The retention ratio, also called the plowback ratio, is the portion of company earnings that stays within its coffers as opposed to earnings distributed among shareholders. Retained earnings are considered as net income and are reflected in the income statement.

The retention ratio is a crucial part of other financial formulas, especially those that measure growth. The retention ratio formula determines how much of what a company earns will be reinvested for growth. Such retained earnings may be viewed as an opportunity cost of distributing stockholders’ dividends for reinvestment in outside the company.

A company that keeps a considerable part of its net income is likely to experience more growth or opportunities for expansion. High retention ratios are usually more present in growing companies than those which are already established, although several other factors like overall economic conditions and industry type must also be taken into account.

Retention Ratio Formulas

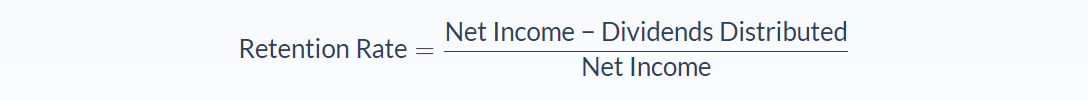

To calculate the retention rate, you subtract the distributed dividends for the period from the net income, then divide the difference by the net income for the year.

Since net income minus distributed dividends are known as the retained earnings and the figure is generally found on the company’s balance sheet, you can simplify the formula:

Calculating a company’s earnings by the end of a fiscal period can be used for a variety of purposes, such as the distribution of dividends among shareholders, retaining a portion of the profit to be reinvested into the business, or both. The percentage of the company’s profit that it decides to retain or save for future use, is known as retained earnings.

Retained earnings are the net income outside what the business has paid out to its shareholders as dividends. Earnings accumulated by a business can be positive and will be called Profits; if earnings are negative, they are referred to as Losses.

Retained earnings are akin to a savings account in that it is an accumulation of profits that are not paid out to shareholders and instead left to be reinvested back into the company for growth.

Retention Ratio Example

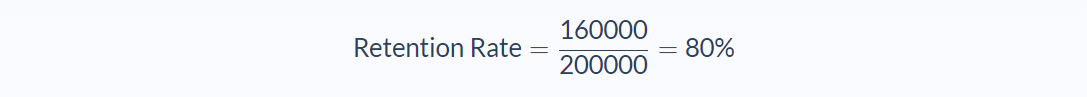

IF EMR Holdings earned a total net income of $200,000 for 2019 and is planning to distribute $40,000 of dividends to its shareholders, what is its retention ratio?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Net income: 200,000

- Dividends distributed: 40,000

- Retained earnings = 200000-40000 = 160000

Now let’s use our formula and apply the values to our variables to calculate the retention ratio:

In this case, EMR Holdings would have a retention ratio of 80%.

This means EMR Holdings is keeping 80% of its profits within the company and distributes the remaining 20% among its shareholders. While an 80% retention rate seems high, it will depend on the conditions affecting the company and the industry in general. For example, in defensive sectors like food production, utilities, and other consumer staples, meaning demand is more or less constant, an 80% retention rate may be unnecessarily high.

In cyclical industries, like construction and technology, this ratio is usually fair enough, depending on other factors such as whether or not the company is new and rapidly expanding, how favorable general economic conditions are, and so on.

Retention Ratio Analysis

Investors can refer to the retention ratio when deciding how much money must be reinvested in their operations. If they decide to distribute all of their retained earnings among shareholders or if they have no plans of reinvesting back into the business, they may continue to make a profit but without significant growth. As well, a company that retains some of its net income but does not use it effectively may incur more debt or issue new equity shares to fund growth.

In essence, the retention ratio helps investors assess their company’s reinvestment rate. When they pocket too much profit, they may not use their cash effectively and should instead invest the money to add more products or purchase new equipment. In most cases, new companies don’t distribute dividends and would rather use their profits to finance their growth.

More stable companies, on the other hand, can afford to distribute part of their retained earnings among shareholders while making sure to allocate a certain portion for reinvestment.

The retention ratio is often higher for expanding companies that rake in huge and rapid revenues and profits. They may decide to plow earnings back into their operations if they think this is beneficial to shareholders through faster revenue and profit increases, compared to what they could expect when investing their dividend receipts.

Investors may not mind not receiving dividends if the company is working on growth prospects. This is a common scenario in an industry such as technology, where new companies rarely distribute dividends and retention rates are generally 100%. In ripe sectors like utilities and telecommunications, investors receive a reasonable dividend and keep a generally low retention ratio.

Depending on factors like the company’s income volatility and policies concerning dividends, a company’s retention ratio may change from one fiscal period to the next. A lot of blue-chip companies pay periodically rising – or at least stable – dividends, while payout and retention ratios in defensive industries tend to be more stable.

Retention Ratio Conclusion

- The retention ratio is a value that indicates how much of a company’s earnings is retained for growth and expansion, as opposed to how much is paid out as dividends among shareholders.

- It is sometimes also referred to as the plowback ratio

- The retention ratio formula requires two variables: net income and dividends distributed.

- The retention ratio is usually expressed as a percentage.

- The retention ratio is generally low for defensive industries, where demand and earnings are relatively constant and higher for cyclical industries, where demand and earnings are more sensitive to the highs and lows of the overall economy and are thus more volatile and unpredictable.

Retention Ratio Calculator

You can use the retention ratio calculator below to quickly calculate how much of your company’s earnings have been or should be retained, by entering the required numbers.

FAQs

1. What is the retention ratio?

The retention ratio is a value that indicates how much of a company’s earnings is retained for growth and expansion, as opposed to how much is paid out as dividends among shareholders. Retained earnings are considered net income and are reflected in the income statement.

2. Is plowback ratio the same as retention ratio?

Yes, the retention ratio is also known as the plowback ratio.

3. What is the retention ratio formula?

The formula for calculating ration ratio is: Retention Rate = Net Income−Dividends Distributed / Net Income

4. What is the relation between dividend payout ratio and retention ratio?

The retention ratio is a converse concept to the dividend payout ratio. The dividend payout ratio is the percentage of a company's net income that is paid out to shareholders as dividends, while the retention ratio is the percentage of a company's net income that is not paid out as dividends.

5. What does a negative plowback ratio mean?

A negative plowback ratio usually suggests that a company is not investing enough of its profits back into the business (i.e. it is paying out too much in dividends and not retaining enough earnings for growth).