?

3. What is the advantage of knowing the inflation rate?

In addition, the government uses the inflation rate to help make monetary policy decisions. For example, if the rate of inflation is high, the government may decide to raise interest rates to try and decrease it.

4. How is the inflation rate calculated?

Inflation Rate = Current Period CPI−Prior Period CPI / Prior Period CPI