Operating leverage, also known as the degree of operating leverage (DOL) determines the extent to which a company can raise its operating revenue by increasing its income. Companies with high gross margins and low variable costs have high operating leverage ratios. However, note that a higher ratio also comes with greater forecasting risk, where even small inaccuracies in sales forecasts can lead to disastrous errors in cash flow projections.

A high operating leverage is a sign of the company’s high fixed operating costs with respect to its variable operating costs. It also means that the business’ core operations are more dependent on its fixed assets, and that the company can earn more profit from every added sale while its fixed costs remain the same.

Hence, the business’ operating leverage ratio increases when it makes less high-margin sales. Essentially, the values of fixed assets, like property and equipment, increase without incurring any cost. In the end, the firm’s profit margin can improve with income rising faster than sales revenues.

In contrast, a low operating leverage shows that the company has a lower percentage of fixed operating costs relative to its variable operating costs. This means it is less reliant on fixed assets to keep its core business going while keeping a lower gross margin.

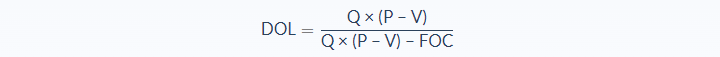

Operating Leverage Formula

- Q = unit quantity

- P = unit price

- V = variable unit cost

- FOC = fixed operating costs

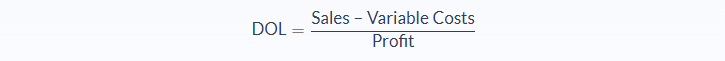

You can also rephrase the formula to:

Since sales minus variable costs are known as the contribution margin, you can simplify the formula further:

By dissecting the formula, it becomes clear that a company’s degree of operating leverage captures the interplay between quantity, price and variable cost per unit and fixed costs.

If a company’s operating income is affected by the most minor changes in pricing and sales, a high operating leverage can be expected, and vice-versa. Managers have to keep track of operating leverage ratios to recalibrate the company’s pricing structure as necessary to achieve more sales, considering a tiny drop in sales can easily cause profits to dive.

It is crucial to acknowledge that minimizing fixed costs can yield higher operating leverage ratios since they are unaffected by sales volume. Profit percentage changes occur as an effect of sales volume changes that are greater than percentage changes. Therefore, a change of, say, 2% in sales can lead to a change in operating profits at a rate higher than 2%.

Ultimately, operating leverage indicates how risky a company is in the eyes of creditors, investors, analysts and managers. While a high operating leverage ratio can be helpful to a firm, it can make the business more sensitive to cyclical and unpredictable macroeconomic environments.

Additionally, a high operating leverage ratio can increase a firm’s profitability in a flourishing economy. But companies that invest huge amounts in property, machinery, distribution avenues, etc. will find it difficult to manage consumer demand. Thus, in an economic downturn, their profits may sink due to increased fixed costs and decreased sales.

Operating Leverage Example

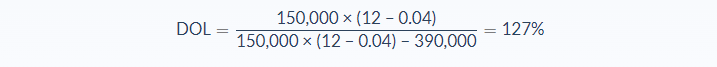

Gigaton is a web development firm with fixed costs of $390,000 (3spent on designer salaries) and a cost per unit of $0.04. The firm sells 150,000 units at $12 each. What is Gigaton’s operating leverage?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Operating Leverage: unknown

- Quantity: 150,000

- Price: 12

- Variable Cost per Unit: 0.04

- Fixed Operating Cost: 390,000

Now let’s use our formula and apply the values to our variables to calculate the operating leverage:

In this case, Gigaton would have operating leverage of 1.2778 or 127.78%. Based on the calculation, if Gigaton’s sales increased by 10%, its profits would increase by 12.78%.

Operating Leverage Analysis

The degree of operating leverage reflects the ratio’s effect on the company’s earnings before interest and taxes (EBIT). Moreover, the operating leverage ratio is crucial when measuring the impact of the firm’s core operational costs, both fixed or variable.

In companies whose costs are mostly fixed, profits can easily increase as a result of higher sales. The challenge lies in how to maintain a sales volume that is high enough to pay those costs. If this is unachievable, fixed costs can be reduced using a variety of solutions, such as outsourcing or moving to a more affordable facility.

Balancing a company’s operating leverage can also boost sales volume, that is, by introducing new marketing and sales activities, and funding the extra payroll. By hiring salespeople and enhancing marketing, a company can convert more of its costs from fixed to variable using financial leverage. It can also balance its fixed and variable costs by keeping an eye on its operating leverage.

Low operating leverage can help a company weather low-revenue episodes in a compromised economy. It also indicates that income can be so low that the business could go bankrupt. When the economy recovers, costs proportionately increase with sales.

Higher fixed costs as a result of regular advertising, even if the company needs a loan to do it, can boost business and profit, no matter the economic climate. In terms of profitability, balancing fixed and variable costs is critical as it drives down operating leverage, possibly increasing financial leverage.

Operating leverage can help investors understand a company’s risk profile. While a high operating leverage is usually beneficial to business, companies with high ratios can also be at risk amid wild economic and business cycle volatility.

As mentioned, when economic or business conditions are favorable, high operating leverage can lead to a dramatic rise in profitability. However, when a company’s costs are considerably tied to plants, machinery, distribution networks and the like, it can be a feat to reduce expenses in response to a change in demand. Hence, in an economic downturn, earnings may not only fall but hit rock bottom.

Operating Leverage Conclusion

- Operating leverage measures the extent to which a company can increase its operating revenue by raising its income.

- The operating leverage formula requires four variables: Quantity, Price, Variable Cost per Unit, and Fixed Operating Cost.

- The operating leverage is usually expressed as a percentage.

- Companies with high operating leverage need more fixed costs monthly, regardless of their sales.

- Companies with Low operating leverage have high costs that are proportionate to their sales volumes but have lower monthly fixed costs.

Operating Leverage Calculator

You can use the operating leverage calculator below to quickly determine the degree to which a company can increase its operating revenue through an income hike, by entering the required numbers.

FAQs

1. What is the Degree of Operating Leverage (DOL)?

The degree of operating leverage (DOL) is the ratio of a company's earnings before interest and taxes (EBIT) to its net income. The higher the DOL, the greater the impact that an increase in sales will have on profits.

2. How is the Degree of Operating Leverage (DOL) calculated?

You can calculate DOL by using this formula:

DOL=Sales-Variable Costs/Profit

3. What does a high Degree of Operating Leverage (DOL) mean?

A high DOL means that a company's profits are more dependent on its level of sales. This can be both good and bad, as it can indicate either that the company is very efficient or that it is very risky.

4. Can operating leverage be less than 1?

Yes, it is possible for a company's operating leverage to be less than 1. This would indicate that a company is not as efficient at increasing its profits through higher sales and would likely be more susceptible to decreases in income during tough economic times.

5. What is the difference between the Degree of Operating Leverage (DOL) and the degree of combined leverage?

The degree of operating leverage (DOL) is the ratio of a company's earnings before interest and taxes (EBIT) to its net income. The degree of combined leverage (DCL) is the ratio of a company's earnings before interest, taxes, depreciation, and amortization (EBITDA) to its net income.