A zero-coupon bond, also called an accrual bond, is an interest-free debt security that trades at a steep discount. It earns a profit when it matures and is retrieved for its face or par value.

Zero-coupons bonds are either originally zero-coupon instruments or converted into such as their coupons are removed by financial institutions before being repackaged as zero coupon bonds. Since they are paid fully upon maturity, the price of a zero-coupon bond can be more volatile than that of a coupon bond.

Upon the bond’s maturity, the bondholder receives payment in an amount equivalent to the bond’s face value. A corporate bond’s face value is usually denoted as $1,000. Should a corporate bond be issued at a discount, investors will be able to buy the bond for less than its par value.

However, some bonds have no coupon payments, and these are called zero-coupon bonds. Such bonds are issued at a deep discount and pay the face value back upon maturity. The value between the purchase price and the par value is the profit made by the investor, who is paid the principal amount invested on top of the interest at a certain yield, compounded annually or semi-annually.

Zero-Coupon Bond Value Formula

- M = maturity value or face value of the bond

- r = rate of interest required

- n = number of years to maturity

Face Value is equivalent to the bond’s future or maturity value. The formula above applies when zero-coupon bonds are compounded annually. When interest is compounded semi-annually, the same formula will be used, but the number of years will be multiplied by 2.

A zero-coupon bond earns interest that is only imputed, which means the interest is merely an estimate instead of an established rate. As such, the bond is subject to income tax based on Internal Revenue Service (IRS) guidelines. This also means that while zero-coupon bonds require no coupon payments towards maturity, investors may still need to pay income taxes on all three levels – local, state, and federal – based on the imputed or “phantom” interest accrued yearly.

However, avoiding this is possible in three ways – buying municipal zero-coupon bonds, buying them in a tax-exempt account, or buying corporate zero-coupon bonds with tax-exempt status.

On the other hand, zero-coupon bonds also have a downside like all other types of investment. For one, it’s no secret that coupon rates are mainly based on interest rates. That means any increase or decrease in such rates causes the bond’s market value to fluctuate as well, depending on whether the coupon rates are bigger or smaller than their interest rate at the time.

Let’s say a $50,000 bond with a 5% coupon rate pays $2,500 in annual interest, irrespective of the bond’s current price. However, if the interest rate increases to, say, 7%, the newly issued bonds with a $50,000 face value will pay an annual interest of $3,500. That means the 5% bond is hardly affected by the secondary market.

But that’s the scenario only for bonds that aren’t based on zero coupons. For zero-coupon bonds, investors have to sustain the securities towards maturity before profit can be made. That’s why their market prices are cheaper than their par values. This also explains why zero-coupon bonds are usually referred to as discounts.

Zero-Coupon Bond Value Example

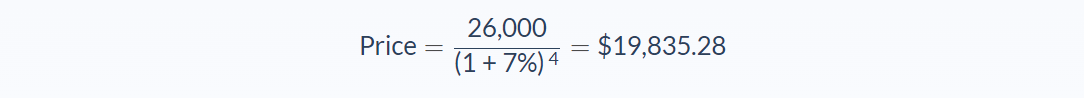

Edward is planning to buy a Zero Coupon Bond whose face value is $26,000 and which matures in 4 years. The bond’s 7% interest rate is compounded yearly. How much is Edward’s Zero Coupon Bond worth today?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Zero-coupon bond value: unknown

- Face Value: 26,000

- Interest Rate: 7%

- Number of Years to Maturity: 4

Now let’s use our formula and apply the values to our variables to calculate the zero-coupon bond value:

If Edward decides to buy the bond today, he will pay 19,835.28, which is 76.29% of the Face Value. When the bond matures, he will earn $6,164.73 for an annual interest rate of 7%.

Zero-Coupon Bond Value Analysis

A bond is a vehicle that allows a private or public body to generate capital. Upon issuance, bonds are purchased by investors, who technically become lenders to the entity that issued the bonds. The investors then receive profit, either annually or semi-annually, in the form of coupon payments distributed throughout the bond’s lifespan.

Zero-coupon bonds are popular for their several advantages, the first of which is that investors generally only pay the capital gains tax. Should there be a large drop in the interest rate, investors no longer have to pay tax on interest, and that’s because the bonds are purchased with a discount and redeemed at par value.

Secondly, the maturity of long-term coupon bonds can range from 10 to 15 years. A longer maturity period automatically reduces the payment required of the investor. Also, zero-coupon bonds are considered less risky compared to other fixed-income securities and are a good option for those working towards long-term financial goals.

Being interest-free, zero-coupon bonds are a good option for anyone interested to invest in fixed income securities, such as those who want to save for their retirement or their children’s college education. They’re also ideal for investors who aren’t very passionate about the market but would be happy to profit from it where and how they can, those who want to diversify their portfolios, or just anyone looking for good long-term investment opportunities.

Zero-Coupon Bond Value Conclusion

- The zero-coupon bond value refers to the current value of a zero-coupon bond.

- This formula requires three variables: face value, interest rate and the number of years to maturity.

- The zero-coupon bond value is usually expressed as a monetary amount.

- This equation is sensitive to interest rate fluctuations.

- The zero-coupon bond value is affected by interest rate risk but not by reinvestment risk.

Zero-Coupon Bond Value Calculator

You can use the zero-coupon bond value calculator below to quickly measure how much your zero-coupon bond is currently worth, by entering the required numbers.

FAQs

1. What is a zero-coupon bond?

A zero-coupon bond is a debt security that doesn't pay periodic interest payments (coupons) to the bondholder. Instead, the entire amount of the bond's face value is repaid at maturity.

2. How do you value a zero-coupon bond?

The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is

Price = M / (1+r)n

where:

- M = maturity value or face value of the bond

- r = rate of interest required

- n = number of years to maturity

3. What is the difference between zero-coupon and traditional coupon bonds?

The primary difference between a zero-coupon bond and a traditional coupon bond is that the former doesn't pay periodic interest payments to the bondholder, whereas the latter does. This means that the price of a zero-coupon bond is typically higher than that of a traditional coupon bond with the same maturity and face value.

Another difference is that the redemption value of a zero-coupon bond is its face value, while the redemption value of a traditional coupon bond is typically higher than the face value, depending on the interest rate.

4. What are the types of zero-coupon bond investors?

The types of investors who typically buy zero-coupon bonds include:

- Individuals who are looking for a higher rate of return than what they can get from traditional savings accounts or certificates of deposit (CDs)

- Retirement account holders, such as 401(k)s and individual retirement accounts (IRAs), who want to reinvest the principal and interest payments they receive into additional bonds

- Investors who are looking for a low-risk investment that offers a higher yield than government bonds or treasury bills

5. What do zero-coupon bonds pay?

Zero-coupon bonds do not pay periodic interest payments like traditional coupon bonds. Instead, the entire amount of the bond's face value is repaid at maturity.