Terminal value (TV) is used to estimate the value of a project beyond the forecast period of future cash flows. It is the present value of the sum of all future cash flows to the project or company and assumes the cash will grow at a constant rate.

At the end of a traditional forecast period, it is difficult to predict the performance of a company or project because, at that point, the variables get too complex. This is where the terminal value is useful.

Forecasting results beyond that period of time can expose your results to a variety of risks. These can affect the accuracy of your projections, especially since it’s already difficult to predict an industry’s conditions beyond a few years into the future. Typical forecasting periods are between one and five years. The further into the future a forecast is, the less the accurate the forecast is likely to be.

Terminal value is used in a multi-stage discounted cash flow analysis. You can use it to avoid some of the cash flow projection limitations of periods involving several years. Accounting professionals have recognised the limitations of traditional forecasting methods. They employ terminal value to estimate the future value of projects or companies.

There are various methods for estimating the terminal value of a project, however, the most popular one is the perpetuity growth method. It’s also called the Gordon Growth Model.

The perpetuity growth method assumes that free cash flow will continue to grow at a constant rate in perpetuity. It assumes that the company will continue to generate reliable growth forever. Perpetuity also takes into account the time value of money. For example, the value of $1 today is not the same as the value of $1 the following year. The value of the $1 will reduce by a percentage, called the discount rate.

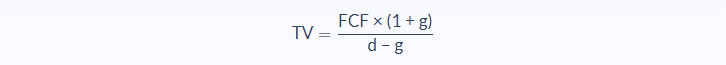

Terminal Value Formula

- FCF = free cash flow for the last forecast period

- g = terminal growth rate

- d = discount rate (usually the weighted average cost of capital)

The forecasted free cash flow comes at the end of the forecast period and is typically the free cash flow at the last year of the forecast period.

Note that the discount rate is generally the weighted average cost of capital (WACC). The perpetuity growth method assumes that the free cash flow of the last projected year will be stable, so it is discounted at WACC to find the present value of the expected future cash flow.

Forecasting a company’s cash flow into the future gets less accurate the more the length of the forecasting period into the future. However, companies need accurate figures about their cash flows well into the future to make key decisions that will affect the sustainability of the company.

In a perpetuity growth method, the terminal value is estimated using the free cash flow for the last forecast period, the discount rate which is usually the weighted average cost of capital, and the terminal growth rate.

A second method of estimating the terminal value is the exit multiple method which assumes that the business has a finite operation time and at the end the time, the business will be acquired or sold.

That method accounts for the realizable value of assets at the end of the projected period of operations. With the exit multiple method, the terminal value is estimated by multiplying the financial statistics by a multiple that is derived from the comparison with other multiples used for similar recent acquisitions.

Terminal Value Example

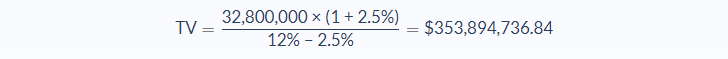

Backfan Group wants to estimate the value of one of its subsidiaries, a paper manufacturing company. The Group’s financial team have decided to use the perpetuity growth method to estimate the future value of the subsidiary. The financial team has put the growth rate of the subsidiary at 2.5% in perpetuity per annum, and the free cash flow is estimated to be $32,800,000 at the end of the fifth year, which is the forecast period. The weighted average cost of capital is 12%.

From the data above, we can identify our main variables:

- Terminal value = unknown

- Forecasted free cash flow = $32,800,000

- Growth rate = 2.5% or 0.025

- Discount rate = 12% or 0.12

Now we can substitute the values for the variables in our formula:

The terminal value of the subsidiary is $353,894,737. This means that the future value of the company, in today’s money value is $353, 894,737. It should also be noted that the growth rate is always lower than the projected growth rate of the economy in which the business operates.

Terminal Value Analysis

Terminal value offers companies a way to calculate the value of a business after the end of the projection period. This result is important to companies for internal financial forecasting models. The perpetuity growth method is widely used by academicians, while the exit multiple method is favoured by investment bankers.

The disadvantage of the terminal value with the perpetuity growth method, is that both the growth rate and the discount rate are assumptions, and any error in one will result in a wrong terminal value. With the exit multiple method too, if the chosen multiple is high or low then the calculated terminal value will also not be accurate.

All firms need to know their financial position for the future. This is because it can play a key role in decision making. A company needs to know its cash flow to determine if it is sustainable. It can help you know whether or not you should fund a project or increase the dividends that go to shareholders. Since long term predictions for cash flow can be difficult, accountants assume a constant cash flow growth rate starting at a particular period in the future. The period is usually the end of a reliable forecast period. This cash flow is referred to as terminal value.

Terminal Value Conclusion

- Terminal value is a financial term that describes the value of a firm at a future time.

- This formula requires three variables: forecasted free cash flow, growth rate, and discount rate.

- As forecasting into the future gets more difficult as the forecast time increases, the terminal value gives the cash flow beyond the possible forecast period.

- The disadvantage of terminal value is that most of the parameters used are assumed, so any errors will translate to wrong terminal value.

Terminal Value Calculator

You can use the terminal value calculator below to quickly calculate the terminal value of a company by entering the required numbers.

FAQs

1. What is terminal value?

Terminal value is the future value of a company at the end of the projection period. It is the value that accounts for the long-term operations of the company.

2. How do you calculate the terminal value?

To calculate the terminal value, you have to first determine your free cash flow at the end of the projection period. Then, multiply this number by a fraction which represents the growth rate and discount rate. The result is the terminal value.

The formula looks like this:

TV = FCF × (1 + g) / d−g

where:

FCF = free cash flow for the last forecast period

g = terminal growth rate

d = discount rate (usually the weighted average cost of capital)

3. Why is the terminal value important?

Terminal value is important because it helps companies with their long-term financial planning. It also allows managers to determine how much cash the business is expected to generate after the projection period.

In addition, it helps them calculate what the expected value of the business will be. This, in turn, enables them to figure out whether or not they should invest in a project or put more money into shareholders' pockets through dividends.

4. What is the difference between book value and terminal value?

One is a historical value, and the other is future-oriented. Book value is what the business's assets are currently worth according to its balance sheet. On the other hand, the terminal value looks at how much those assets will be worth in the future.

5. Is terminal value the same as NPV?

No, not exactly. NPV is a project valuation method for use in capital budgeting analysis to determine the Net Present Value of an investment proposal. In other words, NPV tells you if a project will add value to your company.

Terminal value gives you the value of the company at the end of the projection period and it accounts for long-term operations.