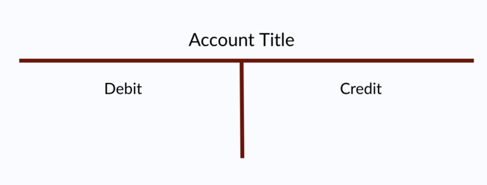

A T-account is a visual depiction of what a general ledger account looks like. It also makes it quite easy to keep track of all the additions or deductions in an account. The debit side is on the left of the t-account and the credit side is on the right. A bookkeeper can quickly spot an error if there is one and immediately fix it with the help of this visualization.

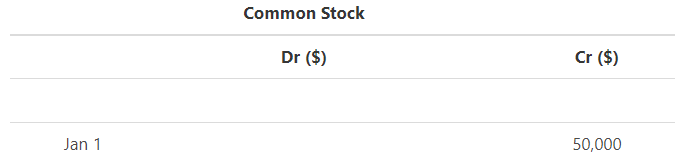

The general ledger of accounts includes many individual t-accounts of different categories such as cash, equipment, accounts receivable, accounts payable, sale revenue, rent expense, equity, etc. Each separate t-account would look something like this:

The Accounting Cycle Example

Throughout this series on the accounting cycle, we will look at an example business, Bob’s Donut Shoppe, Inc., to help understand the concepts of each part of the accounting cycle. Below is the complete list of accounting cycle tutorials:

- Journal Entries

- T-Accounts (you are here)

- Unadjusted Trial Balance

- Adjusting Entries

- Adjusted Trial Balance

- Preparing Financial Statements

- Accounting Worksheet

- Closing Entries

- Income Summary Account

- Post-Closing Trial Balance

- Reversing Entries

We also have an accompanying spreadsheet which shows you an example of each step.

Click here to download the Accounting Cycle template

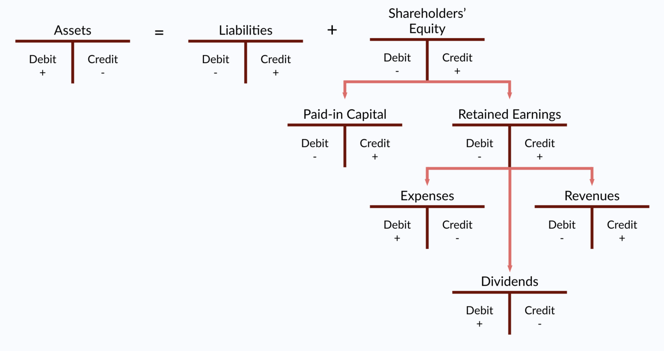

Debits and Credits of T-Accounts

The left side of any t-account is a debit while the right side is a credit. Debits and credits can be used to increase or decrease the balance of an account. This will depend on the nature of the account and whether it is a liability, asset, expense, income or an equity account.

The common rules for debits and credits are:

- Increase in an asset account will be recorded via a debit entry.

- Increase in an expense account will be recorded via a debit entry.

- Increase in dividends or drawings account will be recorded via a debit entry.

- Increase in a loss account will be recorded via a debit entry.

- Increase in an income account will be recorded via a credit entry.

- Increase in a revenue account will be recorded via a credit entry.

- Increase in liability account will be recorded via a credit entry.

- Increase in shareholders equity account will be recorded via a credit entry.

The opposite of what increases the account balances will hold to decrease those accounts. For instance, a debit is used to increase an expense account, therefore logically a credit would be used to decrease that account.

If we use the accounting equation, the t-accounts would look something like this:

Posting of Journal Entries to T-accounts

Once the journal entries have been made in the general journal, the next step is to post them to their individual t-accounts in the general ledger. As discussed in the previous step, journal entries are used to record a business transaction and subsequently a change in the accounting equation.

Posting of these debit and credit transaction to the individual t-accounts provides for an accurate visualization technique for knowing what is happening in each individual account. It provides the management with useful information such as the ending balances of each account which they can then use for a variety of budgeting or financial purposes.

Many companies have nowadays automated this process through the use of an accounting software. Once journal entries are made, they are automatically posted into respective ledger accounts. These can then be viewed by the management. This process is done throughout each accounting cycle.

T-Accounts Example

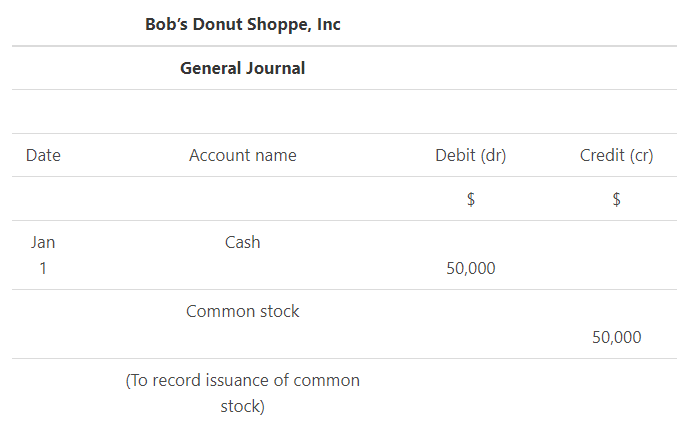

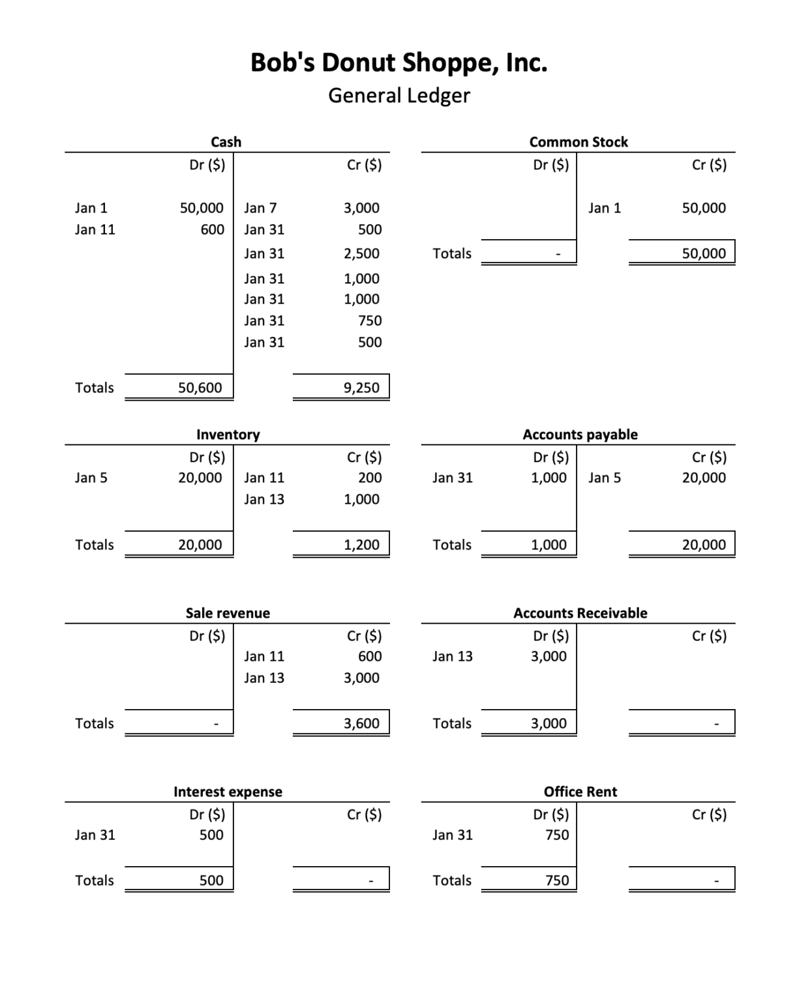

Continuing where we left off in the previous step, we now need to post the journal entries for Bob and his company, Bob’s Donut Shoppe, to the individual t-accounts in the general ledger. Let us take a step by step approach towards understanding how Bob’s bookkeeper will post his first journal entry:

Journal Entry 1

Jan 1. Bob forms the Donut Shoppe, Inc by purchasing 50,000 shares at $1 per share.

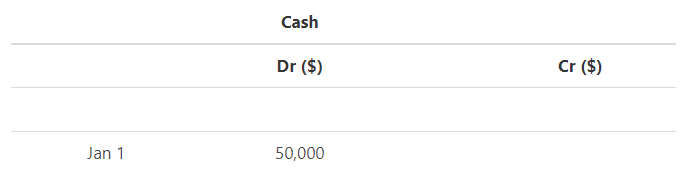

T-accounts for Journal Entry 1

As we can see, the t-account for cash has been debited with $ 50,000 to represent and inflow in the asset account while capital as been credited with the same amount to signify an increase in that account. This is consistent with the rules of debit and credit that have been previously mentioned.

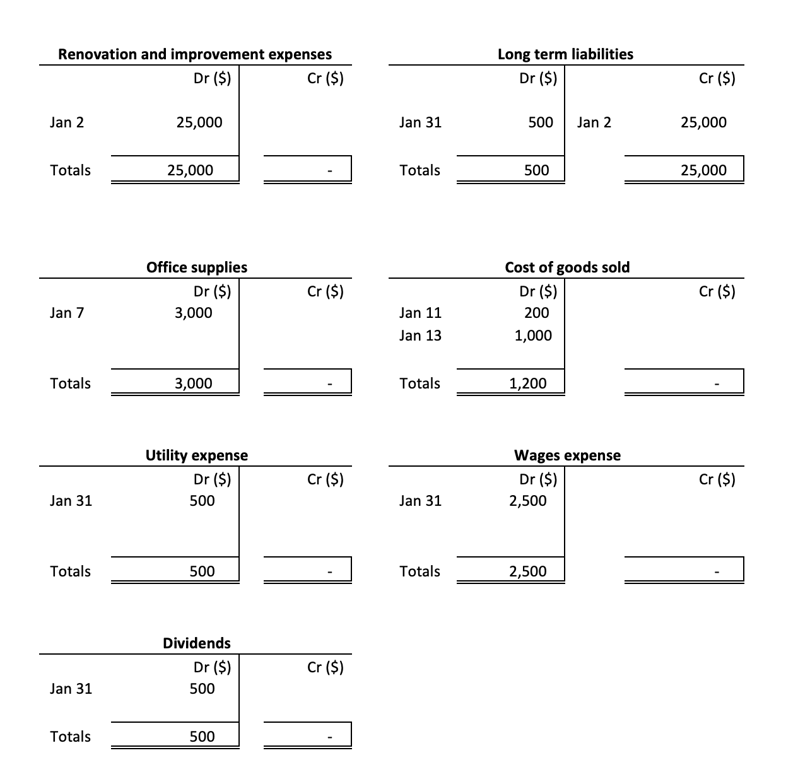

Final General Ledger including all T-accounts

When Bob’s bookkeeper is successful in posting the journal entries to all the individual t-accounts, the general ledger would look like this:

As you can observe from the above example, all the debit and credits entries have been posted to the appropriate side of the respective t-accounts. The balances are totalled in the end, in this example. This will give the management (Bob in this case) a holistic view of what is happening in his accounts and if there is anything out of the ordinary occurring.

Next Step

The difference of these accounts is then carried to the unadjusted trial balance in the next step.

For instance, the difference for the cash account of Bob’s Donut Shoppe would be an overall debit balance of $41,350: (i.e. $50,600 – $9250).

FAQs

1. What is a T-Account?

A T-account is a tool used in accounting to visually represent changes in individual account balances. Each t-account has two columns, one for debits and the other for credits. The total of all the debit columns is always equal to the total of all the credit columns.

2. How are T-accounts used?

T-accounts are commonly used to prepare adjusting entries at the end of an accounting period. The adjusting entries will journalize the difference between the account balances as shown in the general ledger and the actual account balances.

Let's say a company had $10,000 in its cash account as of the end of an accounting period. However, the company only recorded transactions that resulted in a debit balance of $9,000 to the cash account. The difference of $1,000 is what would be journalized as an adjusting entry and posted to the cash account T-account.

3. When should you use T-accounts?

T-accounts should be used whenever you need to track the changes in an account's balance. This can be during the normal course of business or when preparing adjusting entries at the end of an accounting period.

4. What are the problems with T-accounts?

One problem with T-accounts is that they can be easily manipulated to show a desired result. For example, if you want to increase the balance of an account, you could simply credit the account without recording a corresponding debit. This would create a false positive in the accounting records.

Another problem with T-accounts is that they do not show the effect of double-entry bookkeeping. For example, if you debit an account, you must also credit another account to ensure the books are in balance. This is not shown in a T-account.

5. Why can't single entry systems use T-accounts?

Single entry systems cannot use T-accounts because they do not track the changes in account balances. In a single entry system, each transaction is recorded as a debit or credit to one account. There is no way to track the change in balance over time for a particular account.