The accounts receivables turnover is a calculation to measure how successful a company is in collecting money owed to them from customers. It is expressed as a ratio that examines how often you are able to recover that money, compared to customers who you are not able to collect from in a timely manner.

In financial terms, a “turnover” is the action of converting a potential sale (credit lines or inventory) into a cash sale. For a receivables turnover, you are examining a company’s efforts to convert incoming debt from their accounts receivables into cash sales. This ratio answers the question, “am I getting paid for the sales I make on credit?”.

For instance, if a company sells products on lines of credit to 5 people, they would not immediately receive the cash flow for those products. The receivables turnover would help them to know how quick they were at turning the lines of credit into cash by collecting it from the customers.

Accounts Receivables Turnover Formula

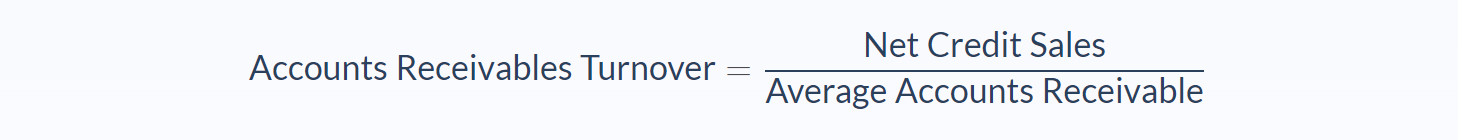

There are two possible equations for calculating the receivables turnover ratio. If you know the average accounts receivable for the company, you can use the following formula:

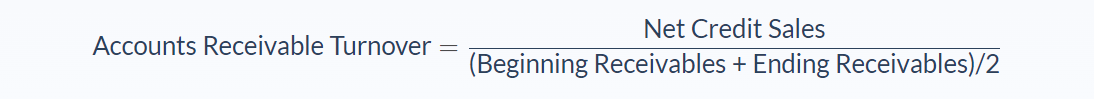

The average accounts receivable is the average balance of funds you’ve collected from clients (who had a credit line with you) for that period of time. However, if you don’t know the average accounts receivable for that period, then you can use the formula below which accounts for that:

In both formula options, you will see the net credit sales as a part of the equation. The value of ordinary net sales looks at the gross amount of your sales after returns, allowances, and discounts are subtracted. The net credit sales also subtract the amount of cash-only sales from that equation as well. This leaves the number of net sales that were made on a credit line (which is what you would collect through your accounts receivable department.

It is helpful to note that any amount reported for accounts receivables on a daily basis occurs at the end of the day, rather than the beginning. To demonstrate, let’s say a customer purchases a product on a credit line with repayment terms of 1 year. On the first day, they pay $100 towards that credit line, then the beginning balance would be $100.

Accounts Receivables Turnover Example

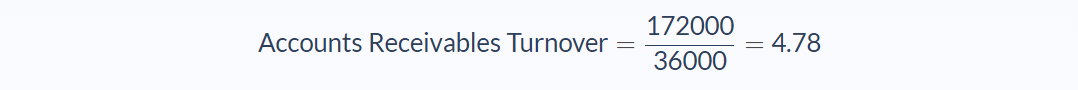

Amy runs a local maintenance supply store that offers lines of credit for select businesses in the area. Over the last year, she has 12 customers with open lines of credit. Her net credit sales amount from them is $172,000. Her average accounts receivable is $36,000. What is her receivables turnover ratio?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Net Credit Sales: 172000

- Average Accounts Receivable: 36000

We will apply the values to our variables and calculate receivables turnover:

In this case, the receivables turnover would be 4.78.

Here is an additional example, for situations where you don’t know the average accounts receivable.

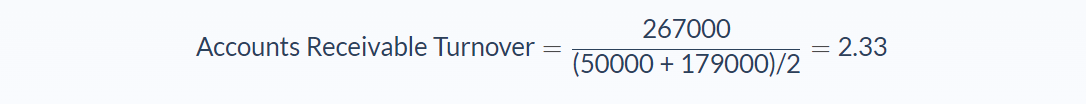

Jeff is a project manager for a construction company that lays steel foundations for bridges. He and his team completed projects for 3 clients last month. For the first job, they charged $65,000. For the second job, they charged $120,000, and for the third job, they charged $82,000. For their beginning receivables, they received $60,000. For their ending receivables, they received $179,000. What was their receivables turnover ratio for that month?

Here are the variables:

- Net Credit Sales: $267,000

- Beginning Receivables: $50,000

- Ending Receivables: $179,000

Now we can apply these values to our formula:

In this situation, the receivables turnover would be 2.33.

Through these formulas, both companies are able to get a better understanding of how well they are doing with collecting on debts owed to their business. Comparing these numbers to their industry-standard can help them understand if they should be adjusting their terms or collection policies to get a better ratio.

Accounts Receivables Turnover Analysis

An accounts receivable turnover ratio is an excellent analytic tool in understanding how financially viable your debt-collection department is. Are they able to collect money owed while still keeping a good relationship with their clients?

One flaw of the receivables turnover formula is that it relies on the average of the accounts receivable. You might think that giving the average would be a fair indication of its health. However, using the average can mask issues within the department. It may not give a realistic assessment of how they are actually doing with their collections. For example, a business may have several smaller accounts with a poor ratio; meanwhile, they could have a larger account with a great ratio. This might skew the numbers and give the impression of overall good efficiency.

But what if that big account just happened to pay it off early? Because of this, someone evaluating the accounts receivable might miss that their general practices and policies need to be re-evaluated. Because of this, it is good practice to take a look at a more detailed list of client accounts for that information.

Nevertheless, the result of the receivables turnover ratio is an important variable in calculating the average collection period (ACP). The ACP estimates the average time it takes for a business to recoup their sales on credit. Having the receivables turnover ratio ready can make that calculation significantly quicker.

Accounts Receivables Turnover Conclusion

- The receivables turnover evaluates how successful you are at recovering money owed from customers.

- A high turnover rate means that the company is able to collect quickly, while a low turnover rate means they are slower at their debt collection.

- If you know the average accounts receivable, the formula has two variables: net credit sales and average accounts receivable.

- If you do not know the average accounts receivable, the formula has three variables: net credit sales, beginning receivables and ending receivables.

Accounts Receivables Turnover Calculator

You can use the accounts receivables turnover calculator below to promptly evaluate how efficient a company is at collecting from its customers by entering the required numbers.

FAQs

1. What is accounts receivable turnover?

The accounts receivable turnover ratio is a formula used to calculate how quickly a company is able to collect on debts owed to it. This number is important in understanding the health of your debt-collection department.

2. How do you calculate the accounts receivable turnover?

The accounts receivable turnover ratio is calculated by dividing the net Credit Sales by the average accounts receivable.

3. Is high accounts receivable turnover ratio good?

A high accounts receivable turnover ratio is good because it means the company is able to collect quickly. A low turnover rate, however, could mean that they are slower at their debt collection.

4. How do you interpret accounts receivable turnover?

The interpretation of accounts receivable turnover is important in understanding the health of your debt-collection department. A high ratio means that the company is able to collect quickly, while a low ratio means they are slower at their debt collection.

5. Why is the accounts receivable turnover ratio important?

The accounts receivable turnover ratio is important because it gives you an idea of how successful your company is at collecting money owed. This number can help you make better decisions about your debt-collection practices.