The Interest Coverage Ratio is both a debt ratio and a profitability ratio. It helps companies determine how easily they can pay interest on outstanding debt or debt they plan to take on. You can determine it by taking a company’s EBIT (earnings before interest and taxes) and dividing it by the interest payments that must be paid within a period of time.

The interest coverage ratio is also known as “times interest earned.” Creditors, investors, and lenders use it to know a company’s risk level in terms of its current or future debt.

However, as with any metric meant to assess a business’ efficiency, the interest coverage ratio is not absolute. For instance, a ratio of 2 is often considered standard for more stable companies in specific industries. This is because production and revenue are almost constant, which means they can probably cover all of their interest payments even if interest was low. For more volatile industries, such as manufacturing, a higher minimum interest coverage ratio such as 3 would be deemed acceptable.

Hence, interest coverage ratio comparisons are only valid when involving companies within a single industry and ideally with business models and revenues that aren’t too diverse. You should factor in all types of debts into interest ratio coverage calculations as well. Otherwise, when looking at a company’s self-published interest coverage ratio, it is important to check whether or not all debts were already part of the calculations, or if interest coverage ratio must be determined separately.

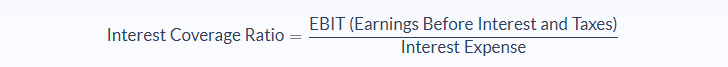

Interest Coverage Ratio Formula

Clearly, the equation makes use of EBIT rather than net income. EBIT is the earnings before interest and taxes. Earnings before interest and taxes are deducted. It is essentially net income plus interest and tax costs.

In the calculation, EBIT is used rather than net income to provide the most accurate picture of what the company can afford to pay in interest. Using net income would mess up the calculation as interest expense would then end up counted twice and tax cost would adjust according to the deducted interest. But this problem can be avoided simply by using EBIT.

Additionally, the interest expense is the interest to be paid on all borrowings, like bonds, loans, etc. It’s important to remember that this formula can be used for any interest period. For instance, monthly or partial year values may be obtained by dividing the EBIT and interest cost by the desired number of months.

If the interest coverage ratio is at least equal to 1, it means the company is earning just enough to afford its interest. This scenario is as bad as the first one because it means that while the company can pay for interest, it still can’t cover its principal payments.

If the business’ interest coverage ratio is more than 1, it means it is earning making more than what it needs to settle its interest and principal obligations. Creditors will naturally want this ratio to be at least 1.5 before granting a loan. In simple terms, banks want to be certain that a borrower will be making no less than 1.5 times more than their current interest payments.

Interest Coverage Ratio Example

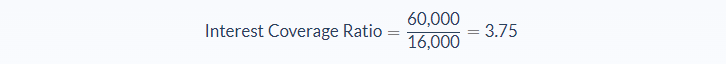

Jerome wants to expand his bacon business but needs additional funding. He applies for a loan at a bank, which naturally asks for his financial statements. His EBIT is $60,000 – $16,000 in interest and $14,000 in taxes. What is Jerome’s interest coverage ratio?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- EBIT: 60,000

- Interest expense: 16,000

We can apply the values to our variables and calculate the interest coverage ratio:

In this case, Jerome’s bacon business would have an interest coverage ratio of 3.75.

A 3.75 interest coverage ratio means Jerome’s bacon business is making 3.75 times more earnings than his current interest payments. That means he will be able to pay the interest and principal payments on his current debt without difficulty. It also means there is a good chance the bank will approve his loan because his ratio shows his business is low-risk and making enough money to cover its payables.

Interest Coverage Ratio Analysis

An interest coverage ratio isn’t always as simple as it seems. It depends a lot on the level of risk the creditor or investor is comfortable with, but in any case, the basics of this measurement are the same.

If the ratio returns a number lower than 1, it means it means the business isn’t earning enough cash to cover its interest payments, let alone its principal payments. This type of company is extremely risky and unlikely to secure bank financing.

When determining a company’s ability to make interest payments, it is crucial to interpret data in the right way. Also, the interest coverage ratio says a lot about a business’ present financial state, but studying interest coverage ratios within a period of time usually offers a more accurate picture of the company’s present position and future direction.

For example, Look at quarterly examinations of interest coverage ratios within a five-year period. Patterns may surface and provide a clearer picture. Will a low current interest coverage ratio get better or worse. Or is a high current interest coverage ratio is still likely to fluctuate or already stable.

The number can also be used to compare different companies’ interest-paying abilities, making it helpful when making investment decisions. When using ratios for this purpose, stability is key. When an interest coverage ratio is going down, it is usually a cause of concern for investors. It shows that it might only be a matter of time before the company becomes unable to settle its debts.

In general, the interest coverage ratio is a very good way to assess a company’s short-term fiscal health. Sizing up an investment opportunity is possible after analyzing a business’ interest coverage ratio history. However, it is difficult to rely on any ratio or metric to foresee a company’s long-term financial state.

Interest Coverage Ratio Conclusion

- The interest coverage ratio indicates how easy it is for a business to make its current interest payments.

- This formula requires two variables: earnings before interest and taxes (EBIT) and interest expense.

- The result of the ratio is expressed as a number.

- The interest coverage ratio is used by creditors and lenders to assess the risk of lending capital to a company.

Interest Coverage Ratio Calculator

You can use the interest coverage ratio calculator below to quickly calculate how easily your company can make your current interest payments by entering the required numbers.

FAQs

1. What is the Interest Coverage Ratio?

The interest coverage ratio is a metric used to measure a company’s ability to make its current interest payments. This formula requires two variables: earnings before interest and taxes (EBIT) and interest expense. The result of the ratio is expressed as a number.

2. How is the interest coverage ratio calculated?

The interest coverage ratio is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expense.

The formula is:

Interest Coverage Ratio = EBIT (Earnings Before Interest and Taxes) / Interest Expense

3. What is the importance of the interest coverage ratio?

The interest coverage ratio is important because it provides a snapshot of a company’s ability to make its current interest payments. This metric is used by creditors and lenders to assess the risk of lending capital to a company.

4. What is a good interest coverage ratio?

The interest coverage ratio is typically expressed as a number. A good interest coverage ratio is one that is greater than three. This means the company is making more money than it is spending on interest payments. Analysts prefer to see a company’s interest coverage ratio remain stable over time. This suggests that the company is in good financial health and can meet its short-term obligations.

5. What does a bad interest coverage ratio indicate?

A bad interest coverage ratio means a company is not making enough money to cover its interest payments. This type of company is at risk of defaulting on its loans and is likely to have difficulty securing new financing.