Operating cash flow (OCF) is a measurement of the amount of cash brought in by a company’s normal business operations. Essentially, operating cash flow shows if a company is generating enough positive cash flow to sustain and grow its operations. If the company cannot generate enough positive cash flow, then it may need external financing for capital expansion.

Operating cash flow indicates the cash impact on the company’s net income from its primary business activities. Operating cash flow, otherwise known as cash flow from operating activities, is the first section of the cash flow statement.

This calculation has two versions, a short and a long version. Even the long form of the formula is not completely comprehensive. There are many more non-cash items and other changes in assets or liabilities that can change the formula. The important thing is to make sure that all the items are accounted for.

Operating Cash Flow Formula

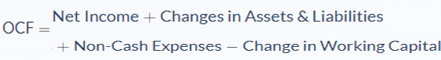

The formula above is the short version of the formula for figuring out operating cash flow. The long form of the formula is as follows:

Changes in assets and liabilities will include:

- + Depreciation

- + Stock-based compensation

- + Deferred tax

- + Other non-cash items

- + Accounts payable

Working capital items would be:

- – Accounts receivable

- – Inventory

Non-cash expenses would be both accrued expenses and deferred revenue.

There are two different methods for presenting the operating cash flow section on a cash flow statement. Both of them are approved under the generally accepted accounting principles (GAAP).

The two different methods are called the indirect method and the direct method. If you use the direct method the company must still perform a separate reconciliation in a similar manner to the indirect method. The reason for this is to make sure that all items have been accounted for and basically to double-check that the number you got from the direct method is right.

In the indirect method, net income is adjusted to a cash basis using changes in non-cash accounts like depreciation, accounts receivable, and accounts payable. Depreciation and amortization and other non-cash items are included because most companies report the net income on an accrual basis.

Net income must also be adjusted for changes in working capital. For example, an increase in accounts receivable shows that revenue was earned and reported in net income on an accrual basis even though cash has not been received. This increase must be subtracted from the net income to find the true cash impact of the transaction.

On the other hand, an increase in accounts payable shows where expenses were incurred and booked on an accrual basis that has not been paid yet. This increase would need to be added back into net income to fine the true cash impact.

Operating Cash Flow Example

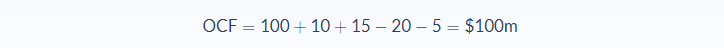

The XYZ, Inc. company reported a net income of $100 million, depreciation of $10 million, deferred tax of $15 million, an increase in accounts receivable of $20 million, and an increase in inventory of $5 million.

Remember that depreciation and deferred tax are considered non-cash expenses. Therefore, an increase in accounts receivable and an increase in inventory are part of the items that are increases in working capital.

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Net Income = $100 million

- Depreciation = $10 million

- Deferred Tax = $15 million

- Increase in Accounts Receivable = $20 million

- Increase of Inventory = $5 million

Now let’s use our formula and apply the values to our variables to calculate operating cash flow:

In this case, the operating cash flow would be $100 million.

The positive operating cash flow indicates that the company is generating enough revenue to maintain and grow its operations without seeking external financing. This also means that there do not need to be any immediate changes to the XYZ, Inc. business operations.

Operating Cash Flow Analysis

Sometimes financial analysts prefer to see and evaluate the cash flow numbers instead of other numbers that can indicate the financial health of the company because the cash flow removes certain accounting anomalies. Operating cash flow in specific provides a clearer picture of the current health of the business operations.

For example, having a large sale gives a huge boost in revenue. But if the company is having a difficult time getting paid for the items sold, then the boost is not a true economic benefit for the company. On the other hand, a company might have a high operating cash flow but has a low net income due to a lot of fixed assets and uses accelerated depreciation calculations.

If a company cannot get a positive operating cash flow it will need to find temporary sources of external funding through financing or investing. However, this is not a fix-all solution. Finding external funding is not a long-term fix. Eventually, the company needs to start generating positive operating cash flow so it can sustain and grow its operations. This is why the operating cash flow is an important indication of the financial health of the company.

Operating Cash Flow Conclusion

- The operating cash flow measures the amount of cash generated by a company’s normal business operations.

- The formula for operating cash flow requires three variables: net income, non-cash expenses, and an increase in working capital.

- Operating cash flow is an important number to evaluate the financial success of a company’s core business activities.

- Operating cash flow is the first section of a cash flow statement.

- There is a short and long version of the formula for calculating operating cash flow.

- There are two different methods for depicting operating cash flow. The indirect method and the direct method.

Operating Cash Flow Calculator

You can use the operating cash flow calculator below to quickly calculate the operating cash flow by entering the required numbers.

FAQs

1. What is Operating Cash Flow (OCF)?

Operating cash flow is the amount of cash generated by a company’s normal business operations.

2. How do you calculate the Operating Cash Flow (OCF)?

There are three variables in the formula for calculating operating cash flow: net income, non-cash expenses, and change in working capital.

The formula for calculating operating cash flow is:

Operating Cash Flow = Net Income + Non-Cash Expenses - Change in Working Capital

3. Why is the Operating Cash Flow (OCF) important?

Operating cash flow is an important number to evaluate the financial health of a company. It is the first section of a cash flow statement and shows if a company is generating enough positive cash flow from its normal business operations to sustain and grow its operations.

4. What is a good Operating Cash Flow (OCF)?

A good operating cash flow is one that is positive and increasing. Analysts preferred to see a cash flow higher than 1.0 as this indicates the company is generating more cash than it is spending.

Conversely, a negative operating cash flow is not desirable as it indicates the company is spending more cash than it is generating. This can be a sign that the company is in financial trouble and may need to seek external financing to sustain its operations.

5. Is operating income the same as Operating Cash Flow (OCF)?

No, operating income is not the same as operating cash flow.

Operating income is the net income of a company after removing non-cash expenses and depreciation. Operating cash flow is the amount of cash generated by a company’s normal business operations. It removes certain accounting anomalies that can distort the net income number.