The working capital ratio is a liquidity tool that gauges a company’s ability to settle its current debts with its current assets. It is sometimes referred to as the current ratio. The working capital ratio is crucial to creditors because it is an indicator of a company’s liquidity.

Creditors prefer current liabilities to be paid with current cash. This could include cash equivalents and marketable securities as well. This is because these assets are easily convertible to cash, unlike fixed assets. Faster cash conversion means more timely debt payments.

This metric is called the working capital ratio because it comes from the working capital calculation. Companies whose current assets are greater than their current liabilities have sufficient capital to sustain their everyday operations. In short, they have enough working capital. The calculation is essentially a comparison between current assets and current liabilities.

Working Capital Ratio Formula

Current accounts and current liabilities are entered into a company’s balance sheet separately. This presentation makes it easier for investors and creditors to analyze a business. In financial statements, current assets and current liabilities always come before long-term assets and long-term liabilities. This calculation shows the portion of a company’s current assets that will cover its current liabilities.

You can see how changes to a company’s current liabilities and current assets directly affect the ratio. Specifically, a company’s working capital ratio is directly proportional to its current assets but inversely proportional to its current liabilities.

Because this ratio measures assets as a portion of liabilities, a higher ratio is better for companies, investors and creditors. A ratio of 1 is typically considered the middle ground. While it’s not technically high-risk, it is not very safe either. It means the firm would have to dispose of all current assets before it can pay off its current liabilities.

A ratio below 1 is significantly risky for creditors and investors. It proves the company isn’t operating efficiently, meaning, it cannot settle its obligations properly. A ratio below than 1 is always negative and is aptly called negative working capital. On the other hand, a ratio higher than 1 shows the company is capable of paying all its liabilities, while still keeping some current assets. Hence, it is called positive working capital.

Working Capital Ratio Example

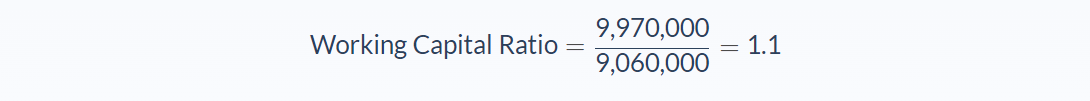

By the end of 2019, CREV Retail Co had total current assets at $9.97 million and total current liabilities at $9.06 million. What is the company’s working capital ratio?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Current assets: 9.97m

- Current liabilities: 9.06m

We can now apply the values to our variables and calculate the working capital ratio:

In this case, CREV Retail Co would have a working capital ratio of 1.1.

CREV Retail Co’s WCR is above 1 which means it is clearly capable of paying its debt. While a ratio of 1 is considered safe, it is still not safe enough because this means the company will have to sell all its assets before it can pay its debt. In this example, the ratio is slightly higher than 1 which means they would not have to sell all of their assets to pay off debt. If the company applies for a new loan, it will have to pay off some of its debt in order to improve its working capital ratio and lower its risk to creditors.

Working Capital Ratio Analysis

Because the working capital ratio has two key moving components – assets and liabilities – it important to study how they operate together.

It is also important to understand the difference between positive working capital and negative working capital. The former is always preferable as it means the business is likely to cover its short-term liabilities with its liquid assets. At the same time, this means the business can continue growing without having to incur additional debt or issue new stocks.

Conversely, a company with a negative working capital means the business lacks liquid assets to cover its current or short-term liabilities, usually due to poor asset management and cash flow. In case a company has insufficient cash to cover its bills when they are due, it will have to loan money, thereby increasing its short-term debt.

In any case, negative working capital is always a sign of a company whose finances are not doing well, but not necessarily to the extent it is going bankrupt. A lot of big companies usually have negative working capital and are fine. This is possible when inventory is so fast they can still pay their short-term liabilities. Such companies – usually big box stores and similar businesses – get their inventory from suppliers and sell the products immediately away for a low margin.

Working capital management demands coordinated actions and strategies for optimal inventory and accounts receivables as one part of the company’s liquidity. For instance, even if a company has a net working capital of 1.8, it can still have a slow inventory turnover or slow collection of receivables. Both potential issues can lead to delays in the availability of actual liquid assets.

On the flip side, when companies depend on credit lines and loans, it can lower their ratios. This is because they obtain assets from creditors only they need to settle outstanding liabilities, reducing net working capital. In the end, the value of a working capital ratio is only as good as the company’s accounts receivables, credit, and inventory management.

Working Capital Ratio Conclusion

- The working capital ratio is a metric that reflects a company’s ability to pay off its debts with its assets.

- This formula requires two variables: Current Assets and Current, Liabilities.

- The working capital ratio is expressed as a number.

- A higher working capital ratio shows a company has more ability to pay its debt, making it less risky to creditors and investors.

- A working capital ratio of 1 indicates that a company will have to sell all its assets to be able to pay its debt.

- The working capital ratio is one of the many metrics that can be used to assess a company’s potential for insolvency.

Working Capital Ratio Calculator

You can use the working capital ratio calculator below to quickly determine how easily a company can repay its debt with its assets by entering the required numbers.

FAQs

1. What is a working capital ratio?

A working capital ratio is a metric that reflects a company’s ability to pay off its current liabilities with its current assets. It is sometimes referred to as the current ratio. The working capital ratio is crucial to creditors because it is an indicator of a company’s liquidity.

2. How is the working capital ratio calculated?

The working capital ratio is calculated by dividing a company’s current assets by its current liabilities. The formula is:

Working capital ratio = current assets / current liabilities

3. Is a high working capital ratio good?

A working capital ratio somewhere between 1.2 and 2.00 is generally considered good. However, this varies depending on the industry.

For instance, a high working capital ratio for a company in the technology industry might be different from a high working capital ratio for a company in the retail industry. A ratio higher than 2.00 might indicate that a company has too much debt and is not as financially healthy as creditors would like.

4. Why is the working capital ratio important?

The working capital ratio is important because it is a measure of a company’s liquidity. A high working capital ratio indicates that a company has more ability to pay its current liabilities and is less risky to creditors and investors. In addition, the working capital ratio is one of the many metrics that can be used to assess a company’s potential for insolvency.

5. What is an example calculation of the working capital ratio?

An example calculation of the working capital ratio would be if a company has $10,000 in current assets and $15,000 in current liabilities, the working capital ratio would be $10,000 / $15,000 = 0.667.