Marginal revenue refers to the increase in revenue realized from the sale of an additional one unit of output. It is a financial ratio that is used to compute the overall change in income obtained from the sales of one additional product or unit.

Marginal revenue follows the law of diminishing returns, which states that holding other factors constant, if a production process, as one factor of production (input) is varied, there will be a point at which the marginal per unit output will start to decrease. In other words, every time a producer increases one unit of input holding other factors constant, the resulting marginal gain will be increased up to a certain point.

After that, the additional output gained by another one unit increase of the input variable will eventually be smaller than the additional output gained by the previous increase in the input variable. This is the point we conclude that the diminishing returns take effect.

Despite being a microeconomics concept, it still incorporates some managerial accounting and financial applications. In the management scenario, marginal revenue helps in analyzing consumer demands, which in turn helps in setting up prices for various products. The consumer demand arrived at by the management further helps in the planning of production schedules.

By understanding these three key concepts, the manufacturer will be better placed in the market because there will be no product shortage resulting from customer demand misjudgment.

Marginal Revenue Formula

The total is earned from sales of products, and these products can be from farm or firm. This formula needs only three variables; units of inputs used, units of output obtained, and the price for the outputs. So, to get the change in total revenue first, we get the total revenues by multiplying the output by the price.

The total is earned from sales of products, and these products can be from farm or firm. This formula needs only three variables; units of inputs used, units of output obtained, and the price for the outputs. So, to get the change in total revenue first, we get the total revenues by multiplying the output by the price.

Marginal revenues vary from one firm to another. For instance, in a perfectly competitive firm where there is full information about prices, and the products are homogenous, the marginal revenue remains typically constant. In this case, companies/sellers use specific prices as the market dictates the optical price levels. If you try to sell at a higher price, consumers will buy from other competitors in the market because the products are homogeneous.

Marginal Revenue Example

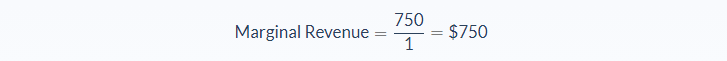

James is producing corn in a one-acre piece of land using fertilizer as the variable input. If James uses one bag of fertilizer weighing 50lbs, the harvest is 5 tons. But if fertilizer is increased to 2 bags, the output increases to 6.5 tons. The price per ton of corn in the market is set at $500. What is the Marginal Revenue for James?

Now let’s break it down and identify the meaning and values of different variables in the problem.

First of all, we can calculate from the problem that the fertilizer increased by 1 bag. Next, we can see that at $500 per ton, James’ revenue went from $2500 to $3250. So he had an increase of $750.

- Change in Revenue = $750

- Change in Quantity = 1

Now let’s take a look at our formula:

For this example, the marginal revenue would be $750.

For this example, the marginal revenue would be $750.

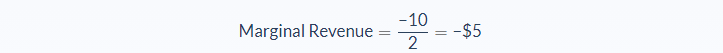

Let’s look at it another way through a different example. Juan sells hospital equipment. He can sell 20 units in a day at $180 each, but for him to sell 22 units in a day, he must reduce the per-unit price to $170. What would his marginal revenue be?

Again, let’s break down the variables in this problem.

- Change in Revenue = -10

- Change in Quantity = 2

We can plug these variables into the equation again.

For this example, the marginal revenue would be -$5. So that would be affecting the revenue margin from his 22nd sale.

For this example, the marginal revenue would be -$5. So that would be affecting the revenue margin from his 22nd sale.

Marginal Revenue Analysis

From the examples above, the concept of marginal revenue is straightforward, and computing it takes the shortest time possible so long as you have a good mastery of the revenues generated in the activity and the respective costs attached to each.

Marginal revenue has considerable influence over product pricing and production levels. It can help companies become successful by guiding them on how to manage their growth and development.

For every marginal revenue gained, there is a marginal cost attached to it of which the marginal revenue has to cover. Hence, perfectly competitive firms are only comfortable producing until the time when marginal revenue equals marginal cost. This explains why firms in a perfectly competitive market maximize profits when the marginal costs, market price and, marginal revenues are equal as illustrated in example 1 above

This is not the same case for monopolies because the firms are in a market with limited competitors accompanied by a sets of demands. There are few products available hence the selling price is affected by the production levels. Therefore for monopolists to benefit from marginal revenue, they have the powers to fix their prices slightly lower or higher than the market price depending with the situation for them to sell an additional unit as illustrated in example 2 above

Conclusion of Marginal Revenue

- Marginal revenue increase in revenue realized from the sale of an additional one unit of output.

- This formula requires two variables: Change in Total Revenue and Change in Quantities sold.

- Marginal revenue is expressed as a financial ratio that is used to compute the overall change in income obtained from the sales of one additional product or unit.

- Depending on the context, you can divide the change in revenue by the quantity/units of input used or units of output sold.

- Marginal revenue varies across firms: In a perfectly competitive market MR is constant while in a monopolistic market MR keeps changing depending with how the price is fixed

Marginal Revenue Calculator

You can use the marginal revenue calculator below to quickly calculate a firm’s Marginal revenue concerning its total revenues and quantities used or units sold by entering the required numbers.

FAQs

1. What is marginal revenue?

Marginal revenue is the increase in revenue realized from the sale of an additional one unit of output. Marginal revenue is expressed as a financial ratio that is used to compute the overall change in income obtained from the sales of one additional product or unit.

2. How do you calculate the marginal revenue?

Marginal revenue can be calculated by dividing the change in revenue by the change in quantity.

The formula for marginal revenue is:

Marginal Revenue = Change in Total Revenue / Change in Quantity

3. Why is calculating the marginal revenue necessary?

Calculating marginal revenue is important because it allows businesses to determine the impact of selling one more unit on their overall income. Marginal revenue can help businesses identify whether increasing production levels will result in increased profits and helps them manage their growth and development.

4. What is a marginal revenue curve?

A marginal revenue curve is a horizontal line at the market price implying perfectly elastic demand at each level of output.

5. What is the difference between the marginal revenue and the marginal cost?

Marginal revenue is the increase in revenue realized from the sale of an additional one unit of output while marginal cost is the increase in total costs associated with producing and selling one more unit of output.

Marginal cost is used to determine whether a business is making profits or not while marginal revenue helps businesses identify how much they can produce without incurring losses.