ESG 401(k) Portfolios

Give your employees low-cost, diversified ESG 401(k) options

Our investments should be able to reflect our values. Unfortunately, if you're a participant in most 401(k) plans in the US, you aren't provided those kinds of options. You can choose between conservative, moderate, or aggressive market-tracking portfolios with no types of ethical filtering.

What is an ESG 401(k)?

ESG stands for “environmental, social, and governance.” This concept is also known as sustainable, responsible, and impact investing (SRI). ESG investing differs from traditional investing in that ESG investors take into account a corporation’s impact on the environment and society, in addition to its financial performance.

This investment framework is becoming increasingly popular as more investors are seeking ways to invest their money into companies that are doing good in the world. The growing interest in ESG has led to some investment advisors enabling companies to offer ESG focused 401(k) portfolios to their employees.

We believe that ESG, while better than nothing, is insufficient in creating real impact. ESG waters down all ethical categories to the point where these portfolios are simply less bad, but not actively pushing for real change.

We started our sustainable 401(k) program at Carbon Collective to give founders and companies who care about sustainability and climate impact low cost, diversified 401(k) portfolios. Nobody should be forced to invest green, but they should be given the option to.

Target-Date Portfolio Options and ESG Retirement Investing

We help you and your team get access to three types of target-date portfolios:

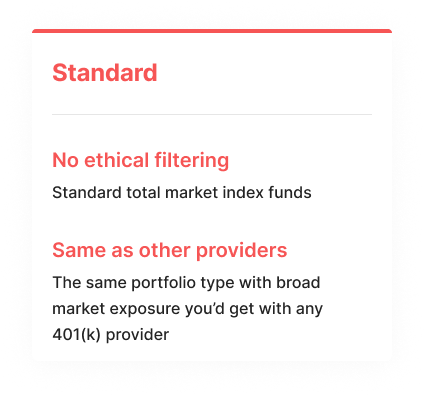

- Standard: We use Vanguard target date funds for those who want their investments to track the overall market.

- Traditional ESG: We build a series of retirement date portfolios, swapping out low-cost ESG funds where available.

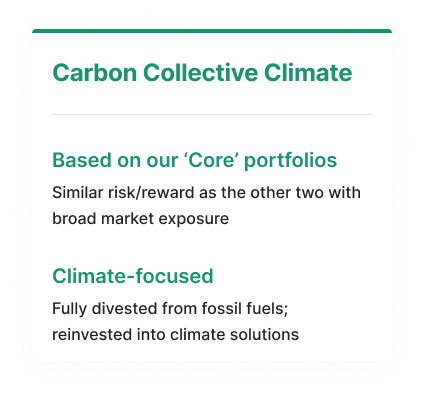

- Climate: Our signature strategy that follows our "Divest, Reinvest, Pressure the Rest" portfolios.

For those participants who want to construct their own portfolio they can choose from any of the underlying funds from the above portfolios in addition to two series of fund lineups:

- Vanilla: We include a full series of low-fee funds for each building block of a standard portfolio (large cap growth, large cap value, etc.).

- Good (But Expensive) ESG: We include a series of funds from two prominent, longtime ESG providers (Calvert and Brown Advisory Board)

.png)

What is a target date fund? These funds are on a set path, called a glide path, to slowly become more conservative (invest more into bonds than stocks) as the retirement date becomes closer. They are popular investments for retirement accounts because they automatically rebalance, typically have low fees, and are usually diversified across a mix of stocks and bonds.

If you're an employer, you can choose any of these three as the "default" option (QDIA) for the plan.

Your employees choose a portfolio type, then a retirement date. That's it.

This includes the same portfolios you'd get in a standard 401(k) plan with target date retirement funds (an example of this is VFORX — Vanguard’s Retirement Date 2040). These portfolios have broad market exposure and no filtering for ESG criteria.

The second option is an ESG version of the target date funds with the same broad market exposure. The ESG retirement portfolio is what we call the "less bad" option, meaning, it still invests in plenty of harmful companies, but fewer of them compared to the standard options.

Most of our 401(k) clients go with the Carbon Collective Climate as the default option because, just like the standard options, it is diversified with the same broad market exposure and has a similar balance of risk/reward, but the portfolio is not invested in any fossil fuel companies and holds a percentage of climate solutions. While some ethical filters are applied, the focus is on climate.

.png)

.png)

.png)

"Don't tell employees how to invest—give them options.”

—Zach Stein, Chief Investment Officer at Carbon Collective

Sustainable Investing Matters:

We cannot solve climate change without changing how we invest.

According to the International Energy Agency (IEA), as a globe we need to invest over $5 trillion per year into climate solutions if we are to mitigate the worst effects of climate change. According to Project Drawdown and the Climate Policy Initiative, in 2019, the globe invested ~$600 billion into climate solutions. For humanity to achieve its targets by 2050, we need to invest closer to $5.2 trillion per year into climate solutions, and $0 into expanding fossil fuel extraction.

Learn more about our theory of change and why sustainable investing is the only realistic path to solving climate change.

Standard 401(k) portfolios don't align with this reality.

When you review the most popular ESG funds and portfolios and what they are actually invested in, it's clear that many of them are not good options for investors who care about climate. And most of the common options for 401(k) portfolios fare even worse. For example, the portfolio pictured here is a breakdown of Vanguard's Global 80% stock, 20% bonds (VFORX). This portfolio is far more invested in fossil fuels than climate solutions.

And the common ESG 401(k) portfolios are often a disappointing mix of the same underlying BlackRock ESG funds that still invest in fossil fuel companies.

Carbon Collective's 401(k) portfolios were built to fully divest from fossil fuels (and fossil fuel dependent industries), reinvest into climate solutions, and engage the remainder of the market to pressure them to decarbonize faster, all while offering a similar risk/reward profile as a generic index-based portfolio.

.png)

Common funds like Vanguard’s Retirement Date 2040 (VFORX), seen in this graph, are still far more invested in fossil fuels than climate solutions.

ESG in 401(k) Plans

A couple random ESG funds is not enough. You need comprehensive sustainable portfolios.

It’s not enough to offer a random mix of one or two sustainable or “ESG” funds — employees who care about climate change and sustainability need sustainable portfolios. For example, let’s say an employee has a few ESG funds available to them in their 401(k) plan to choose from. The employee would need to be knowledgeable about building a portfolio allocation that will carry them through to retirement age and beyond. It’s no surprise to anyone that the average investor would not feel comfortable choosing an allocation for their life savings! This is where sustainable portfolios that are specifically focused on solving climate change come into play.

While Carbon Collective and most 401(k) plan providers give plan participants the option to hand select their portfolio breakdown, the majority of participants go with the default target date fund portfolios. These portfolios offer a diversified, low cost mix of funds that automatically rebalance as the investor gets closer to retirement age. And the Carbon Collective target date fund portfolios offer a mix of sustainable stock and green bond funds. This way, plan participants can feel comfortable simply selecting their portfolio type from the three options and their retirement date.

Mission-driven investing is what we do:

Divest from the companies fueling climate change

85% of CO2e emissions from all publicly traded companies comes from this ~20% of the market.

Reinvest in the companies solving climate change

Clean electricity, to energy efficient buildings, to sustainable food; invest in most of the US-traded companies building climate solutions.

Explore all 160+ companies included in our List of Green Stocks Solving Climate Change, and why each one made the cut and what we believe these companies can do better.

Learn about the timeline and process to switch 401(k) providers or set up a new plan, and how Carbon Collective's 401(k) payroll integration works.

ESG 401(k) Plans Summary

What is an ESG 401(k)?

ESG stands for “Environmental, Social, and Governance.” An ESG 401(k) differs from traditional 401(k)s in that the portfolios offered take into account a corporation’s impact on the environment and society, in addition to its financial performance.

What is the best option for ESG 401(k) plans?

Carbon Collective's 401(k) portfolios fully divest from fossil fuels (and fossil fuel dependent industries), reinvest into climate solutions, and engage the remainder of the market to pressure them to decarbonize faster, all while offering a similar risk/reward profile as a generic index-based portfolio.

Why is "ESG" retirement investing not enough?

Many of the top ESG funds in common 401(k) plans are not good options for investors who care about climate because they often still invest in fossil fuel companies. They also tend to have higher expense ratios. Sustainable 401(k) portfolios are better options for mission-aligned companies and employees.