The statement of cash flows, sometimes called the cash flow statement, sums up how balance sheet changes can affect the cash account throughout the accounting period. It is one of the three essential financial statements that records all your sources of cash inflows. A cash flow statement also breaks down the cash outflows to identify how much money has moved out of the business.

Statement of Cash Flows Template

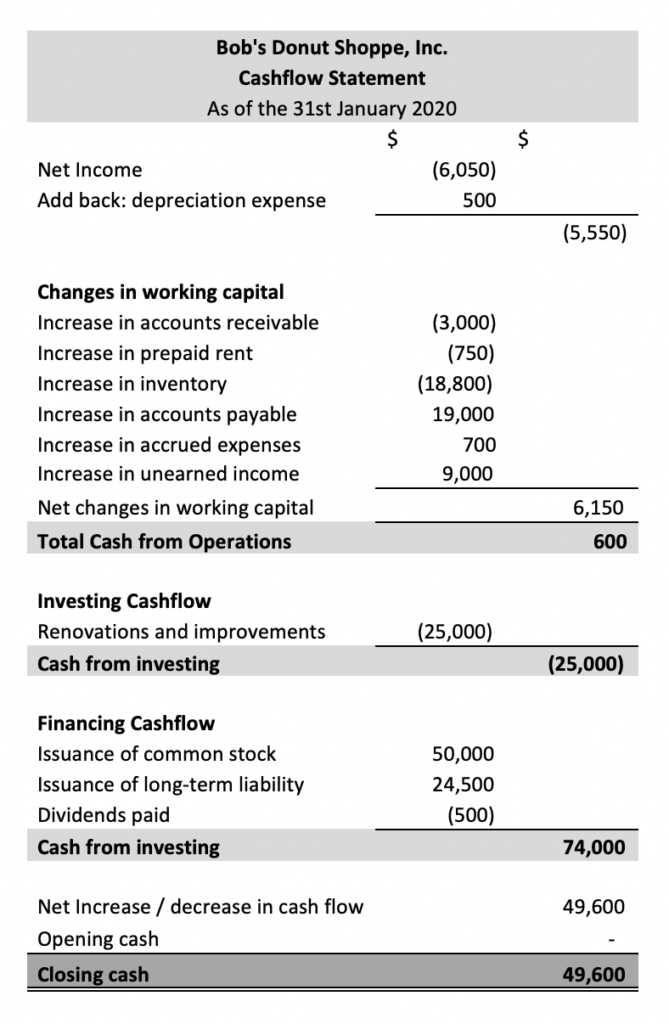

Throughout this series on financial statements, you can download the Excel template below for free to see how Bob’s Donut Shoppe uses the statement of cash flows to evaluate the performance of his business.

Three Sections of the Statement of Cash Flows

Operating Activities

This is the revenue generated by an organization through its core activities and any other activities that are not investing or financing; any cash flows that are a result of current assets and current liabilities.

Investing Activities

Any cash flows from the purchase and sale of long-term assets and other business investments not included in cash equivalents.

Financing Activities

Any cash flows that change the structure and size of the contributed equity capital. This means money acquired or paid out when financing the business.

Free Cash Flow (FCF)

Cash flow statements give the owner of the business and potential investors a lot of decisive information. Free cash flow is considered one of the most important among these. Free cash flow (FCF) is the money that remains when the business’s capital expenditures are subtracted from its operating cash flow.

One of the signs of a growing company is a high FCF. It is one of the determining factors that investors consider when investing or buying a stock.

Cash Flow Calculation

To calculate cash flow, start out with the beginning cash balance from last year’s statement, then add or subtract cash from operating and investing activities, add cash payments and receipts, and subtract cash paid to suppliers and cash paid out for salaries.

Cash Flow Methods

There are two main cash flow methods:

- Direct Cash Flow

- Indirect Cash Flow

Direct Cash Flow

The direct cash flow statements do not include non-cash factors that may affect the cash flow from operating activities. Net income is also not included in these statements, but instead, it simply shows the amount of cash earned and spent by listing every cash payment and receipt over a given time period.

Indirect Cash Flow

Indirect cash flow statements, on the other hand, are much more commonly practiced. The operating activities include the company’s net income or the money remaining after deducting expenses.

Applications

There are uses for both direct and indirect cash flow methods. It mostly depends on the situation and the need that the company has to fulfill. The indirect method is mostly utilized by companies, but it is time-consuming to prepare and may not be very accurate as many variables are being accounted for.

The direct method, on the other hand, doesn’t need a lot of time to prepare other than separating the cash transactions from the non-cash transactions. It is also more accurate than the indirect method.

Importance of a Cash Flow Statement

Like other financial statements, the cash flow statement proves to be an excellent communication tool, providing valuable insight into how well a business is doing. A cash flow statement will state whether the company has positive cash flow or negative cash flow. If the former is the case, then it means the company is in a good position to expand. If the company has a negative cash flow, it is losing more money than it is gaining, which should be a sign of cost-cutting.

A business’s liquidity, solvency, and short-term viability can all be measured with a cash flow statement. Using this knowledge, a business owner can take key decisions to improve the performance of the business and help it grow. In the future, when an opportunity arises, the decision-maker will be better equipped with the financial situation of the business to make an informed decision.

Profit vs. Cash

Analyzing cash flow has major implications when it comes to major business decisions. It is possible for a business to be profitable and to expand into profitable opportunities, while still burdening the business with constant cash outflows, leading to negative cash flow.

In such a situation, if the business is unable to increase production, or find other ways to increase cash inflow, it may simply run out of cash at one point.

A business’s immediate financial situation is represented by the cash flow, while profit represents the long-term health of a business. Every business needs to understand the relationship between profit & cash flow, and must monitor it in order to assess its health.

Statement of Cash Flows Example

The cash flow statement for Bob would look something like this:

Conclusion

The cash flow of a company is useful to both investors and business owners. Whenever investors are looking to buy shares in a company, they focus on companies that have a high cash flow. Usually, when an investor requests to see the cash flow statement, they are analyzing the financial feasibility of the company and whether the business will be able to give out dividends in the near future.

The significance of the cash flow statement should not be understated. It provides an insight into the financial sources and the usage of funds within a business, and whether the business will succeed in the future or not.

Cash flow is referred to as the lifeblood of a business, and it is important for both investors and analysts to study it when analyzing a business or stock.

FAQs

1. What is a cash flow statement?

A cash flow statement is a financial statement that shows how the cash in a company has changed over a specific period of time. It is one of the three essential financial statements that records all your sources of cash inflows.

2. Why is a cash flow statement important?

A cash flow statement is important because it gives you an overview of your company's liquidity. It tells you whether your company is generating more cash than it's using, and it can be a helpful tool for forecasting future cash needs.

3. What are the three sections of a cash flow statement?

The three sections of a cash flow statement are:

1) Operating Activities - This is the revenue and expenses section that reflects the normal business operations of a company.

2) Investing Activities - Any cash flows from the purchase or sale of long-term assets, such as property or investments, fall into this category.

3) Financing Activities - This section includes activities such as issuing stock or borrowing money from a lender.

4. How can a business improve its cash flow?

There are various ways a business can improve its cash flow, including increasing sales, reducing expenses, and generating more cash through investment or financing activities. It's important to note that a business may be profitable but still have negative cash flow, which is why it's important to monitor both metrics when assessing a company's health.

5. What is the difference between profit and cash flow?

The difference between profit and cash flow is that profit reflects a company's long-term financial health, while cash flow reflects the company's current financial situation. Profit is calculated by subtracting expenses from revenue, while cash flow includes both operating and non-operating activities.