Return on debt ratio is one of the profitability ratios measuring the net profit generated by a company relative to its debt. The goal of this ratio is to determine how much the contribution of borrowed resources in making the company profitable.

Return on debt (ROD) is not a common indicator. Analysts tend to use other kinds of profitability ratios to analyze the performance of a company. Companies rarely report return on debt in their financial statements. With that said, ROD may be used as one of the components in building a financial model as a basis for businesses’ executive decision.

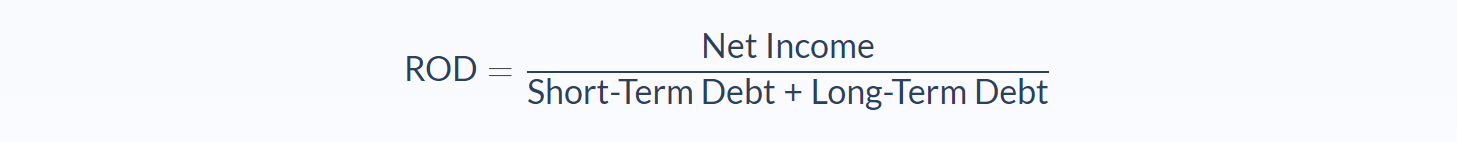

Return On Debt Ratio Formula

To determine the ratio, first, we need to know the value of net income. Net income, also known as net earnings, is the company’s total revenue minus any expenses incurred to run the business operation. Basically, net income is the profit after it’s operating expenses, depreciation, taxes, and all other costs. Net income is the amount of money that will be further divided as dividends for the shareholders as well as retained earnings to be used for future operations.

To obtain net income, you only need to see the value at the bottom of the company’s income statement. This is the reason why analysts refer to net income as the bottom line. You can see the value of total revenue or total sales at the very top of the income statement. Then, the figure of the profit will continue to decrease as all kinds of expenses are taken into account until it comes to the point where no expenses left would reduce the revenue. The remaining figure is net income.

The second variable we need is total debt, which comprises of short-term debt and long-term debt. Keep in mind that debt is different from liabilities. Debt is the amount of borrowed money or capital used by companies to fund their activity. Meanwhile, liability can also include other types of obligations like unearned revenue and unused employee vacation pay. In general, you can think of liabilities as something a company owns to other entities such as banks, customers, and even their own employees, but not necessarily in the form of debt. All debts are liabilities, but not all liabilities are debt.

Short-term debt is a part of current liabilities, which are obligations that are due within a year. On the other hand, long-term debt is one of the non-current liabilities that are expected to be paid off in more than one year.

Return On Debt Ratio Example

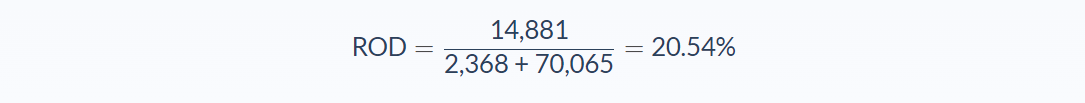

Shopmart Inc., a retail corporation, managed to get $14,881 million as the net income for the fiscal year of February 2019 to January 2020. The amount of short-term debt for that period is $2,368 million. In the meantime, the total value of long-term debt is $70,065 million. This figure is the combination of long-term debt under non-current liabilities and the current portion of long-term debt (CPLTD) under current liabilities. What is the return on debt?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Net Income = 14,881

- Short-term Debt = 2,368

- Long-term Debt = 70,065

Now let’s use our formula and apply the values to our variables to calculate return on debt:

In this case, the return on debt would be 0.2054 or 20.54%.

From this result, we can see that Shopmart has more or less 20% of ROD. Quite a high number if we compare it to the last year’s result of about 11.5%. You can imagine that investors are flocking to Shopmart’s stock from the past year until now, evident from the rise of the stock price to about 25% in the span of one year.

Return On Debt Ratio Analysis

The return on debt ratio can be useful to estimate if a company carries a manageable risk or not in order to generate profit. No matter how profitable a business is, investors and analysts still need to pay attention to the company’s leverage. Should the company suffer a loss, their net assets can be a determining factor to in avoiding bankruptcy.

Still, as mentioned before, ROD is not used as much as other profitability indicators like return on equity (ROE). Return on equity compares the value of net income to shareholders’ equity. With ROE, you can get a more intuitive view of a company’s profitability. This is because you can see the value of net profit relative to the asset that the company’s truly own. There’s also return on capital (ROC). This divides the value of net income to the sum of total debt plus shareholders’ equity. ROC gives us a more comprehensive view as it groups all types of capital into one denominator, no matter if they come from debt or equity.

To get the most of ROD, you can compare results from different periods. Doing it that way provides us with an insight into the company’s dependency on debt overtime. Is it decreasing or increasing? Additionally, comparing it with other corporations from the same industry is also a good idea. We can see the company’s leverage position in proportion to the industry’s overall value of ROD.

Return On Debt Ratio Conclusion

- The return on debt ratio is a profitability ratio indicating a company’s generated net income in proportion to the leverage used.

- The formula for return on debt requires 3 variables: net income, short-term debt, and long-term debt.

- The denominator of ROD can be either long-term debt plus short-term debt or simply long-term debt.

- ROD is not a common profitability ratio. Other indicators, e.g. return on equity, give comparably more intuitive insight.

- To get the most of ROD, you can compare results from different periods and/or companies of the same type.

Return On Debt Ratio Calculator

You can use the return on debt ratio calculator below to quickly calculate a company’s net income corresponding to the leverage used by entering the required numbers.

FAQs

1. What is a return to debt ratio?

The return to debt ratio is a profitability ratio indicating a company's generated net income in proportion to the leverage used. The formula for ROD requires 3 variables: net income, short-term debt, and long-term debt.

2. How do I calculate the return on debt?

You can calculate the return on debt with the following formula:

ROD= Net Income / (Short-Term Debt)+(Long-Term Debt)

3. What is a good ratio for the return on debt ratio?

There is no one, single good ratio. But if you look at the industry's average return on debt, a number above 20% should be considered great. Anything below 10% would be bad and cause for concern.

4. What does a debt ratio of 60% mean?

It means you have $60 of debt for every $100 of equity. This is a lot and should be cause for concern as it burdens the company with a high amount of risk should they ever lose money.

5. What is the difference between the return on debt ratio and the return on equity ratio?

Return on equity is the value of net income relative to shareholders' equity. You are comparing the company's profitability to what they own, i.e. their assets. On the other hand, return on debt is more comprehensive as it groups all types of capital into one denominator, no matter if they come from debt or equity.