Accounting Profit Definition: Profit or income is the amount of money that exceeds the costs and taxes of your expenses for a specific period. Your income left over after all the fees have been subtracted. Business owners can choose what to do with the profits that are earned, do they use it for themselves or reinvest it back into the company.

Accounting Profit Definition

The matching principle states that all the expenses that happened in the period to produce the income must be recognized. Some costs might not occur in this period, but they are deducted from the income before showing your net income for that given period. Accrued expenses are the most common example of the matching principle.

For example, payroll, payroll is paid the first week of the following year. The business incurred the costs of the labor it must however recognize the costs in the current period even though the checks will only clear in the next accounting period.

Accounting Profit Formula

You calculate the profit by subtracting all expense incurred during a period from the total revenues earned in the same accounting period.

Profits will be at the bottom of the Income Statement. If the revenue doesn’t exceed the expenses for the year the company cannot record a negative profit, they will show a net loss on the Income Statement. Indicating that they do not have enough money to cover their expenses for this period.

What Does the Accounting Profit Tell You?

Therefore, the profitability of the company determines the performance. There are three major types of profit.

Gross Profit

The gross profit looks at profit after direct expenses has been subtracted. Can be calculated by subtracting the cost of goods sold from the sales. These three figures are normally listed at the top of the Income Statement.

The formula to calculate gross profit is:

So, for a company with $200,000 in sales and COGS of $80,000:

The Gross Profit Margin can be calculated by dividing the Gross Profit by the sales.

Operating Profit

The operating profit determine how profitable the company is after all the operating expenses has been deducted. Operating expenses are things like material cost, labour cost, production and overheads, transportation, sales and marketing cost etc. Operating is calculated by subtracting the operating expenses from the gross profit.

The formula to calculate operating profit is:

So, if the company has operating expenses that amount to $30,000 and a gross profit of $120,000:

The operating profit margin can be determined by dividing the operating profit by the sales.

Net Profit

Net profit is the profit that is left over after all the expenses which includes taxes and interest was paid. The net profit is calculated by subtracting the interest and taxes from the operating profit.

The formula to calculate net profit is:

If the company has $6,000 in taxes and $5,000 in interest:

The net profit margin can be calculated by dividing the net profit by sales.

Accounting Profit Vs Cash Profit

Cash profits is considered the real profit where accounting profit is a theoretical profit. Cash profits take into consideration the inflow and outflow of the actual cash of the business.

If a company prepares financial statements using the account approach and the cash flow approach, they will see a higher profit in the cash flow approach. This is because the cash flow approach does not consider non-cash flow expenditures.

Advantages of Accounting Profit

- The performance and financial position of the business is reflected in the accounting profit.

- The accounting profit can be used to compare businesses against each other.

- The profit amount can be used to make business decisions.

- The profit can encourage or discourage investors to invest in the business.

Disadvantages of Accounting Profit

- Accounting profits doesn’t indicate the cash inflows.

- It cannot be used to compare across businesses that make use of different methodologies for depreciation & amortization, impairment, provisions, accruals and valuation.

- Different laws for taxation in various countries and there are different ways of presenting the financial statements.

- Profits can be manipulated to show a better profit than what there actually is.

Limitations of Accounting Profit

- It measures the performance for a single period.

- Non-cash expenditure like depreciation, amortization, etc. reduces the accounting profit but does not have any impact on the cash flows.

- Return on investment is not considered in the calculation of accounting profits.

Accounting Profit Examples

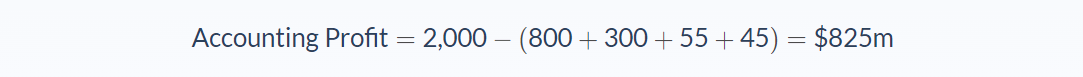

Example 1: ABC manufactures jackets, the annual turnover is $2,000,000. The direct expenses are:

- Raw materials: $800,000

- Labor cost: $300,000

- Production costs: $55,000

- Depreciation: $45,000

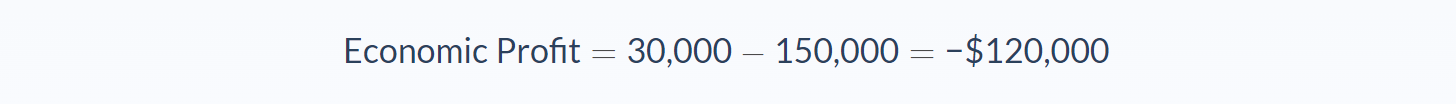

Example 2: Sandy decided to leave her job as a business analyst where she made $150,000 per year to start a coffee shop. In 2018 she made an accounting profit of $30,000.

Sandy’s economic profit will be the profit of the coffee shop less the opportunity cost of the job that she left.

Through rational thinking, Sandy would see that she is still making a profit and keep her coffee shop open, but having such a big economic loss could lead to her deciding to rather go back to her previous job.

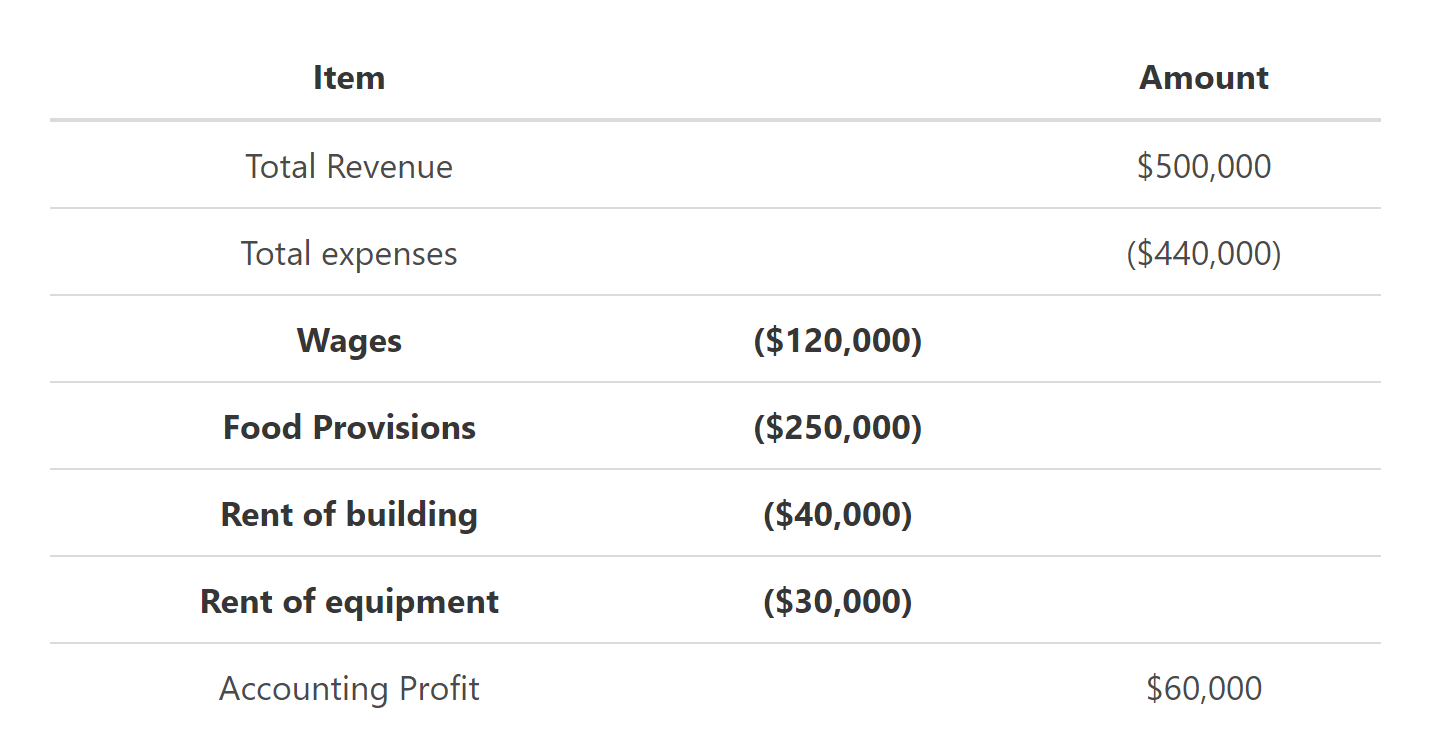

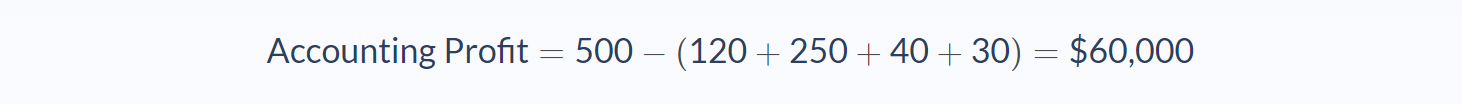

Example 3: Freddy decide to leave his work as a doctor to start a pub. He earned $220,000 per annum as a doctor. In 2018 his new pub made a revenue of $500,000.

Freddy has the following expenses:

- Wages– $120,000

- Food Provisions – $250,000

- Rent of building – $40,000

- Rent of Equipment – $30,000

What is the accounting profit for Freddy’s pub in 2018?

What is the economic profit for Freddy?

Freddy did earn a profit of $60,000 but he has an economic loss of $160,000. If he is rational, he will still see the accounting profit as a profit but having such a big difference in the economic profit might convince him to move back to being a doctor.

Accounting Profit Conclusion

- Profit or income is the amount of money that exceeds your expenses, costs, and taxes for a specific period.

- Profit is calculated by subtracting all expense incurred during a period from the total revenues earned in the same accounting period.

- The three major types of accounting profit are Gross profit, Operating profit and Net profit.

- Cash profits are considered the real profit where accounting profit is a theoretical profit. Cash profits take into consideration the inflow and outflow of the actual cash of the business.

FAQs

1. What is accounting profit?

Accounting profit is the amount of money that a company earns through its operations, minus the costs of doing business. To calculate accounting profit, companies subtract all of their expenses from their total revenue for a given period. This number is then used to measure the company's financial performance over that particular time frame.

2. How do you calculate accounting profit?

To calculate accounting profit, companies first need to determine their total revenue for a given period. This is done by adding up all the money that they have earned through sales and other income sources. Once this number has been established, businesses then need to subtract all their expenses from it.

3. What is an example of accounting profit?

One example of accounting profit would be a company that has earned $100,000 in revenue throughout a given year but has incurred expenses totaling $90,000. This company would have an accounting profit of $10,000.

4. Why is accounting profit important?

Accounting profit is important because it provides businesses with a snapshot of their financial standing at a given point in time. This information can be used to make strategic decisions about the future of the company and determine whether it is profitable to continue doing business as usual.

5. What are the key differences between accounting profit and economic profit?

The key difference between accounting profit and economic profit is that accounting profit only considers the company's financial performance, while economic profit also accounts for the company's costs of capital. Additionally, economic profit takes into consideration the opportunity cost of using resources for a particular purpose.