The accumulated depreciation to fixed assets ratio is a measurement to compare the amount of depreciation for a physical asset with its total value. In accounting, depreciation is a method that calculates the cost of a physical asset over its life expectancy. The number that comes from depreciation shows how much of the asset has been used. In other words, the accumulated depreciation ratio indicates the overall remaining usefulness of an asset.

Most physical assets owned by an entity, whether an individual or corporation, will most likely decrease in value over time after being used. If you were to sell your laptops, phones, or TVs, you will usually get a lower amount of money compared to the amount you pay when you buy them.

This happens because your assets are depreciated over time, thanks to wear and tear. Accumulated depreciation to fixed assets tries to estimate how much value these tangible assets have been lost compared to their original cost by these wears and tears.

Accumulated depreciation is only an estimation and does not reflect the price at which the asset can be sold. Normally, the value of accumulated depreciation can be found on the balance sheet.

Formula

To start with, we need to know the value of the asset’s accumulated depreciation. To calculate this variable, several methods can be used. Each company adopts one of these methods. One such method is called straight-line depreciation. Apparent from its name, this method estimates an asset depreciation in a straight manner. For instance, a car is depreciated by $2,000 each year over its estimated useful life, let’s say seven years. In this case, after seven years, the value of the car is depreciated by $14,000 from its initial value.

The next variable we need is the value of total fixed or physical assets. Physical assets are economic material that has real-world existence and directly contribute to businesses to generate revenue. Things such as cars, buildings, and computers are some the examples of physical assets. These assets are not intended for sales and typically stay with businesses for as long as they can or if they decide to replace them. However, if these assets are intended for sales by some companies like electronic shops or vehicle shops, they are considered inventory.

Often, people refer to physical assets as fixed assets, both of which are part of tangible assets. These two terms are usually pointing to the same thing: property, plant, and equipment (PP&E). PP&E value can be found on the balance sheet and that’s the value we use for the total physical assets variable.

One important thing to note is that we don’t include lands when evaluating the accumulated depreciation ratio of physical assets. While the land is still a part of PP&E they typically don’t depreciate. This is contradictory to other assets in PP&E, so be careful not to include lands in your calculation.

Example

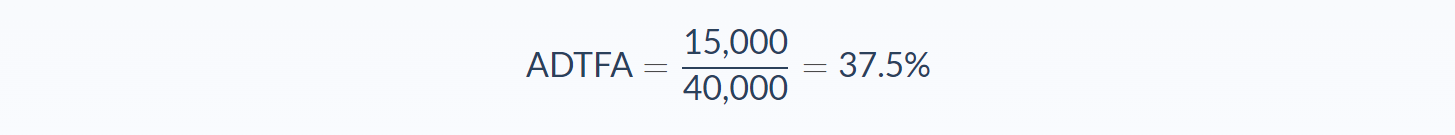

An accountant for a company wishes to determine the accumulated depreciation ratio for her company’s physical assets. To do this, she needs to review the variable needed from the balance sheet. The value of property, plant, and equipment (PP&E) save for lands is found to be $40,000. On the other hand, the value of accumulated depreciation from these assets is $15,000. What is the accumulated depreciation ratio?

- Total physical assets: $40,000

- Accumulated depreciation: $15,000

We can apply the values to our variables and calculate the accumulated depreciation to fixed assets ratio:

In this case, the accumulated depreciation to fixed assets ratio would be 0.375 or 37.5%.

From this result, we can conclude that the physical assets or fixed assets of the company have been, overall, depreciated by 37.5% from their original costs. Keep in mind that these results are aggregated and don’t reflect each of the depreciation of the assets. Some of them would have a higher or lower accumulated depreciation ratio individually.

Analysis

The accumulated depreciation ratio can be an essential tool for companies that want to estimate the general remaining usefulness of their physical assets. If they see that the ratio is too high for comfort, they can opt to investigate which assets mostly contribute to the large depreciation ratio. Then, they may replace these assets efficiently by selling and replacing them or by purchasing them with loans.

Accumulated depreciation in itself as part of the accumulated depreciation ratio equation is also important. Companies implement depreciation for their assets for accounting and tax reasons. Depreciation is part of contra assets, which is a negative account that is paired with each of the appropriate assets. Depreciation doesn’t cost companies anything but it still contributes to reducing companies’ revenue. With reduced revenue, companies can lower the potential taxes that need to be paid. This aspect is one of the most attractive things about accumulated depreciation for businesses.

Please note that corporations still need to comply with the generally accepted accounting principle (GAAP) when calculating the variable. They cannot give an arbitrarily value to accumulated depreciation to further decrease tax.

One last thing to note is that the accumulated depreciation ratio may not provide an accurate picture if accumulated depreciation is not calculated properly. Companies may have very little or very big metrics compared to their assets’ real condition so they may be either replacing these assets too soon or too late. Both possibilities may cost more money than needed.

Conclusion

- The accumulated depreciation to fixed assets ratio is a metric indicating the portion of accumulated depreciation of total physical assets or fixed assets.

- This formula requires two variables: accumulated depreciation and total physical assets.

- Physical assets—or fixed assets—are usually recorded on the balance sheet as property, plant, and equipment (PP&E).

- Companies use the accumulated depreciation ratio to get a general outlook of their physical assets’ remaining usefulness.

Calculator

You can use the accumulated depreciation ratio calculator below to quickly indicate the portion of accumulated depreciation of total physical assets or fixed assets by entering the required numbers.

FAQs

1. What is the accumulated depreciation to fixed assets ratio?

The accumulated depreciation to fixed assets ratio is the portion of accumulated depreciation on total physical assets or fixed assets.

2. How is the accumulated depreciation to fixed assets ratio calculated?

The accumulated depreciation to fixed assets ratio is calculated by dividing the accumulated depreciation by the total assets.

The formula is:

ADTFA = Accumulated Depreciation / Total Fixed Assets

3. What is a good accumulated depreciation to fixed assets ratio?

There is no definitive answer to this question as it depends on the company and its individual circumstances. However, the lower the ratio, the better as it suggests that the physical assets have been depreciated less.

4. What is the relation between the accumulated depreciation ratio and the fixed assets ratio?

The accumulated depreciation to fixed assets ratio is a component of the fixed assets ratio. The fixed assets ratio is calculated by dividing the total fixed assets by the net income.

5. What is the importance of accumulated depreciation to fixed assets ratio?

The accumulated depreciation to fixed assets ratio can be an essential tool for companies that want to estimate the general remaining usefulness of their physical assets.

If the ratio is too high for comfort, companies may replace these assets. Additionally, the accumulated depreciation ratio helps companies reduce their taxable income. However, it is important to note that this metric may not be accurate if accumulated depreciation is not calculated properly.