The sales to current assets ratio is a measure of how efficiently a company is using its current assets to generate revenue. It shows the relationship between the net sales that are being made and the current assets of a business.

Current assets include cash, prepaid expenses, marketable securities, inventories and any other receivables. This is used to calculate the level of revenue that a company’s current assets are generating.

For businesses that have quite a substantial inventory, figuring out the worth of the company’s assets or their liquidity value can be quite tricky and tedious. The sales to current ratio gives an estimate of that.

When the sales to currents assets ratio is high, this means that the business is not generating income with many assets. It is also very important to note that the sales to currents assets ratio can vary drastically with time, which is why it is useful to identify patterns over some years within the same company, or companies that operated within the same industry like manufacturing.

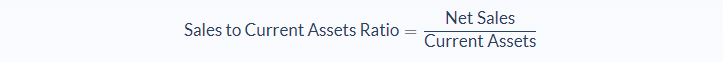

Sales to Current Assets Ratio Formula

Net sales can be found on the company’s income statement, and the current assets will be found on the balance sheet.

To get an efficient value and most use out of the sales to current assets ratio, it is best to measure it over several periods and study the pattern. It also needs to be measured against the average sales to current assets ratio of other companies in that industry as the sales to current assets ratio varies greatly with different industries. A decreasing sales to current assets ratio is always a welcome improvement.

Sales to Current Assets Ratio Example

Katie and Grace started a shoe and handbag business about ten years ago and Katie is convinced the business is not producing enough sales. Grace, however, is certain that they are doing well. To settle this, they decided to find out the liquidity position of their company and gauge how well they are doing by measuring against other shoe and handbag businesses.

The sales to current assets ratio of most shoes and bag businesses are bench-marked at 4.8. They find the following values over the last three years when they go through their income statement and balance sheet.

Year 1

- Net sales = 445,000

- Current Assets = 100,000

Year 2

- Net sales = 600,000

- Current Assets = 125,000

Year 3

- Net sales = 722,000

- Current Assets = 130,000

The value of the last year’s sales to current assets ratio on its own may not mean much but when you look at the last three years you will see that it has been climbing steadily. And in sales to current assets ratio, the smaller the ratio, the better.

When you measure it against the bench-marked 4.0 then you can see that by year 3, they are above the industry benchmark. This means that Katie was right to be worried and although they have made more sales each year, they are not using their current assets to generate sales.

Sales to Current Assets Ratio Analysis

The sales to current assets ratio is very important especially in industries like production where most of the companies do not allow their customers to keep their inventories but rather keep them in-house. The sales to current assets ratio does not apply to companies that all their transactions are done via credit cards and all their customers hold their inventory.

Another importance of sales to current assets ratio as demonstrated in the example is that making more sales does not always mean the company assets are being utilized. More money might be generated, but not from the assets.

It is also very important because it allows potential investors to measure a company’s liquidity and long term liabilities. Also, keep in mind when dealing with sales to current assets ratio that the inventories used by companies are unique to each industry so benchmarking and looking for a pattern is the most efficient way to determine if the sales to current assets ratio is high or not.

When it is determined that the sales to current assets ratio is high, this could be an indicator that the business does not have enough working capital or is not making maximum utilization of their assets. This means the financial pattern or plan is not very reliable, long term. However, when it is increasing over time, but it is not high, this means there is a drop in the production value of the company or it has plenty of debtors.

Sales to Current Assets Ratio Conclusion

- The sale to current assets ratio is a ratio of the net sales that are being made to the current assets of a business.

- It is used to determine how much a business is using its assets to generate funds.

- The formula for the sales to current assets ratio requires two major variables: current assets and net sales.

- Current assets include receivable accounts, prepaid expenses, marketable securities, inventories and cash

Sales to Current Assets Ratio Calculator

You can use the sales to current assets ratio calculator below to quickly get the sales to current assets ratio by entering the required numbers.

FAQs

1. What does the sales to current assets ratio mean?

The sales to current assets ratio is a ratio of the net sales that are being made to the current assets of a business.

2. How do you calculate the sales to current assets ratio?

The sales to current assets ratio is calculated by dividing the net sales by the current assets.

3. What is a good sales to current assets ratio?

A good sales to current assets ratio is anything below 4.0.

4. What does the sales to current assets ratio show you?

The sales to current assets ratio shows you how much a company is using its assets to generate funds.

5. Why is the sales to current assets ratio important?

The sales to current assets ratio is important because it allows potential investors to measure a company’s liquidity and long term liabilities.