- A Quick Glimpse at Stockholders’ Equity

Shareholders’ or Stockholders’ equity is the amount you get when you deduct from the assets on hand to shareholders all paid liabilities of the company.

Shareholders’ Equity (SE) is also known as net worth or Stockholders Equity. Shareholders’ Equity from an accounting perspective refers to the difference between a company’s total assets and total liabilities, which is the general accounting equation. From the investor’s point of view, SE can be referred to as retained earnings and shared capital less its treasury shares. This is the investor’s equation. In other words, the investor’s point of view typically shows how preference and common shares finance a company’s operations.

Understanding Shareholders’ Equity

A company shuts down its operations and liquidates all its total assets. The cash this company returns to its shareholders after they pay off all debts represents the shareholders’ equity. Thus, it symbolizes the net worth of a company.

In simple terms, SE represents the remaining amount of assets available to shareholders after the debts and other liabilities have been paid. The SE subtotal is located in the bottom half of the balance sheet. Financial analysts usually employ this financial metric to analyze the overall fiscal health of a company. SE, as a financial metric, has been adopted by companies, accountants, and financial analysts in computing critical financial ratios such as return on equity, the book value of equity per share, and debt-to-equity ratio, among others.

Insights of Shareholders’ Equity

Depending on the financial status of the company, SE can be positive or negative. A positive SE is a sign that all the company’s liabilities can be comfortably be covered by its assets. On the other hand, if the SE is negative, then its liabilities exceed its assets, which signifies a risky investment as the company. If a company is unable to cover its liabilities from its asset resources, it may, to some extent, deter investors from choosing to invest in the company. It is worth noting that SE is not the only financial health indicator, though. Therefore, before you make an investment decision, always try to double up your research with other metrics. This way, you can get an all-inclusive outlook of an organization’s standing.

Sources of Shareholders’ Equity in a Company

You can find a Shareholders’ Equity with two very important sources. These sources include:

- Original Individual’s investments made to the company after the initial payment.

- Company’s retained earnings accumulated through its operations over some time.

Components of Stockholders Equity

Several factors influence SE, but below are its three major components:

Share Capital

Share capital is contributions from stockholders. It is gathered through the sale of shares. Share capital is divided into two separate accounts: common stock and preferred stock. Its common shares represent residual ownership in a company. In the case of liquidation or dividend payments, preferred shareholders always paid their dividends first before common shareholders receive their shares.

Retained Earnings

Retained earnings are also known as accumulated profits. It represents the portion of the business’s profit that has been held back for re-investment after divided distribution. Retained earnings are used by a company for funding working capital, fixed asset purchases, or debt servicing, among other things.

Treasury Shares

Treasury shares are issued by the company and later purchased back. The cost of these shares is taken from stockholders’ equity.

Formulas for Calculating Shareholders’ Equity

You can calculate the SE of a company in two different ways, both informed by the two different sources from which it originates. These formulas include:

Formula 1

This formula represents the easiest and quickest way to compute shareholders’ equity to inform an investment decision. It is the basic accounting equation. It represents the difference between a company’s total assets and total liabilities. Total assets, in this case, is the total of both current assets and long term assets. It’s worth noting that a company should hold all these figures for only one fiscal year. Total liabilities, on the other hand, involves adding both the company’s current liabilities and the long term liabilities.

Note

In situations where the company’s balance sheet is not available, the SE can be calculated by adding all the company’s assets (both long term and current assets) and then subtracting its total liabilities (both short term and long term). In doing so, the resulting figure is the company’s stockholders’ equity or the net worth of the business. For example, if a company has $80,000 in total assets and $40,000 in liabilities, the shareholders’ equity is $40,000. This is the business’s net worth.

Formula 2

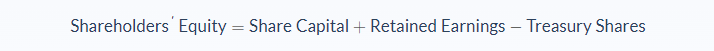

This formula is referred to as the investor’s equation, and it makes use of share capital, retained earnings (profits made by the company), as well as treasury shares (shares the company sells and the repurchases). Here you have to compute the share capital of the company and then figure out the retained earnings of the business. In summary, this formula deducts treasury shares of a company from the summation of its retained earnings and the share capital.

Applications in Personal Investing

Now that we are familiar with various debt and equity instruments, we can apply this knowledge to personal investment decisions. Many investment decisions depend on the level of risk we want to undertake, but we cannot neglect the critical components covered above. Bonds are contractual liabilities. Unless the issuer defaults or stops paying, annual payments are guaranteed. Dividend payments are optional and fluid.

In terms of payment and liquidation order, common shareholders are at the bottom of the chain. Preferred shareholders (like those who own QUIPS or MIPS) are above common shareholders. Bondholders are ahead of preferred shareholders. Consequently, from an investor’s point of view, debt is seen as the least risky investment. Companies prefer debts as their most economical source of financing operations as the interest payments are deducted for tax purposes. Nevertheless, debt is also the most unsafe way a company can go because it must have a contract with bondholders. This attracts regular interest payments that must be paid regardless of economic times.

Conclusion

Before you even step foot into an investment broker’s office, you can figure out just exactly what the risk of investing in a company can be. Pay attention to a company’s shareholders’ equity. Nothing shouts, “Hey, potential shareholder, look at me!” quite like equity with your title next to it.