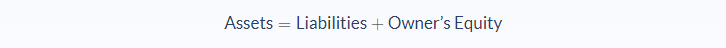

The accounting equation is fundamental to the double-entry accounting system and, put simply, it states that the assets of a business must equal its liabilities & owner’s equity.

The equation helps support the double-entry accounting system which indicates that every entry has an opposing credit entry.

To understand this equation better we need to understand the different components of this accounting equation. In this article, we’ll look at assets, liabilities and owner’s (or shareholders’) equity to help you learn the fundamental accounting equation.

Assets

Assets are general resources that are owned by a company. These resources can either be long term or short term. Assets help businesses generate revenue. Assets can be broken down into Non-Current & Current assets.

Non-Current assets are those assets that have a validity of more than a year. Land, buildings, fixtures & fittings, equipment, machinery all are classified as non-current assets. Furthermore, non-current assets also include intangible assets such as goodwill, brand name, patents & copyrights.

Current assets on the contrary are short term assets. They are generally liquid and can easily be converted to cash. Examples of such assets include cash & equivalents, marketable securities, accounts receivables.

Liabilities

Liabilities include amounts which a company owes to another party. Like assets, liabilities can also be divided into non-current & current. Non-Current liabilities are mainly used to finance non-current assets and include long term debt, mortgage, bonds, etc.

Current liabilities similarly are short term in nature and are used to finance short term assets of the company. Examples of current liabilities include short term loans, overdrafts, accounts payable, etc.

Owner’s Equity

The owner’s equity represents the amount that is invested by the owner in the company plus the net profit retained in the company. For a sole trader, equity would be the amount invested by the sole proprietor plus net income. Similarly, for partnerships and private limited companies, it may be the cumulative investments by all partners plus net income.

The owner’s equity for Public Limited companies also includes shareholder’s equity plus retained earnings. This may be because such companies issue shares to the general public. Shareholders thus, in fact, are the owners of the company and their equity is in the form of investments in shares.

Expense and income accounts would also have to be analyzed as they help accountants determine net profit or a net loss. The owner’s equity increases or decreases by the net profit or loss reported for that particular year. Expense accounts are normally debit in nature, while income amounts are credit in nature.

Double Entry & T Accounts

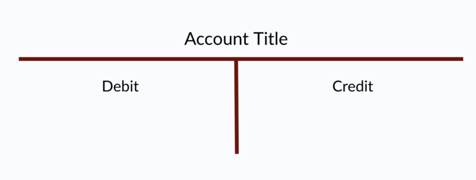

T Accounts are informal financial records used by a company as part of the double-entry bookkeeping process. For every transaction, at least two classes of accounts are impacted. A typical T Account is shown below.

The left side of the T Account shows a debit balance while the right side of the T account shows a credit balance. Account classes such as Assets & Expenses tend to have a debit balance, while account classes such as liabilities & income have a credit balance. The main idea behind the double-entry basis of accounting is that Assets will always equal liabilities plus equity.

This double-entry method of bookkeeping is designed in such a way that assets will always equal to liabilities plus owners’ equity. To maintain accuracy, accountants must follow a step by step process of recording entries. These steps are as follows.

- Make a list of all business transactions.

- Add those business transactions in T accounts and calculate closing balances.

- Make a trial balance to ensure that debit balances equal credit balances. A trial balance shows a list of all debit and credit entries.

- Make financial statements using the trial balance.

Financial Statements & Accounting Equation

The income statement and balance sheet play a pivotal role when it comes to formulating the accounting equation. An income statement of the company shows the revenues, cost of goods sold, gross profit & net profit. The net profit/ net loss is then added to the balance sheet and shows any changes to the owner’s equity. In case of a profit, the owner’s equity increases, while in case of a loss, equity decreases.

The balance sheet shows the assets, liabilities & owners’ equity. It is an extended version of the accounting equation showcasing how assets are equal to liabilities plus equity. Let’s take a look at certain examples to understand the situation better.

Examples

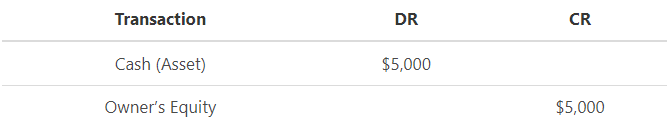

- John sets up a business with $5,000 in cash. The transaction will be recorded as follows

When John sets up his business, assets will increase by $5,000, while the owner’s equity will increase by $5,000.

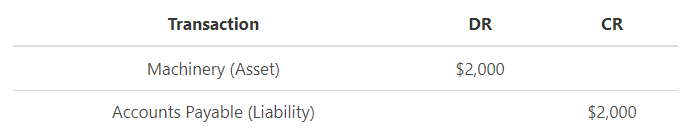

- John Buys machinery worth $2,000 by borrowing from the bank.

As machinery is bought on credit, liability will increase by $2,000, while machinery or asset will increase by $2,000.

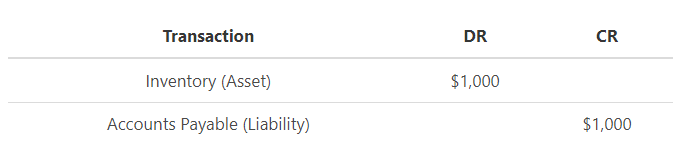

- John buys goods worth $1,000 on credit

The above transaction increases the asset & liability by $1,000

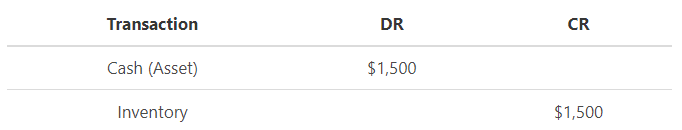

- John sells good worth $1,500 on cash.

When goods are sold, assets increase first in the form of cash and then decrease due to declining inventory, the net effect on asset is zero

- John incurs a marketing expense of $500.

When a marketing expense is incurred it negatively impacts the owner’s equity.

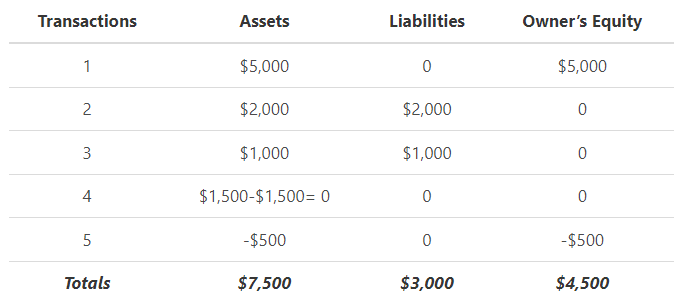

The combined effect on the accounting equation is as follows

The double-entry accounting system is designed to make sure that assets will always be equal to liabilities + owner’s equity. The totals above show that John has total assets worth $7,500, while his liabilities and equity are $3,000 & $4,500, respectively.

The double-entry accounting system is designed to make sure that assets will always be equal to liabilities + owner’s equity. The totals above show that John has total assets worth $7,500, while his liabilities and equity are $3,000 & $4,500, respectively.

As we can see, the assets of $7,500 are equality to the liabilities and equity of $7,500.

FAQs

1. What is the accounting equation?

The accounting equation is a fundamental principle of accounting that states that the total value of an entity's assets must equal the total value of its liabilities plus its equity. This equation is used to ensure that companies' financial statements are accurate.

2. Why is the accounting equation important?

The accounting equation is important because it forms the foundation for all financial statements. The income statement, balance sheet, and statement of cash flows can all be derived from this one simple equation. Furthermore, the accounting equation helps to ensure that a company's financial statements are accurate.

3. What are the 3 elements of the accounting equation?

The three elements of the accounting equation are assets, liabilities, and equity. These three elements are all essential for understanding a company's financial position.

4. What is the basic accounting equation formula?

The basic accounting equation formula is Assets = Liabilities + Equity. This equation states that the total value of an entity's assets must equal the total value of its liabilities plus its equity. It is this simple equation that forms the foundation for all financial statements.

5. What is the goal of an accounting equation?

The goal of the accounting equation is to ensure that a company's financial statements are accurate. The three elements of the accounting equation-assets, liabilities, and equity- provide a snapshot of a company's financial position. By ensuring that these three elements balance, accountants can make sure that the financial statements are correct.