In financial terms, the value of an asset derives from the cash flows associated with that asset. This applies whether the asset is a financial asset or a real asset.

The cash flows must be evaluated on a present value basis. Thus the value of any asset at time 0 would then be the discounted value of net cash flows over a relevant time horizon.

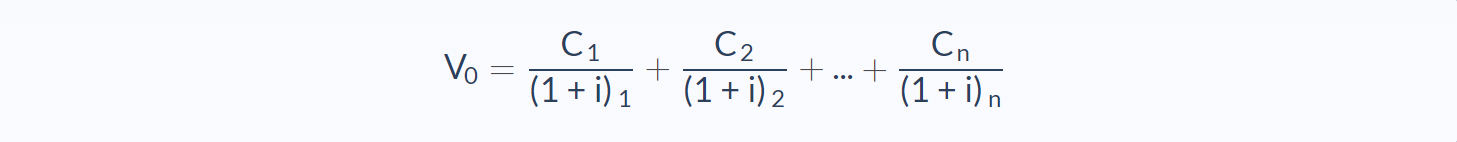

General Valuation Model

- V0 = Value at time 0

- C = Year’s Cash Flow

- i = Annual Interest Rate

- n = Number of Years

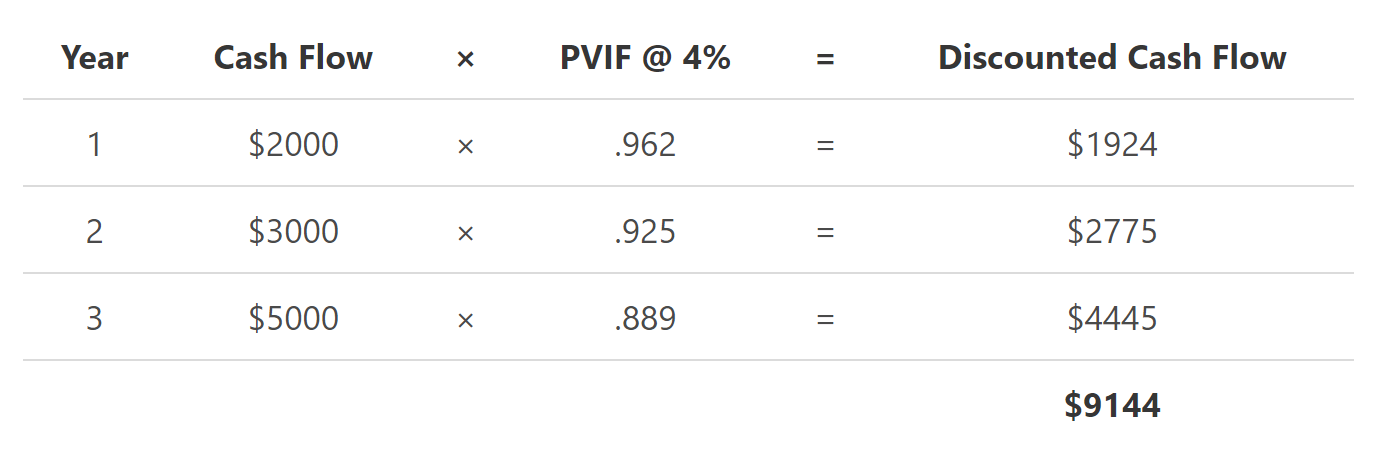

For instance, a three-year asset with cash flows of $2000 in year one, $3000 in year two, and $5000 in year three would be valued at $9144 if interest is 4%.

So the discounted value of the cash flows for this asset is $9144. Does this mean that the price of the asset at time 0 would be $9144? It does if the market for the asset is efficient1. So in an efficient market, V0 = P0. Thus to value or price an asset in an efficient market, simply identify the cash flows associated with the asset and discount them down to present value.

Valuing Bonds

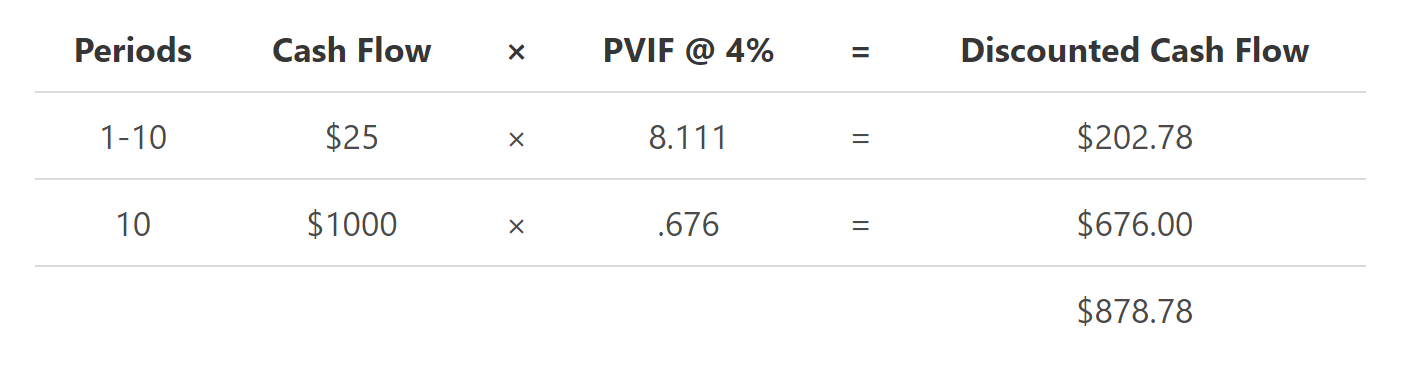

Bonds are a corporate security representing debt of the company. They are easily valued since the cash flows are easy to identify. The cash flows associated with bonds are the coupon payments2 on the bond each coupon period and the maturity value3 or face value4 of the bond. Most bonds in the U.S. pay coupons semiannually and most bonds have maturity values of $1000 each. The following example illustrates how easily bonds are priced.

Price a 5% coupon, $1000 bond with 5 years to maturity if other bonds of similar quality are sold to yield 8%.

The coupon payments would be $50 per year (5% of $1000) or $25 each six months. There will be 10 compounding periods (2 × 5 years.) The maturity value is $1000. The bonds will be discounted at the market rate which is 8% per year or 4% each six months.

If one wanted to sell this bond for $980, no one would want to buy it. The only way the holder of the bond could unload it would be to lower the price. On the other hand, if one said they would sell the bond for $750, there would be a rush into the market to buy the bond. Thus, demand would be greater than supply and the price of the bond would rise. To how much? To $878.78, all other things being equal. Thus the $878.78 is the equilibrium price5 for the bond until market conditions change.

Bond Yields

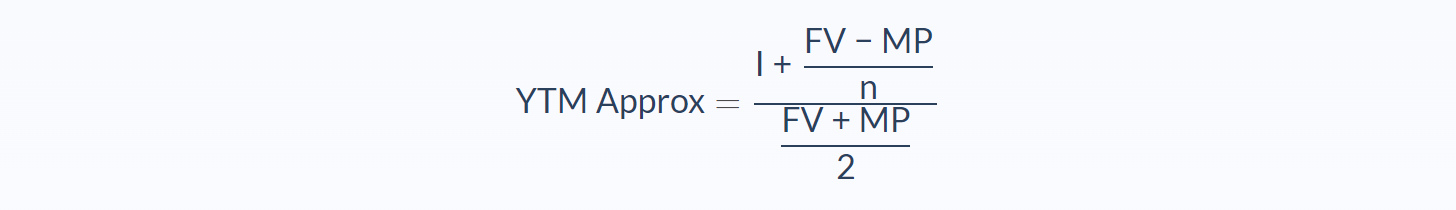

In the previous example the market rate of discount was 8%. That did not mean that all bonds sold in the market had coupon rates of 8%. Rather it meant that all bonds of similar quality went through the same auction price as the bond in the example. If the bond sold for a discount6, that would increase the yield. If it sold at a premium7, that would decrease the yield, all other things being equal. The yield to maturity8 is actually the internal rate of return9 on a bond. To find the internal rate of return, use a financial calculator, a bond yield table, or a spreadsheet program. However, an approximation of the yield to maturity may be found by employing the following formula.

- I = Annual Interest in Dollars

- FV = Face Value of Bond

- MP = Market Price of Bond

- n = Number of Years Until Maturity

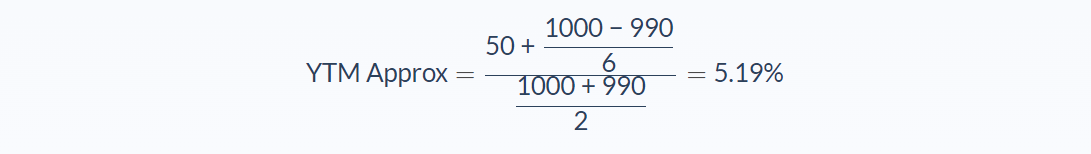

An example shows the approximate yield to maturity for a 5%, $1000 bond selling for $990 with 6 years to maturity.

Note that in using this approximation formula that the semiannual payments are not adjusted. In an efficient market, the yield, market rate of discount, and investors’ required rate of return are all equal.

For more information, see our lesson on the yield to maturity formula, and the included yield to maturity calculator.

Valuing Preferred Stock

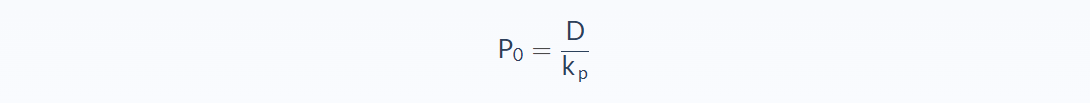

Although preferred stock is an equity instrument10, it is easy valued. Technically it is a perpetuity. As previously explained in time value of money, to value a perpetuity, simply take the annual return in dollars and divide by the appropriate discount rate. The annual return in dollars for a share of preferred stock would be the dividend rate, which is found by taking the dividend rate and multiplying it by the par value for the preferred. The formula for valuing preferred stock could then be written as follows.

- D = Annual Dividend in Dollars

- kp = Investors’ required rate on similar preferred

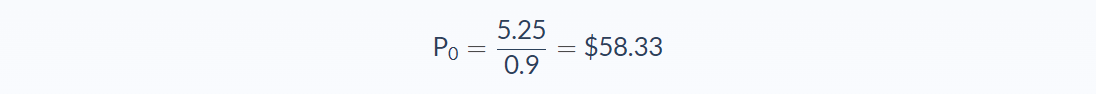

An example illustrates the use of the formula. A share of preferred that pays a 5.25% dividend has a par value of $100. If the investors’ required rate of return is 9%, what would be the price?

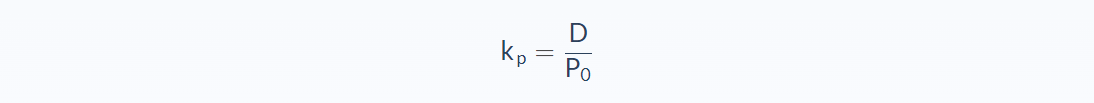

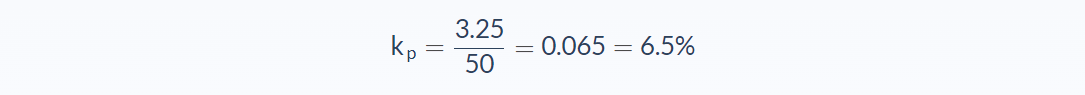

The yield on a share of preferred may be calculated by a simple manipulation of the pricing formula.

So if a 3.25%, $100 par preferred were selling for $50, the investors’ required rate of return would be 6.5%.

Valuing Common Stock

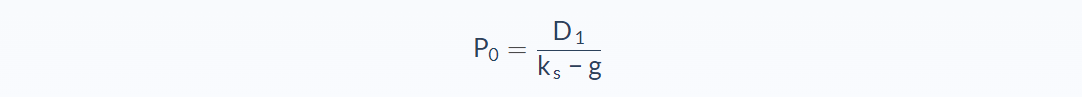

Common stock is not so easy to value. The cash flows are not stable or easily identified. One simple model that is sometimes used to value common stock is the Gordon Dividend Valuation Model.

- D1 = Dividends Year 1

- ks = Investors’ Required Rate of Return

- g = Growth Rate in Dividends

D1 would be calculated by multiplying current dividends by (1 + g).

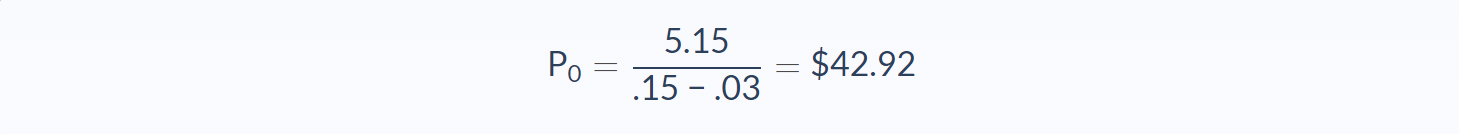

For example, price a share of common stock with current dividends of $5, a dividend growth rate of 3% if the investors’ required rate of return is 15%.

D1 was found by multiplying the current dividends of $5 by 1.03 (1 + .03).

Rate of Return

Investors’ Required Rate of Return on Common Stock

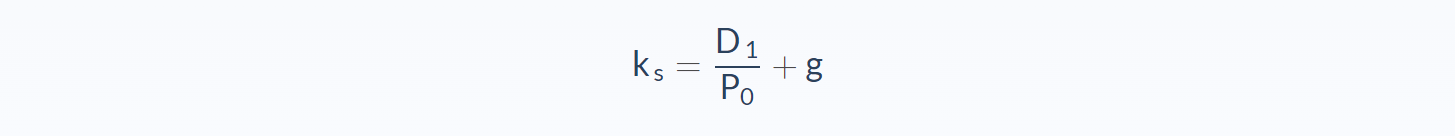

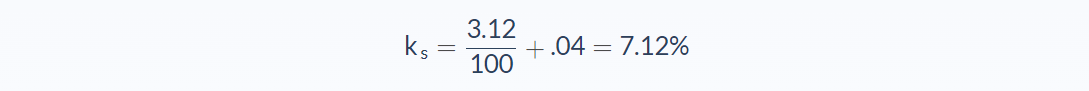

By manipulating the Gordon formula, the investors’ required rate of return may be estimated.

For example, find the investors’ required rate of return on a share of common stock selling for $100, current dividends of $3 and a dividend growth rate of 4%.

This overview was developed by Dr. Sharon Garrison.

No adaptation of its content is permitted without permission.

-

Markets in which prices adjust quickly to new information and prices reflect the economic value of information.↩

-

Periodic interest payments on a bond. Usually made semiannually.↩

-

Par value/face value on a bond. Amount to be repaid at maturity.↩

-

Par value/maturity value on a bond. Amount to be repaid at maturity.↩

-

Price securities sell for in efficient market, which is the discounted value of cash flows.↩

-

Selling below par.↩

-

Selling in excess of par.↩

-

Return on bond if held to maturity. Reflects premium/discount and price and maturity of bond.↩

-

Rate of return that causes net present value to equal 0.↩

-

Ownership interest in the firm.↩

FAQs

1. What are corporate securities?

Corporate securities are any financial instruments issued by a corporation. They can include stocks, bonds, and preferred stock.

2. What is meant by valuation of securities?

Valuation of securities is the process of estimating the worth of a security. This is done by looking at the cash flows that will be generated by the security and discounting them back to the present using an appropriate rate.

3. Why do we need to calculate valuation of securities?

The purpose of calculating the valuation of securities is to ensure that we are paying a fair price for the investment. It also allows us to determine the rate of return that we would need to receive to break even on our investment.

4. What is the general valuation model?

The general valuation model is a formula that is used to estimate the price of a security. It considers the cash flows that will be generated by the security and discounts them back to the present using an appropriate rate.

5. What are the characteristics of corporate bonds?

Corporate bonds have a number of characteristics that set them apart from other types of bonds. These includes their maturity, their coupon rate, their tax status, and their callability.