The materiality concept states that any transaction that can significantly impact financial statements should not be ignored. It should be accounted for using the GAAP (Generally Accepted Accounting Practices) standards.

Put simply, all financial information that has the power to sway the opinion of a user of financial statements should be included in the financial reports.

The main question that needs to be asked is whether financial information makes a significant impact on financial statements. If not, the company does need to fret about including it in their financial reports as it is immaterial.

Materiality is very subjective and can vary from company to company. Some information might be valuable to one company, but it might be too small for another larger company to worry about. It is therefore left upon the professionals to determine whether something is material or not based on their experience and good judgment.

The Securities and Exchange Commission (SEC) has recommended that an item constituting at least 5% of total assets must be disclosed separately in the balance sheet. However, even much smaller items can be considered material and it will ultimately depend on the judgment of the company.

For instance, if a minor item has the impact of changing a profit figure into a loss figure, then it will be considered material regardless of how small the amount is. Similarly, if by including a transaction, a ratio that needs to comply with changes, it would be considered material.

Materiality Can Ignore Other Principles

The materiality concept can in essence override other principles of accounting. Accountants can choose to ignore other accounting concepts if it does not have an important effect on the financial statements of the company.

For instance, a company might choose to charge telephone utility expenses in the books during the period that the cash is paid instead of charging it during the period in which the expense was incurred. This clearly violates the accrual principle and the matching principle of accounting. Accounting for a telephone bill on a cash basis is convenient and as per the materiality concept, we know that it will not cause a material difference in the financial statements.

What Constitutes Materiality

Materiality will depend on the subjective judgment of a professional. There are several factors that result in determining whether an item is a material for a company to account for in its books. Some of them are:

Size of the Business

The size of a business is one of the key factors that determine materiality. Therefore, a $5000 amount for a small restaurant might be significant, but it will be immaterial for a larger organization such as IBM, Apple, Google, Tesla, General Electric, etc.

A specific item might be considered material based on its relative importance of it on the company’s financial statements. There is no specific limit available to determine the materiality of an amount. However, the general idea is that if it represents more than 2 % or 3 % of net income, it will be considered immaterial.

Cumulative Effect

The accountant must take the combined effect of all the individual items as well. It might be possible that individually each item contributed less than 0.25% of net income, but when combined the impact of ten such items is around 2.5% or more. This will require that these amounts be accounted for as material.

Nature of the Item

We have seen that materiality will depend a lot on the dollar amount, but it will also depend on the nature of the item or event. For instance, the company discovers that one of its managers has been siphoning off some money for personal use. Although the amount may be insignificant and might not be more than a couple of hundred dollars, that it was stolen will make it a material event to disclose on the financial reports.

General Rule of Thumb

Although there is no specific limit of materiality and can vary largely from company to company, a general rule of thumb is:

- On the income statement, an amount representing more than 5% of pre-tax profit or more than 0.5% of revenue is seen as a large enough amount to matter.

- On the balance sheet, an amount that is more than 1% of total equity or 0.5% of total assets is seen as a large enough amount to matter.

Materiality Concept Example

Let us study the case study below to get a better idea of how materiality can be determined.

A company reports an extraordinary loss of $50,000 related to the damages caused to its office building in the hurricane. In which of the below two scenarios will it be considered a material item?

- The net income of the company is $40,000,000.

- The net income of the company is $1,000,000.

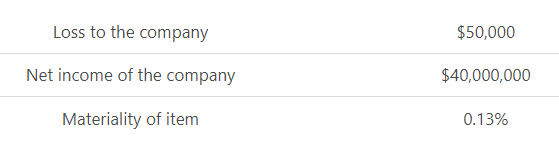

Scenario 1 – Net Income: $40,000,000

In this scenario, we can see that the materiality of the extraordinary loss item is only 0.13% of the net income of the company, which is way below the rule of thumb of 5%. Therefore, it is not material and can be ignored.

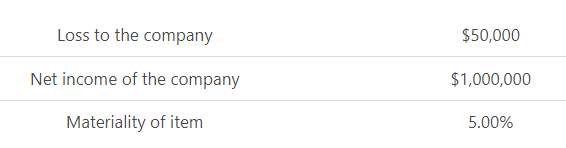

Scenario 2 – Net Income: $1,000,000

In the second scenario, we can see that the materiality of the extraordinary loss item is 5% of the net income of the company, which is meet the rule of thumb of 5%. Therefore, it should be accounted for as a material item.

Abuse of Materiality

Since neither GAAP nor IFRS specifically identifies the criteria for materiality, companies can easily abuse the grey lines provided. It is left to the auditors or the courts to review the cases of materiality abuse. They will need to study the motivation and intent behind the deliberate actions of the companies that have misused the materiality principle.

FAQs

1. What is the materiality concept?

The materiality concept is the principle by which an accountant determines whether an event or item is significant enough to be disclosed in the financial reports of a company. This determination is based on the relative importance of the event or item on the company’s financial statements.

2. Why is the materiality concept important?

The materiality concept is important because it allows companies to disclose only those events or items that are significant to their financial health. This helps to avoid the clutter of insignificant information and allows investors to focus on the most important details.

3. What are the advantages and disadvantages of the materiality concept?

The advantages of the materiality concept are that it allows investors to focus on the most important information and helps to avoid the clutter of insignificant details. The disadvantage is that it can be abused by companies who may want to conceal unfavorable information. Therefore it is important for auditors and the courts to review cases of materiality abuse.

4. What is the difference between the materiality concept and the full disclosure concept?

The materiality concept focuses on the importance of an event or item to the financial health of a company, while the full disclosure concept requires companies to disclose all information, regardless of its importance. The materiality concept is less rigorous than the full disclosure concept and allows for more discretion on the part of the company.

5. What other principles or concepts can the materiality concept ignore?

The materiality principle can ignore other important principles such as the full disclosure concept and the conservatism principle. It can also be abused by companies who may want to conceal unfavorable information. This is why it is important for auditors and the courts to review cases of materiality abuse.