The weighted average cost of capital (WACC) is a calculation of a company or firm’s cost of capital that weighs each category of capital (common stock, preferred stock, bonds, long-term debts, etc.). The ratio of debt to equity in a company is used to determine which source should be utilized to fund new purchases. An increase in a company’s WACC signifies an increased risk and a decrease in valuation.

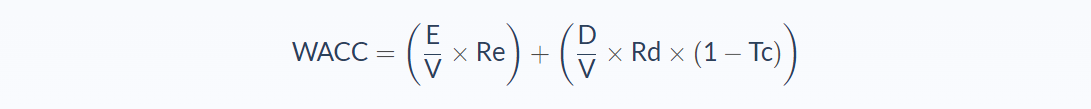

Weighted Average Cost of Capital Formula

- Re = Cost of equity

- Rd = Cost of debt

- E = Market value of the firm’s equity

- D = Market value of the firm’s debt

- V = E + D = Total market value of the firm’s financing

- E/V = Percentage of financing that is equity

- D/V = Percentage of financing that is debt

- Tc = Corporate tax rate

In the WACC calculation, the cost of each capital component is multiplied by its proportional weight. It is then multiplied by the corporate tax rate.

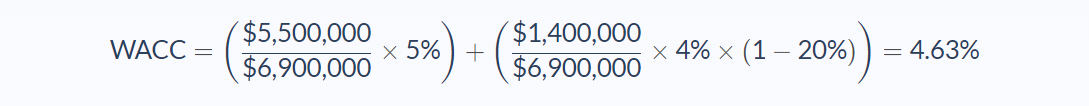

Weighted Average Cost of Capital Example

Using the following values, do a quick calculation of a fictional company’s WACC:

- Re = 5% or .05

- Rd = 4% or .04

- E = $5,500,000

- D = $1,400,000

- Tc = 20% or .20

- V = $6,900,000 (E+D)

Using this example, one can determine that the company has a WACC of 4.63%, which is the amount of money the company needs to pay investors for each $1 of funding. In this case, it amounts to $.0463 per $1.

Analysis of Weighted Average Cost of Capital

The cost of equity (Re) can be difficult to determine, as each share of stock in a company doesn’t have a specific value or price, and the value or price that investors are willing to pay is always fluctuating. Ultimately, the cost of equity is how much a company must spend to keep stock prices steady and meet its investors’ required rate of return. The cost of equity can be found using the capital asset pricing model (CAPM), which uses a company’s beta, expected return of the market, and the risk-free rate.

The cost of debt (Rd) is calculated using the actual interest rate or market interest rate that a company is paying. Interest is generally deductible, so the savings generated by these tax deductions is represented at the end of the formula (1-Tc).

The market value of a firm’s equity (E) refers to the value of all outstanding shares, or those owned by insiders and shareholders investing in the company.

The market value of a firm’s debt (D) refers to the value of all outstanding debt, which can be found on a company’s balance sheet.

The corporate tax rate (Tc), or effective tax rate, can be determined by dividing the total tax paid by that company’s taxable income.

Many analysts and investors tend to come up with different WACC numbers for the same company due to the many different assumptions that need to take place when determining the cost of equity. As a result, WACC is often used as more of a speculation tool than a concrete number used in final investing decisions.

Weighted Average Cost of Capital Conclusion

- The Weighted Average Cost of Capital is used to determine whether debt or equity should be used to finance a purchase.

- WACC is not a concrete number, it is very assumption-based and subject to change.

- WACC incorporates all aspects of a company’s capital, including preferred stock, common stock, bonds, and other possible long-term debt.

- Cost of equity can be found by utilizing the CAPM.

- WACC is an essential part of any economic value added (EVA) calculations.

- There are many values included in the calculation of WACC, namely the market value of a company’s equity, the market value of a company’s debt, the cost of equity and cost of debt for that company, the total market value of that company’s financing, and the corporate tax rate.

Weighted Average Cost of Capital Calculator

You can use the WACC calculator below to quickly work out the weight average cost of capital by entering the required numbers.

FAQs

1. What is the Weighted Average Cost of Capital (WACC)?

The weighted average cost of capital, or WACC, is the calculation that determines the amount of money a company needs to pay its investors in order to receive funding. This number takes into account the cost of equity, the cost of debt, and the total market value of a company’s financing.

2. How is the Weighted Average Cost of Capital (WACC) calculated?

The weighted average cost of capital is calculated by taking the market value of a company’s equity, the market value of a company’s debt, the cost of equity, and the cost of debt. These values are all plugged into a formula that takes into account the corporate tax rate. The formula is as follows: WACC = (E/V) * Re + (D/V) * Rd * (1-Tc)

3. Why is the Weighted Average Cost of Capital (WACC) important?

The weighted average cost of capital is important because it determines how much a company needs to pay its investors in order to receive funding. It is also essential in any economic value added calculations. For example, if a company is looking to purchase new equipment, the WACC can help determine whether it should finance the purchase through debt or equity.

4. Is cost of capital and WACC the same?

No, the cost of capital is the rate at which a company can borrow money, while the weighted average cost of capital is the calculation that determines the amount of money a company needs to pay its investors in order to receive funding. An example of the cost of capital would be a company’s interest rate on a bond. An example of the weighted average cost of capital would be the calculation that incorporates the cost of equity and the cost of debt.

5. Is the Weighted Average Cost of Capital (WACC) always accurate?

Unfortunately, no, the weighted average cost of capital is not always accurate. This is because it is very assumption-based and depends on a number of factors, which can change over time.