Retirement Terms

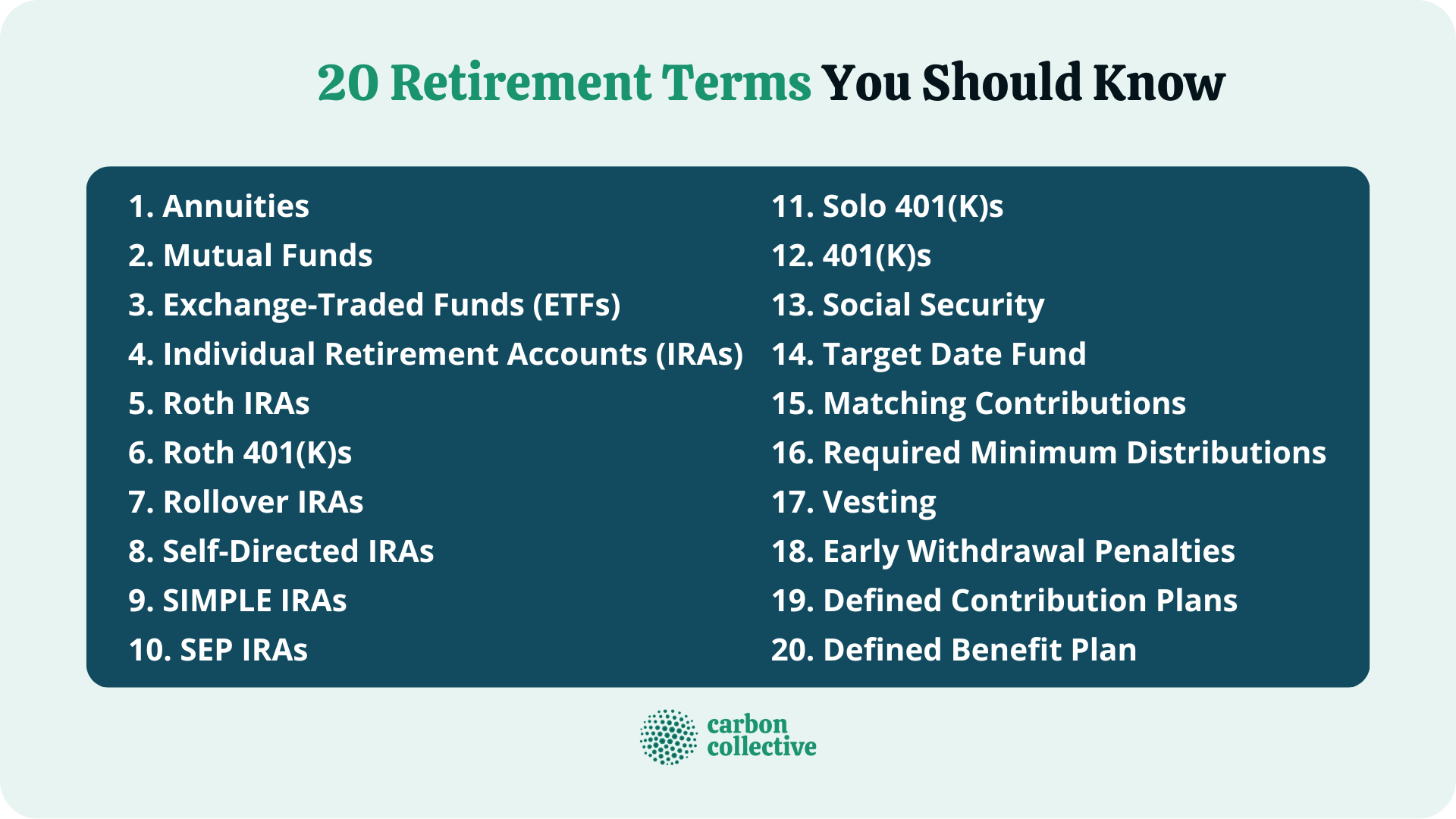

It is never too early to start planning for retirement. The sooner you start, the better! But when it comes to retirement planning, there are a lot of terms that can be confusing. It is important to become familiar with the basics.

That is why we have put together this glossary of 20 retirement terms you should know. By understanding these key terms, you will be able to make more informed decisions about your retirement planning.

1. Annuities

Annuities are contracts between an investor and a financial institution, typically an insurance company, in which the institution agrees to make periodic payments to the investor over a fixed period or for the rest of that person's life.

They are usually sold as insurance policies, but can also be an investment product for retirement. Annuity payments may be fixed or variable, depending on the terms of the contract and the performance of underlying investments.

A fixed annuity guarantees a specific monthly payment, while a variable annuity's monthly payout will fluctuate based on the performance of the investments chosen to back it up.

2. Mutual Funds

A mutual fund is a collection of stocks, bonds, and other securities that are bundled together and managed by a professional money manager.

Mutual funds can be either open-end or closed-end. Open-end funds allow investors to buy and sell shares at any time, while closed-end funds only allow investors to buy shares when they are first issued.

3. Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) are similar to mutual funds, but they are traded on stock exchanges and have lower fees.

They also offer more flexibility than mutual funds because investors can buy or sell shares at any time of the day, rather than just once per trading session. ETFs can invest in a wide range of assets, including stocks, bonds, and commodities.

4. Individual Retirement Accounts (IRAs)

An individual retirement account (IRA) is a type of retirement plan that allows you to save money for when you stop working.

This savings account can be set up at any bank or financial institution and has no tax implications until it is withdrawn during retirement.

IRAs are great because they offer many benefits, including tax-deferred growth on earnings and contributions, as well as tax-free withdrawals in retirement.

5. Roth IRAs

Roth IRAs allow you to make tax-free contributions and investments, as well as withdrawals that are tax-free once certain conditions have been satisfied.

One big distinction between a traditional IRA and a Roth IRA account is how they are taxed. While with a traditional IRA, your contributions are tax-deductible and your withdrawals are subject to income taxes, with a Roth IRA, your contributions are made with after-tax money and your withdrawals are tax-free.

All future transactions will depend on this initial decision. If anything changes within these parameters, everything could potentially shift accordingly.

6. Roth 401(K)s

A Roth 401(k) is a retirement plan that lets you save money for when you stop working. Unlike other plans, this type of savings account has no taxes on investment gains or contributions made during your lifetime.

The only time there will be taxes owed is if income exceeds the threshold for filing returns under federal law. In this scenario, the taxable income portion of Roth 401(k) withdrawals will be subject to federal income tax.

7. Rollover IRAs

A Rollover IRA may occur when an individual takes money from one retirement account and moves it into another.

Rollovers can happen at any time, but they are most common during periods where there is a change in employment (such as leaving or retiring from your current job).

Rollovers can be a very effective way for people to consolidate their retirement assets and manage them under one account.

They also offer tax advantages, such as transferring funds from an old employer-sponsored plan into another type of retirement savings vehicle.

This allows you to avoid paying taxes on those contributions until they are withdrawn during retirement, or when other circumstances apply.

8. Self-Directed IRAs

Self-directed IRAs are a great way for investors who want control over their retirement funds but do not know where to start. With these accounts, you can invest in real estate or any other asset that suits your needs.

This only applies as long as the investment is approved by the IRS. This type of account can be opened at most financial institutions and gives you a lot of freedom when it comes to your retirement savings.

9. SIMPLE IRAs

A SIMPLE IRA, or Savings Incentive Match Plan for Employees, is a retirement account offered by many employers.

This type of plan is very simple, hence the name. It lets employees save money for when they stop working that grows tax-free.

Unlike other retirement plans like 401(k)s that have contribution restrictions each year, employees can contribute up to $15,500 annually to a SIMPLE IRA.

Contributions made to a SIMPLE IRAs are not tax-deductible, but the money in the account grows tax-free and distributions during retirement are taxed as regular income.

This type of plan is a good option for people who want to save for retirement but do not have a lot of money to invest each year.

10. SEP IRAs

SEP IRAs are a great way to save money while reducing your current taxes because contributions made into this plan can also be deducted from your gross income personal tax return.

You will need an employer to sponsor a SEP IRA, but if you have a small business or are self-employed, this may be a good option for you.

Employees can contribute up to 25% of their annual salary (up to $66,000 in 2023) and the employer must match that contribution.

11. Solo 401(K)s

A Solo 401(k) is a retirement account that is only for self-employed individuals or small business owners.

This type of plan has many of the same benefits as a regular 401(k), like contribution and deduction limits, but it also allows you to contribute more money each year than what is allowed in traditional plans.

12. 401(K)s

A 401(k) is a retirement account that many employers offer their employees. This type of plan lets you save money each year and invest it in stocks, bonds, or other investments. The money in your account grows tax-free and you do not have to pay taxes on it until you withdraw the money during retirement. You can contribute up to $22,500 per year (in 2023) and your employer may also match your contributions.

13. Social Security

Social Security is a government program that provides retirement benefits to Americans. It is funded by payroll taxes taken out of your paycheck and is not tied to the stock market, so your benefits will not go down if the market crashes.

The amount of money you receive from Social Security each month depends on how much money you made during your working years, when you start receiving benefits, and how long you live.

Most people will not receive enough money from Social Security to live on during retirement, so it is important to save money in other accounts as well.

14. Target Date Fund

A target date fund is a type of mutual fund that becomes more conservative as you get closer to retirement.

This is a good option for people who do not want to have to worry about picking the right investments themselves and who want their investment portfolio to become more stable as they get older.

Target date funds are available through most retirement accounts, like 401(k)s and IRAs, and are a good way to diversify your investments.

When you invest in a target date fund, you choose the year that you want to retire and the fund will take care of the rest.

15. Matching Contributions

Matching contributions are payments that an employer makes to a retirement account each time an employee contributes money.

For example, if an employer matches 50% of every contribution made by the employee, the employer will contribute $0.50 for every dollar contributed by the employee.

Matching contributions are a great way to save for retirement because the employer is essentially giving you free money.

Many employers will match 100% of employee contributions, so it is important to take advantage of this benefit if it is offered.

16. Required Minimum Distributions

Required minimum distributions (RMDs) are payments that you must make from your retirement account each year once you reach a certain age.

The RMD amount depends on how much money is in your account and how old you are when you start receiving them.

RMDs are designed to force people to start withdrawing money from their retirement accounts once they reach a certain age.

If you do not take money out of your account, the Internal Revenue Service (IRS) will tax you at an excessively high rate on any earnings that come from it.

17. Vesting

Vesting is the process of gaining ownership of your employer's matching contributions to your retirement account.

Vesting usually happens over a period of several years and you are always fully vested in your contributions. However, employers can choose to vest their matching contributions over a longer or shorter period of time.

If you leave your job before you are fully vested in your employer's matching contributions, you will lose some or all of the money that they contributed on your behalf.

It is important to be aware of your company's vesting schedule before you decide to leave your job.

18. Early Withdrawal Penalties

An early withdrawal penalty is a fee that you will have to pay if you take money out of your retirement account before you reach the age of 59½.

Typically, these penalties are charged by the Internal Revenue Service (IRS), but there may also be fees from other sources as well.

The IRS charges a penalty equal to 20% of the amount that you withdraw early from your retirement account.

This can be a significant amount of money, so it is important to think carefully before you decide to take money out of your account prematurely.

19. Defined Contribution Plans

A defined contribution plan is a type of retirement account in which you contribute money on a regular basis and your employer contributes matching funds.

The most common types of defined contribution plans are 401(k)s and 403(b)s, but there are other types as well.

The amount that you will receive when you retire depends on how much money you contribute to your account and how well it performs over time.

This is in contrast to a defined benefit plan, which pays out a predetermined amount each month once you retire.

20. Defined Benefit Plan

A defined benefit plan is a type of retirement account in which you receive a set amount of money each month once you retire.

This amount depends on how long you worked for the company and what your salary was during that time. The most common example of this type of retirement account is a traditional pension plan, but there are other types as well.

Defined benefit plans are becoming less common as employers move away from them in favor of defined contribution plans. This is because defined benefit plans are more expensive for employers to offer and difficult to manage financially.

The Bottom Line

Understanding retirement terms will help you in your retirement planning process. By knowing what these terms mean, you can make more informed decisions about your retirement savings and how to best use them.

This is just a small sample of the many retirement terms that you will encounter during your planning process. Be sure to do additional research on the ones that are most relevant to you so that you can understand them completely.

It is important to understand retirement terms so that you can make the right decisions for yourself and your future.

FAQs

1. What is the early withdrawal penalty?

The IRS charges a 20% penalty on any amount that you withdraw from your retirement account before you reach the age of 59½. This can be a significant amount of money, so it is important to think carefully before you decide to take money out of your account prematurely.

2. If I take money out of my retirement account before I reach the age of 59½, how much will I have to pay in penalties?

The 20% penalty is only for early withdrawals from retirement accounts that are tax-deferred, such as traditional 401(k)s and IRAs. If you take money out of a Roth IRA or Roth 401(k), there will be no penalties because those contributions were already made with after-tax dollars (and are therefore not tax-deferred).

3. What is a defined contribution plan?

A defined contribution plan is a type of retirement account in which you contribute money on a regular basis and your employer contributes matching funds. The most common types of defined contribution plan are 401(k)s and 403(b)s, but there are other types as well. The amount that you will receive when you retire depends on how much money you contribute to your account and how well it performs over time. This is in contrast to a defined benefit plan, which pays out a predetermined amount each month once you retire.

4. What is a 401(k)?

A 401(k) is a type of defined-contribution plan in which you contribute money on a regular basis and your employer contributes matching funds. The most common type of 401(k) is the traditional 401(k), but there are other types as well. A 401(k) can also be used as an investment vehicle for other types of retirement accounts, such as IRAs or Roth IRAs (see question #11 below for more information on Roth IRAs).

5. What is the maximum amount that I can contribute to a 401(k)?

The maximum amount that you can contribute to a 401(k) in 2023 is $22,500. This limit applies to both employees and employers, so the total contribution from both parties cannot exceed $66,000. If you are 50 or older, you can make "catch-up contributions" of up to $7,500 per year. These are in addition to the regular limits and cannot be made until after you turn 50.