The time value of money impacts business finance, consumer finance, and government finance. Time value of money results from the concept of interest.

This overview covers an introduction to simple interest and compound interest, illustrates the use of time value of money tables, shows a matrix approach to solving time value of money problems, and introduces the concepts of intrayear compounding, annuities due, and perpetuities. A simple introduction to working time value of money problems on a financial calculator is included as well as additional resources to help understand time value of money.

Note: You can use our interactive finance calculator to work out a number of different TVM problems.

Simple Interest

Simple interest1 is a topic that most people cover in elementary school. Interest may be thought of as rent paid on borrowed money. Simple interest is calculated only on the beginning principal.

For instance, if one were to receive 5% interest on a beginning value of $100, the first year interest would be:

Continuing to receive 5% interest on the original $100 amount, over five years the growth of the original investment would look like:

Compound Interest

Compound interest2 is another matter. It’s good to receive compound interest, but not so good to pay compound interest. With compound interest, interest is calculated not only on the beginning interest, but on any interest accumulated in the meantime.

For instance, if one were to receive 5% compound interest on a beginning value of $100, the first year interest would be the same as simple interest on the $100, or $5. The second year, though, interest would be calculated on the beginning amount of year 2, which would be $105. So the interest would be:

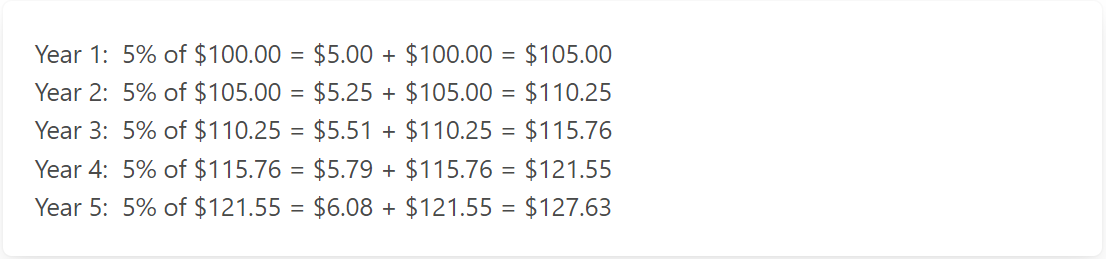

This provides a balance at the end of year two of $110.25. If this were to continue for 5 years, the growth in the investment would look like:

Note that in comparing growth graphs of simple and compound interest, investments with simple interest grow in a linear fashion and compound interest results in geometric growth. So with compound interest, the further in time an investment is held the more dramatic the growth becomes.

Simple Interest

Compound Interest

Compound Interest Formula

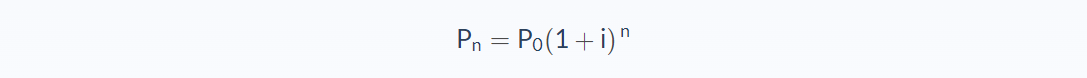

Instead of calculating interest year-by-year, it would be simple to see the future value of an investment using a compound interest formula. The formula for compound interest is:

- Pn = value at end of n time periods

- P0 = beginning value

- i = interest

- n = number of periods

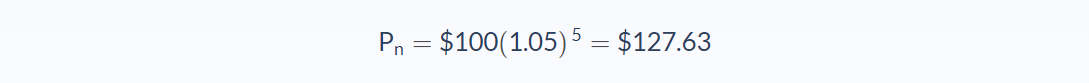

For example, if one were to receive 5% compounded interest on $100 for five years, to use the formula, simply plug in the appropriate values and calculate.

If there was a factor that summarized the part of the compound interest formula (1 + i)n, then to find future values all that would be necessary is to multiply that factor by the beginning values.

Future Value Tables

Using Tables to Solve Future Value Problems

Compound interest tables have been calculated by figuring out the (1+i)n values for various time periods and interest rates. Download and review Time Value of Money Table 1: Future Value Factors.

You can use our free, online calculator to generate a present value of $1 table which can then be printed or saved to Excel spreadsheet.

You will notice that this table summarizes the factors for various interest rates for various years. To use the table, simply go down the left-hand column to locate the appropriate number of years. Then go out along the top row until the appropriate interest rate is located. Note there are three pages containing interest rates 1% through 19%.

For instance, to find the future value of $100 at 5% compound interest, look up five years on the table, then go out to 5% interest. At the intersection of these two values, a factor of 1.2763 appears. Multiplying this factor times the beginning value of $100.00 results in $127.63, exactly what was calculated using the Compound Interest Formula previously. Note, however, that there may be slight differences between using the formula and tables due to rounding errors.

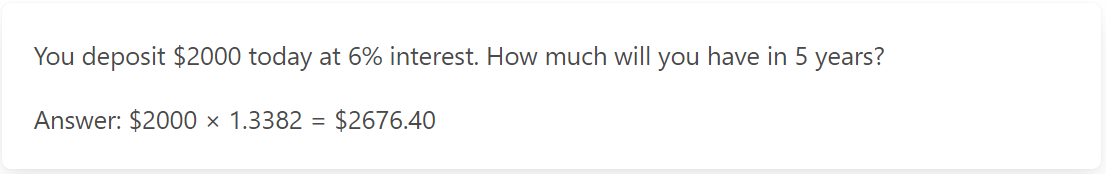

An example shows how simple it is to use the tables to calculate future amounts.

Annuities

Using Tables to Solve Future Value of Annuity Problems

An annuity is an equal, annual series of cash flows. Annuities may be equal annual deposits, equal annual withdrawals, equal annual payments, or equal annual receipts. The key is equal, annual cash flows.

When cash flows occur at the end of the year, this makes them an ordinary annuity3. If the cash flows were at the beginning of the year, they would be an annuity due4. Annuities due will be covered a later.

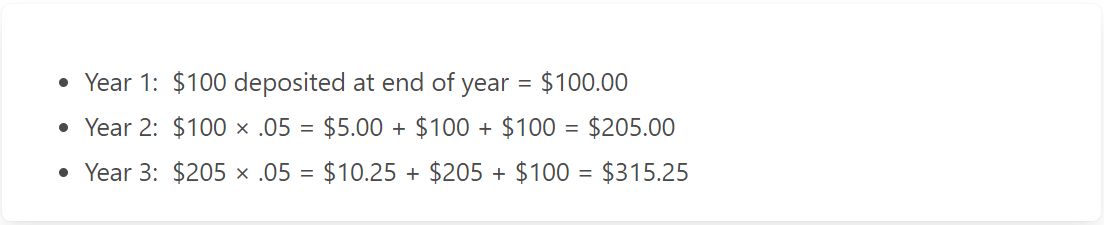

Annuities work as follows:

- Annuity = Equal Annual Series of Cash Flows.

- Assume annual deposits of $100 deposited at end of year earning 5% interest for three years.

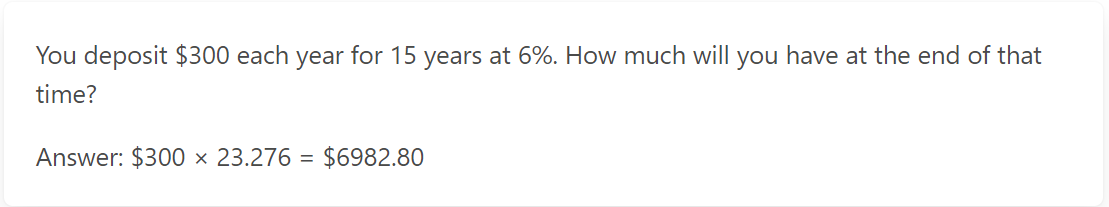

Again, there are tables for working with annuities. TVM Table 2: Future Value of Annuity Factors is the table to be used in calculating annuities due. Basically, this table works the same way as the previous table. Look up the appropriate number of periods, locate the appropriate interest, take the factor found and multiply it by the amount of the annuity.

For instance, on the three-year, 5% interest annuity of $100 per year. Going down three years, out to 5%, the factor of 3.152 is found. Multiply that by the annuity of $100 yields a future value of $315.20.

Another example of calculating the future value of an annuity is illustrated.

Present Value

Using Tables to Solve Present Value Problems

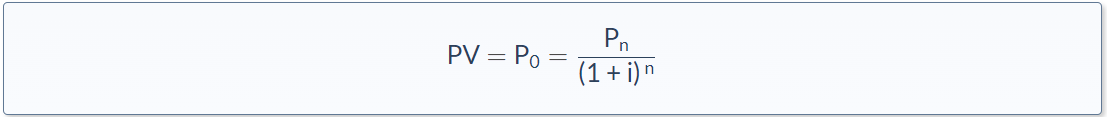

Present value5 is simply the reciprocal of compound interest. Another way to think of present value is to adopt a stance out on the time line in the future and look back toward time 0 to see what was the beginning amount.

TVM Table 3 shows Present Value Factors. Notice that they are all less than one. Therefore, when multiplying a future value by these factors, the future value is discounted down to present value.

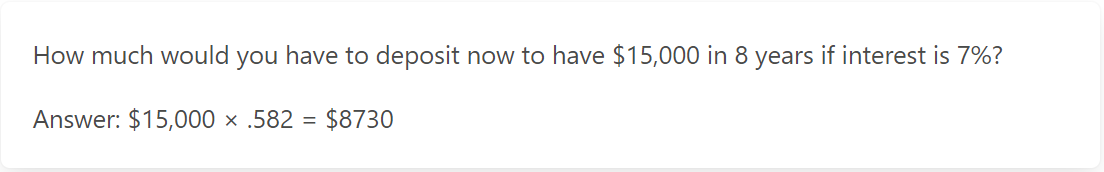

The table is used in much the same way as the previously discussed time value of money tables. To find the present value of a future amount, locate the appropriate number of years and the appropriate interest rate, take the resulting factor and multiply it times the future value.

An example illustrates the process.

Present Value of an Annuity

Using Tables to Solve Present Value of an Annuity Problems

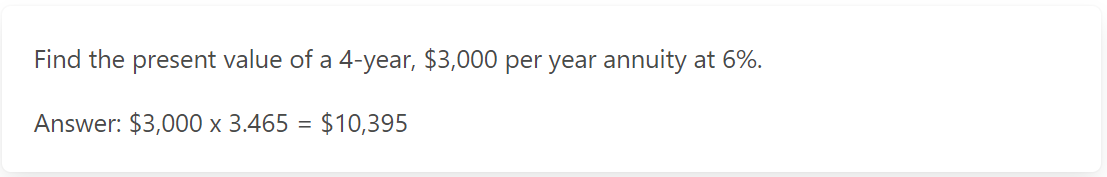

To find the present value of an annuity, use TVM Table 4: Present Value Of Annuity Factors. Find the appropriate factor and multiply it times the amount of the annuity to find the present value of the annuity.

An example illustrates the process.

Intrayear Compounding

If a cash flow is compounded more frequently than annually, then intrayear compounding6 is being used. To adjust for intrayear compounding, an interest rate per compounding period7 must be found as well as the total number of compounding periods8.

The interest rate per compounding period is found by taking the annual rate and dividing it by the number of times-per-year the cash flows are compounded. The total number of compounding periods is found by multiplying the number of years by the number of times-per-year cash flows are compounded.

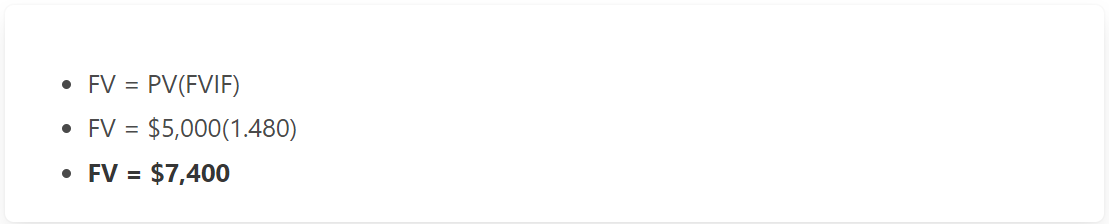

For instance, suppose someone were to invest $5,000 at 8% interest, compounded semiannually, and hold it for five years.

- The interest rate per compounding period would be 4%. (8% ÷ 2)

- The number of compounding periods would be 10. (5 × 2)

To solve, find the future value of a single sum by looking up 4% and 10 periods in the TVM Table 1: Future Value Factors.

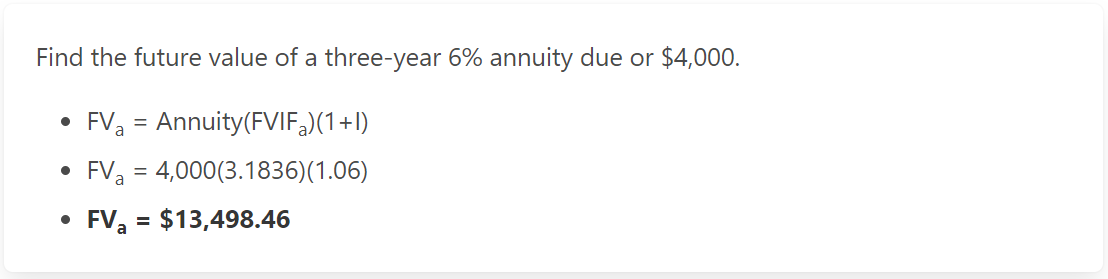

Annuities Due

Annuities due9 are beginning-of-year annuities. To work annuities due, simply set up the problem the same way as would be done with an ordinary annuity, then multiply the resulting factor by (1+I). This is done whether the problem is present value or future value.

To illustrate:

Perpetuities

Perpetuity10 is a cash flow without a fixed time horizon.

For example, if someone were promised that they would receive a cash flow of $400 per year until they died, that would be a perpetuity. To find the present value of a perpetuity, simply take the annual return in dollars and divide it by the appropriate discount rate. To illustrate this:

Using a Financial Calculator

Financial calculators may be used to solve time value of money problems. To use a financial calculator, it is necessary to understand the owner’s manual. Generally, the following steps should be followed:

- Read the problem thoroughly.

- Make sure what is being asked in the problem.

- Clear the calculator.

- Input the known value.

- Input the number of compounding periods per year.

- Input the annual interest rate.

- Input the total number of compounding periods.

- Request the unknown.

An important thing to keep in mind is that cash outflows should carry a minus sign.

The examples on the following three pages illustrate the use of a financial calculator in solving time value of money problems. There are many financial calculators available and they all have their strengths. For these examples, the Hewlett Packard 10bII+ is used.

Example 1

How much will $15,000 be worth in five years if interest is 8% compounded quarterly?

- Read the problem thoroughly.

Remember cash outflows carry a minus sign. - Make sure what is being asked in the problem.

What is the future value of the $15,000? - Clear the calculator.

C C ALL - Input the known value.

1 5 0 0 0 +/- PV - Input the number of compounding periods per year.

4 P/YR - Input the annual interest rate

8 I/YR - Input the total number of compounding periods.

2 0 N - Request the unknown.

FV

Answer: $22,289.21

Example 2

How much would you have in four years if you deposit $40,000 at the beginning of each year for four years and interest is 10% compounded annually?

- Read the problem thoroughly.

Remember cash outflows carry a minus sign. - Make sure what is being asked in the problem.

What is the future value of a $40,000 four-year annuity due? - Clear the calculator.

C C ALL - Input the known value.

4 9 0 0 0 +/- PV - Input the number of compounding periods per year.

1 P/YR - Input the annual interest rate

1 0 I/YR - Input the total number of compounding periods.

Beg/End 4 N - Request the unknown.

FV

Answer: $204,204.00

Example 3

What would you have to deposit today to have $50,000 in eight years if you can earn 6% interest, compounded semiannually?

- Read the problem thoroughly.

Remember cash outflows carry a minus sign. - Make sure what is being asked in the problem.

What is the present value of $50,000? - Clear the calculator.

C C ALL - Input the known value.

5 0 0 0 0 +/- PV - Input the number of compounding periods per year.

2 P/YR - Input the annual interest rate

6 I/YR - Input the total number of compounding periods.

1 6 N - Request the unknown.

PV

Answer: $31,158.35

Additional Resources

Time Value of Money Solution Grid

In this overview we touched on the use of a financial calculator to determine time value of money. Another overview, Time Value of Money Solution Grid, illustrates how to achieve consistent results when using a financial calculator to determine time value of money.

Time Value of Money Using Microsoft Excel

It’s possible to use spreadsheet applications to solve time value of money problems. Microsoft Excel is a popular program, and included is an Excel workbook which illustrates the use of built-in financial functions to solve time value of money problems.

This overview was developed by Dr. Sharon Garrison.

No adaptation of its content is permitted without permission.

-

Interest that is paid on beginning principal only.↩

-

Interest paid on beginning principal and any additional accumulated principal.↩

-

End of year cash flows.↩

-

Beginning of year cash flows.↩

-

The reciprocal of future value.↩

-

More frequent compounding than annual.↩

-

Annual rate ÷ times-per-year compounding.↩

-

Number of years × number of times-per-year compounding.↩

-

Beginning-of-year cash flows.↩

-

Cash flow with no fixed time horizon.↩

FAQs

1. What is meant by the time value of money?

The time value of money, or TVM, is a theory that explains the idea that money has a different value depending on when it's received.

Technically speaking, it means that a dollar today is worth more than a dollar tomorrow because if you have a dollar today and invest it at 10% interest per year for one year, you'll have more than a dollar next year.

2. What is an example of the time value of money?

An example of the time value of money would be a simple savings account. If you have a bank account that earns 5% interest and you allow it to accumulate for 12 months, for example, you'll have more than if you put your money in the same bank but didn't allow it to accrue any interest.

Another example is If you have $100 today and invest it at 10% interest per year, you'll have $110 after one year.

3. Why is the time value of money important?

TVM is important because it helps businesses make better decisions about future investments.

If a company knows, for example, that it will see over $1 million in the next 10 years, it can make more informed choices on what percentage of its income to invest in capital goods.

4. What are the 3 main reasons for the time value of money?

The first reason is inflation. It is the most important reason for the time value of money because it can reduce a dollar's worth to next to nothing if you wait too long.

The second reason is liquidity, which is the ease with which assets may be converted into cash.

The last reason is risk, which refers to how likely you are to lose some or all of your money if you choose the wrong investment.

5. How do you calculate the time value of money?

The formula for TVM is:

FV = PV x [ 1 + (i / n) ] (n x t)

where:

FV = Future value of money

PV = Present value of money

i = interest rate

n = number of compounding periods per year

t = number of years