The investment turnover ratio is a financial tool used to determine how efficiently a company is generating revenues using their debts and equity. This ratio provides insight for investors on how effectively a company utilizes its resources to generate revenues. In other words, the investment turnover ratio measures how many times a company is capable of turning over the money invested in the company.

High investment turnover ratio means that the company is efficiently turning over stockholders invested shares in increasing its value. Low investment turnover ratio indicates that the company is less efficient as it struggles to generate revenue from its debts and equity. Analysts using this metric to compare companies should ensure that the figures are benchmarked against companies in the same industry.

There are two ways companies usually generate money that they invest in their operations. One way is through debt financing, like taking a loan from banks or any other loaning institutions. The other way is through equity financing, such as issuing shares.

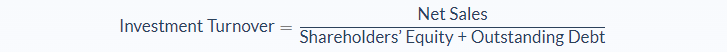

Investment Turnover Ratio Formula

Net sales can be found on the income statement and shareholders’ equity on the balance sheet.

For outstanding debt, you can sum up all of the short- and long-term debt of the company:

Generally speaking, a high investment turnover ratio means that the company is efficient in its use of resources. This results in a higher value for the shareholders' investment. Meanwhile, a lower investment turnover ratio implies that the company is not efficient in its operations, meaning the stakeholders’ investment is not being maximized. So when you are comparing firms from an investor’s perspective, a company with a higher ratio is the best to trust with your capital as it has a higher chance of outperforming competitors.

Investment Turnover Ratio Example

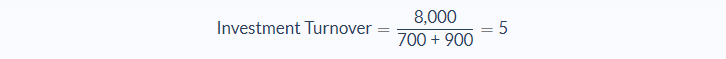

LMO Limited, a leading investment company in Japan, reported sales revenue of $8 billion for the fiscal year 2017. They also reported long-term debt of $300 million and short-term debt of $500 million. They had short-term securities of $100 million and $700 million in shareholders’ equity.

Assess how LMO Limited is utilizing shareholders’ capital and debt to generate sales.

In order to find outstanding debt, we’ll need to add long-term debt, short-term debt, and short-term securities. (values in thousands)

- Net sales = $8,000

- Stakeholders equity = $700

- Outstanding debt = $900 (300 + 500 + 100)

Now we can use the formula to calculate the ratio:

LMO Limited has an investment turnover ratio of 5, and this means that for every $1 invested into the company, it generated $5 in revenue.

Investment Turnover Ratio Analysis

A company’s investment turnover ratio measures its ability to generate sales revenue using the money it has invested in the company. This ratio is an analytical tool used to determine how efficiently a company can create revenues using its debts and equity. The term “turnover,” indicates the number of multiples of revenue that can be generated with the current funding level. This ratio is useful for investors to be able to evaluate the best company to invest in and how much they expect to earn in the long run.

Some analysts argue that companies with higher results might as well be incurring losses. This ratio uses net sales instead of profits, so large sales volumes yielding high net sales might be accompanied by excessive expenses. Having a high investment turnover ratio is not necessarily an indicator of excellent performance.

Even though the investment turnover ratio provides insightful metrics for investors, specific investment levels can vary considerably among different industries. For instance, asset-intensive industries require substantial investment for them to achieve returns.

In contrast, some industries do not even require any fixed asset for them to start operating, and therefore fewer funds may be needed to generate the same sales revenue. Consequently, it is from this point that we conclude that it could be possible for a company to have a high investment turnover ratio but still be recording losses from daily operations.

Because of this, the investment turnover ratio is not the ideal ratio if you wanted to compare two companies that operate in different industries.

Another unique feature of the investment turnover ratio is that you cannot extrapolate the trend. An excellent historical turnover ratio observed at the beginning might not hold up to the end when the market niche becomes saturated.

Investment Turnover Ratio Conclusion

- An investment turnover ratio is an analytical tool for gauging the ability of a company to generate revenues using the debt and capital that have been invested in the business.

- A high rate means that the company is using its resources more effectively, earning shareholders a higher value for their investment.

- A low investment turnover ratio means that the firm’s operation is not as efficient as others.

- This formula requires three variables: net sales (total revenue), stakeholders’ equity and debts outstanding.

- This may not be a good predictor of long term returns as a business may have an excellent historical turnover ratio, but additional funds might not produce the same turnover rate if the market maxes out.

- Investment turnover ratio shouldn’t be used to compare industries that differ in asset-intensity as it will change the investment amounts.

Investment Turnover Ratio Calculator

You can use the investment turnover ratio calculator below to quickly calculate the ability of a company to generate revenues using the debt and capital that have been invested in the business by entering the required numbers.

FAQs

1. What is the investment turnover ratio?

The investment turnover ratio is a measure of how much revenue can be generated for each dollar invested into assets, such as property plant and equipment (PPE).

2. to calculate the investment turnover ratio?

The investment turnover ratio can be calculated by dividing the net sales by the PPE.

3. How do you interpret the investment turnover ratio?

A higher investment turnover ratio means that the firm is better at generating revenue using its assets.

4. What are the implications of the investment turnover ratio?

The investment turnover ratio is a helpful metric to gauge how well an entity can generate revenue using the assets that have been invested. This may not be a good predictor of long term returns as it does not take into consideration funds required in the expansion of new assets while existing assets are still being depreciated.

5. What is a good investment turnover rate?

A company’s investment turnover rate is dependent on its industry. For example, the investment turnover rate for industrial companies is lower than for retail and wholesale service-based companies as industrial companies will require more capital to produce goods that they can sell.