What is a financial plan? A financial plan is a document that outlines your financial goals and what you need to do to achieve them. It is a roadmap that will help you get what you want in life.

A financial plan helps people retire early, pay off debt, travel the world, and live their best lives.

And even if it is just about sticking to a budget or saving for a rainy day – having one can help make your future what you want it to be.

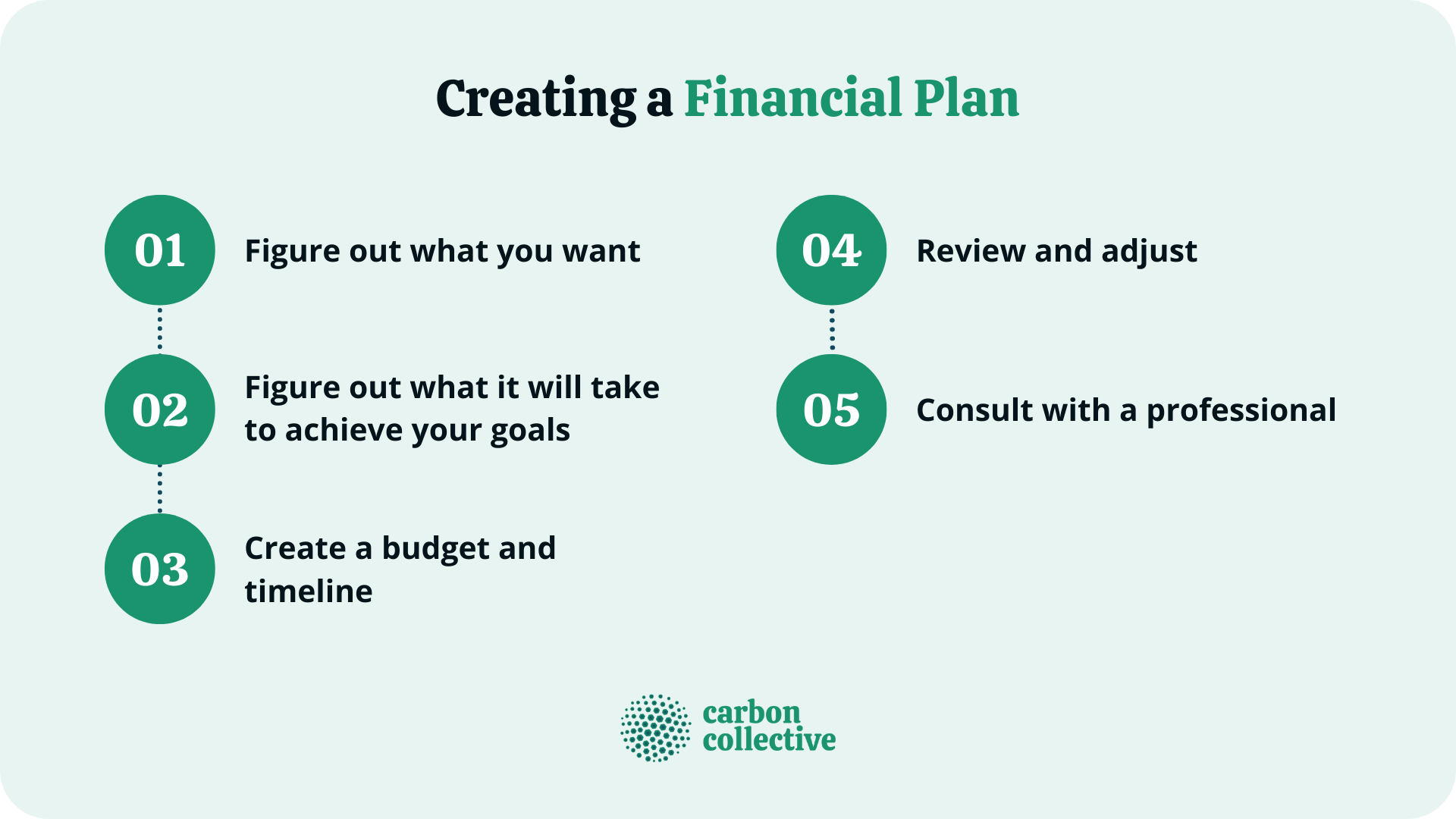

Creating a Financial Plan

The most crucial step in creating a financial plan is getting started – even if what you come up with is not perfect.

No one starts out as an expert, and your plan will constantly evolve. But what matters most is having something written down that can help guide your decision-making process.

There are a few steps that you can take to start creating yours, and what your plan includes is entirely up to you. The main thing is that it works for YOU – so feel free to tweak what follows as needed.

Step #1: Figure out what you want

The first step is figuring out what your goals are. What do you want to achieve financially? This can be anything from retiring at a certain age to buying a house or traveling the world.

Be specific about the time frame in which you would like to achieve these things. For example, if you want to retire in 15 years, you will need to save more money each month than if you want to retire in 30 years.

Step #2: Figure out what it will take to achieve your goals

Now that you know your goals, the next step is figuring out what it will take to achieve them. This includes what you need to save and what kind of income you will need.

For example, if you want to retire in 15 years with a $500,000 nest egg, you will need to save around $3,500 per month.

Or if you want an annual income of $100,000 when retired, you will need around $8,000 per month saved up.

Step #3: Create a budget and timeline

The next step is to create a budget and timeline for how you will achieve your goals. This includes figuring out what you need to save each month and when you want to have each goal achieved.

For example, if you want to retire with $500,000 in 15 years – what kind of income do you need to earn?

And what kind of expenses can you cut back on to save more money each month? Or what kind of changes can you make to move your monthly savings closer to the amount you need?

Step #4: Review and adjust

Once you have created your financial plan, the last step involves reviewing how you can achieve what you want and making adjustments as needed.

If what you need to do seems unrealistic – what can be done? Is there a way to increase savings? Or can you find a way to bring in more income?

The beauty of having a financial plan is its flexibility. As your life changes, so will what you need to do financially to achieve your goals.

Step #5: Consult with a professional

The final step. If you want some help putting everything together or just want a second opinion, consult a financial professional.

They can review what you have created and make sure that what you have in mind is realistic – and then help you achieve what you want.

Getting Started

The most important thing about creating your financial plan is getting started! Even if what you come up with is not perfect, what matters is having something written down that can help guide your decision-making process.

Importance of Having a Financial Plan

There are a number of reasons why having a financial plan is important.

Some of the benefits include:

- knowing what you need to save each month to achieve your goals

- tracking your progress

- helping make informed decisions about big purchases or investments

- getting professional advice when needed

The Bottom Line

Creating a financial plan is the best way to achieve what you want. By following these simple steps, what once seemed impossible can become a reality.

When it comes to finances, many people feel overwhelmed and unsure of what to do. It is hard enough to keep up with monthly expenses, let alone try and save for something years down the road.

But with a financial plan in place, you can make headway towards your goals one step at a time.

You can also consult with a financial advisor to get more advice on what steps you should take next.

FAQs

1. Why should I make a financial plan?

There are a number of reasons why having a financial plan is important. Some key benefits include: knowing what you need to do to achieve your goals, tracking your progress, making informed decisions about purchases or investments, and getting professional advice.

2. Who is a financial planner?

A financial planner can help you put together a financial plan and make sure what you have in mind is realistic. They can also provide advice on what steps to take. If you are feeling overwhelmed or unsure of what to do when it comes to your finances, talking to a financial planner may help. It can help give you peace of mind knowing what needs to be done and how much time you have until retirement. They may even find ways in which your savings could grow faster so that when retirement comes around, what was once thought impossible becomes a reality.

3. Can I do my own financial planning?

Absolutely! There are many online resources that can help you create a plan and make sure what you have in mind is realistic. If anything seems unrealistic or overwhelming, consult with a professional who can provide advice on what steps to take.

4. What should a financial plan include?

A financial plan should include your goals, what you need to save each month to achieve them, a timeline for reaching those goals, and what steps you will take along the way. It is important to remain realistic when creating your financial plan and make sure that what you have in mind can be accomplished.

5. After developing a plan, what next?

The next step is to track your progress and make any necessary adjustments. This means revisiting your plan regularly and making changes as needed. If you find that what you are doing is not getting you closer to your goals, it is time to change things up.