Revenue accounts are how companies record their revenue transactions within different accounts based on the nature and type of revenue earned, to make it easier for management analysis.

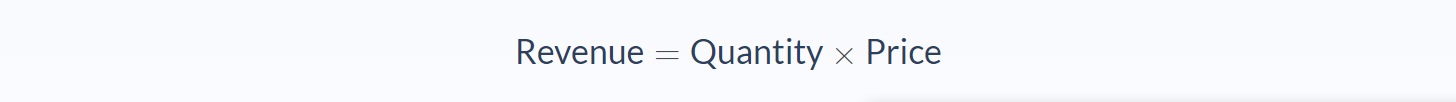

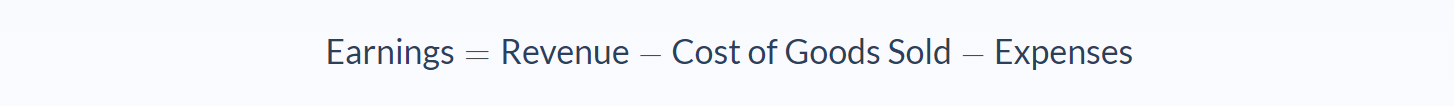

For beginners, it’s often easy to confuse revenue with earnings or profit. Put simply:

When going through the company’s financial statement analyzing revenues is extremely important. It helps investors gauge the viability of a company’s business model.

The accounts that revenue transactions are recorded into will depend on the nature of those transactions and the type of revenue earned.

Nature of Business

Businesses operate in different sectors. Hence, the type of revenues may also vary with these sectors. Let us look at manufacturing businesses.

Manufacturing Businesses

Most organizations in the developing world engage in the secondary or manufacturing sector. The cost of producing items in such economies is relatively cheaper than the developed world. Hence, multinationals move their manufacturing arms to these countries to reap massive benefits.

The business model for such a business is simple and easy to understand. Companies procure raw materials, produced in factories, and then sell products in the market. Income generated through the sale of these products is known as revenue.

Example

Coca Cola has set up 5 factories in Pakistan. Each factory produced and sold 30,000 units in May 2020. The unit price of each product sold is Rs.25. What is Coca Cola’s revenue?

As per the above example, revenue earned by Coca Cola is Rs. 3.75 million ((30,000*5) * Rs. 25)).

Service Businesses

Some companies operate as service providers. Normally, in developed economies, the ratio of service to manufacturing companies is higher when compared to developing economies. Banks, brokerage houses, theme parks (Disney land). With the recent breakthroughs in the digital world new and innovative service providers with the likes of Uber & Facebook have also sprung up.

Example: 1

In Florida, almost 2000 visitors visit Disney Land daily. The entry fee for each visitor is $100. What is the revenue from entry tickets?

As per the above example, daily total revenue from entry ticket sales for Disney theme parks would be $200,000 (2000*$100).

Example 2

Netflix charges $16 monthly for its premium package. The current subscriber base is 100. What is Netflix’s total monthly revenue?

Again, the calculation is easy. The answer would be $1600 (100*$16).

Revenue Recognition Principle

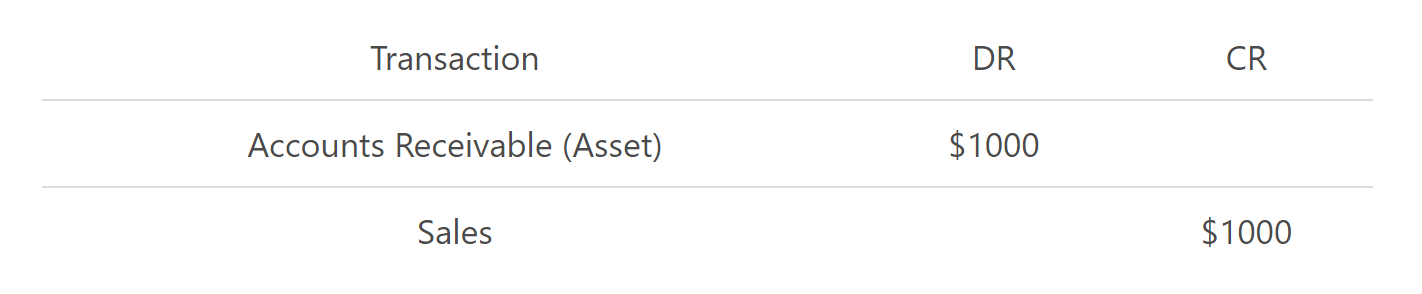

As per the revenue recognition principle, revenue is only recorded by the company when the delivery of services is completed. Often, goods are sold on credit. While the sale is made on paper, the company has not fully received the benefits of rendering those services in the form of cash. Thus, whenever a sale is made on credit, it is also recorded on the balance sheet as Accounts receivable.

Example

- Company A. sells goods worth $1000 to John on credit.

The entry would be as follows

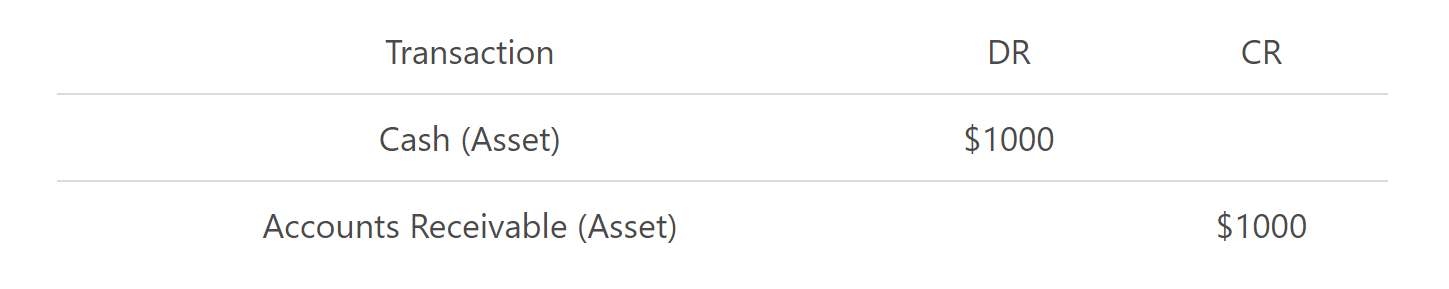

- John makes payment of $1000 of goods received earlier.

The entry would be as follows

Revenue Nature in Accounting

Accounting is based on the universal double-entry bookkeeping system. As Newton’s Law states that “For every action, there is an equal and opposite reaction.” Similarly, every transaction in accounting also has two impacts. Or to put it simply for every debit entry there is an equal credit entry.

Example

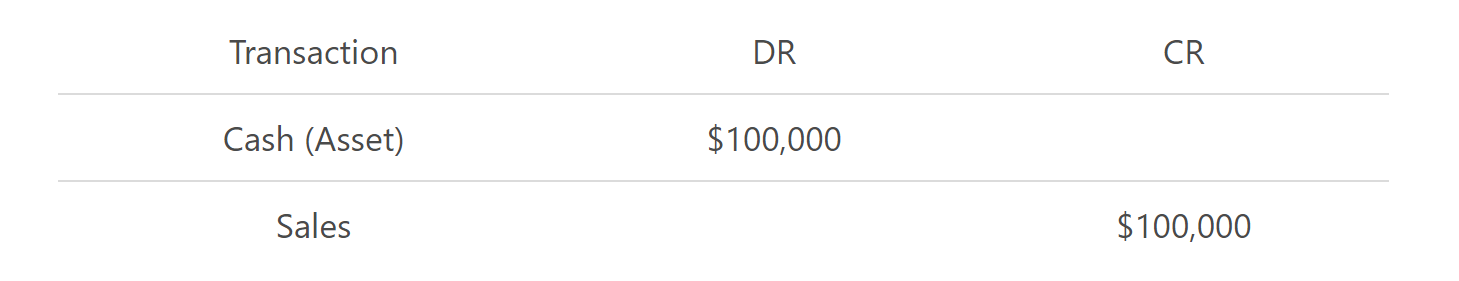

Revenue has a credit nature. This means that as revenue increases it is credited and as it decreases it is debited. The opposing entries are hence debited and credited, respectively. An example can be used to better explain the situation.

Example

Company XYZ sells goods worth $100,000 for cash. The entries would be as follows

As seen from the example above, sales or revenue increases by $100,000 hence it is credited. Meanwhile the opposing entry which is cash is debited with the same amount. This ensures that the double-entry system is maintained, and all balances are equal in the end.

Types of Revenue Accounts

To understand the above examples, it is important to be aware of the types of revenue accounts.

Operating & Non-Operating Revenue

Operating income is the money generated by a business from its core operations. This is the primary source of the revenue made by a company. For most manufacturing companies, the main account that falls under this head is sales.

Non-operating revenue is the money earned through secondary operations of the business. This form of revenue is the one generated other than the core operations of an organization. Different revenue accounts can be viewed below.

Sales

Sales are the exchange of goods & or services for money. We have mentioned countless examples above depicting how sales may vary for businesses that are operating in different sectors. This is the purest form of operating revenue.

Rent Income

Rental income can either be classified as operating or non- operating income. It will be operating revenue for a company whose main business is renting our property, but non-operating for a company that operates it as a secondary form of revenue.

Interest Income

For a company that earns interest through a savings account or other deposits would be a non-operating income but for banks whose primary source of income is earning through the issuance of loan would consider it as operating revenue.

Commission & Consulting Fee

Companies such as Mckinsey & Bane charge a consulting fee for offering services. Similarly, brokers or intermediaries charge a commission for their operations.

Franchise Fee

Franchisors such as McDonalds & KFC charge franchise fees and record these as revenues.

Conclusion

Revenues are recorded on the top portion of the income statement and are also known as the top line of the company. For investors & shareholders, this is an extremely important and pivotal item used before making key investment decisions in a company.

FAQs

1. What do you mean by revenue account?

A revenue account is an account used to track the revenue generated by a company through the sale of goods or services.

2. What are examples of revenue accounts?

Some common examples of revenue accounts are sales, service revenues, rent income, interest income, etc.

3. What is the importance of revenue accounts?

The revenue generated by a company is one of the most important items used before making key investment decisions. This is also known as the top line of the company and appears on the income statement.

4. What is the difference between assets and revenue?

An asset is a term used to describe anything that a company owns and has a monetary value. Revenue, on the other hand, is the money generated by a business through the sale of goods or services. An example of an asset would be a cash balance, while an example of revenue would be the income generated from the sale of goods or services.

5. Is income a revenue account?

No, income is not a revenue account. Income is the result of revenue and expenses being calculated.