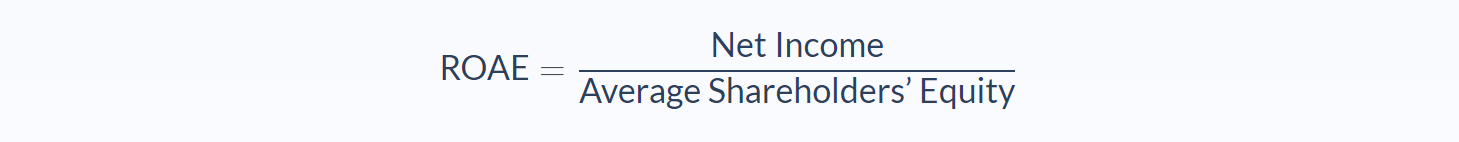

Return on average equity is a profitability ratio that measures the amount of net income compared to the average shareholders’ equity of a company. The goal of this ratio is to estimate the performance of a company using its owners’ investment to generate profit.

Return on average equity (ROAE) is a variation to the commonly used return on equity (ROE) ratio. Some analysts argue that ROAE offers a more accurate outlook on the general profitability of a business.

There’s often a possibility of radical change in the percentage of owners’ equity among total assets throughout the fiscal year of a company. ROAE takes into account this aspect into its calculation as opposed to ROE which only takes the end value of equity.

Return On Average Equity Ratio Formula

To determine ROAE, first, we need to obtain the value of net income. Net income can be found on the bottom part of the income statement. For most companies, net income value exists at the very bottom of the document. As a side note, this is the reason why net income is often called the “bottom line” of a company.

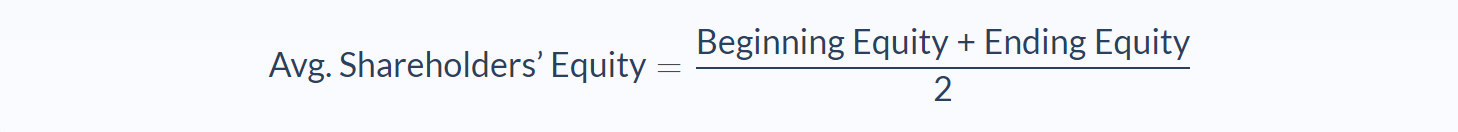

The second variable we need is the average shareholders’ equity. Average shareholders’ equity refers to the sum of the beginning and end value of owners’ equity, divided by 2. The value of shareholders’ equity is available on the balance sheet reported yearly. However, this figure is simply the end value.

To get the beginning value, we need to look at the last year’s figure of stockholders’ equity. The logic here is that the end value of last year is always equal to the beginning value of the current year. By definition, the beginning value of any indicator is the figure before any changes were to happen in that particular year.

One last thing to note is that either ROAE or ROE may give the wrong impression of a company’s performance in certain cases. A high ROAE ratio can mean two things; either a large net income or debt.

A company may have a high ROAE not because they are profitable, but the proportion of debt is so large that it gives the impression of a solid ratio. To prevent this kind of misinterpretation, look at other ratios such as leverage ratios. Furthermore, looking at results from other companies within the same industry as well as the business’s own past results is also a wise thing to do.

Return On Average Equity Ratio Example

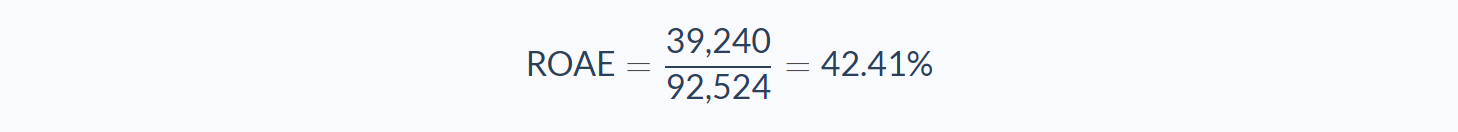

For this example, we will look into last year’s annual report for TechRight (July 2018 – June 2019). The giant technology company booked $102,330 million as the end value of shareholders’ equity for the fiscal year (2019). As for the previous year (2018), the corporation has $82,718 million worth of owners’ equity as part of total assets. Additionally, TechRight managed to gain $39,420 million as the net revenue. What is the return on average equity ratio of TechRight?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Net Income (in million) = 39,240

- Beginning Shareholders’ Equity (in million) = 82,718

- Ending Shareholders’ Equity (in million) = 102,330

First, we can work out the average shareholders’ equity:

Now let’s use our ROAE formula:

In this case, the return on average equity ratio would be 0.4241 or 42.41%. From this result, we can see that the value of net income is equal to about 42.5% of shareholders’ equity value.

At a glance, it seems to be quite a high number. However, to get a more comprehensive outlook, we can compare this result against those of other companies of the same type. For instance, the ROAE of SciTech for FY2019 is 55.92%, which is considerably higher compared to TechRight’s.

Return On Average Equity Ratio Analysis

Profitability ratios such as Return on Average Equity are important indicators to determine whether the company can get a satisfactory profit in the long run. For investors, this is a deciding factor as more revenue means potentially more dividend income and higher share value in the future.

As mentioned before, Return On Average Equity may give analysts a more factual view towards the profitability of a company compared to Return On Equity, which takes into account only the end value of shareholders’ equity.

Shareholders’ equity end value can sometimes be an unreliable indicator. For example, corporations may execute share repurchase on the last-minutes of the accounting period. The share repurchase is an internal transaction where a company buys its own shares from the market. This is usually done to raise the value of stocks when it’s deemed undervalued. This action effectively reduces the number of shares held by investors, increasing demand and price for the shares.

There’s also a more common case which is dividend payment. By paying dividends to stockholders’ before the period ended, the value of owners’ equity would decrease when the balance sheet comes out. The dividend comes from net income. If the dividend has not been paid, all of the net income would still become a part of the owners’ equity. Otherwise, only the leftover amount after the dividend payment is considered a portion of equity.

In all of the above cases, return on average equity will give a more correct evaluation of a business’ profitability. Besides, even if the amount of owners’ equity does not change radically, the value of both ROAE and ROE should be similar or even identical.

Return On Average Equity Ratio Conclusion

- The return on average equity ratio is a profitability ratio comparing the value of net income and average shareholders’ equity.

- This formula requires 3 variables: net income, beginning shareholders’ equity and ending shareholders’ equity.

- Return on average equity (ROAE) can give a more accurate depiction of a company’s profitability compared to ROE if the value of shareholders’ equity has altered considerably through the period.

- To get an even more accurate perspective, look at other ratios as well as results from other companies of the same industry and past results.

Return On Average Equity Ratio Calculator

You can use the return on average equity ratio calculator below to quickly compare the value of net income and average shareholders’ equity by entering the required numbers.

FAQs

1. What is return on average equity ratio?

The return on average equity ratio is a profitability ratio that compares the value of net income and average shareholders' equity. This formula requires 3 variables: net income, beginning shareholders' equity, and ending shareholders' equity.

2. How is the return on average equity ratio calculated?

To calculate the return on average equity ratio, divide the net income by the average shareholders' equity.

3. What is a good return on average equity ratio?

There is no definitive answer as to what is a good return on average equity ratio. However, comparing the ratio to that of other companies in the same industry and past results can give you a better idea.

4. How is return on average equity ratio interpreted?

The return on average equity ratio is interpreted as the percentage of net income generated from the average shareholders' equity. This measures a company's profitability and how well it is utilizing its resources.

5. Why is the return on average equity ratio important?

The return on average equity ratio is important because it measures how well a company is generating profits from its resources. This can be used to compare the performance of a company against others in the same industry or against past results.