First and foremost, the age 59½ withdrawal rule applies only to traditional IRA accounts and 401(k) plans.

Second, the money that you withdraw must be considered taxable income. This means that it will be included on your tax return for the year in which you withdrew the money.

If you are thinking about withdrawing money from your retirement account, it is important to understand the tax implications involved.

You may want to speak with a tax professional to learn more about age 59½ withdrawal rules and taxation.

IRA Withdrawals: Age 59½ and Under

When you withdraw money from your IRA before age 59½, there are two penalties for early withdrawal that apply: an additional tax penalty of 10% and state income taxes (if applicable).

The 59½ age limit is set by the IRS so that people do not use their retirement savings as a way to avoid paying taxes.

Traditional IRA Rules

There are a few exceptions to the age 59½ rule that allow you to take money out of your IRA without incurring the additional tax penalty. These include:

- You become disabled or die and need the funds to pay for expenses related to these events

- The withdrawal is used to pay for unreimbursed medical expenses that exceed a specific amount.

- The withdrawal is used to pay for medical insurance payments when you are unemployed or have a loss of income due to disability. However, you must have been laid off from work and not be seeking new employment.

- The withdrawal is used as an investment in a first home purchase.

- The withdrawal is a part of a series of substantially equal periodic payments (SEPP). This exception applies to those who have retired and are taking distributions from their retirement account.

- The withdrawal is used for birth or adoption expenses. If you are a new parent, you may be wondering if you can withdraw money from your retirement account to pay for expenses related to the birth or adoption of your child.

The good news is that you can. The IRS has recently announced that parents can now withdraw up to $5,000 from their retirement account without incurring the additional tax penalty.

This applies to both birth and adoption expenses. Keep in mind that this is just a one-time exemption, and any additional withdrawals will still incur the 10% penalty.

- The withdrawal is used as an investment in higher education tuition, fees, books, and supplies. This restriction is set by the IRS to encourage people not to use their retirement funds for educational purposes.

- Under certain circumstances, if the account owner dies, their beneficiary can make penalty-free withdrawals from an inherited Roth IRA.

If you are thinking about taking an early withdrawal from your IRA, be sure to check the age 59½ withdrawal rules to see if you qualify for an exception.

If you do not qualify for one of the exceptions, you may have to pay a penalty in addition to income taxes on the withdrawal amount.

Please consult a tax professional about additional age restrictions that pertain to your specific retirement account and state laws.

Taking Out a 401(k) Loan

As an alternative to taking a withdrawal from your IRA, you may want to consider taking out a loan from your 401(k) account.

This option allows you to borrow money from your retirement savings without having to pay the additional tax penalty.

Keep in mind that you will still have to pay income taxes on the amount that you borrow, but you will not have to pay the additional tax penalty.

If you qualify, this can be a good option for those who need money quickly and do not want to wait until turning 59 ½.

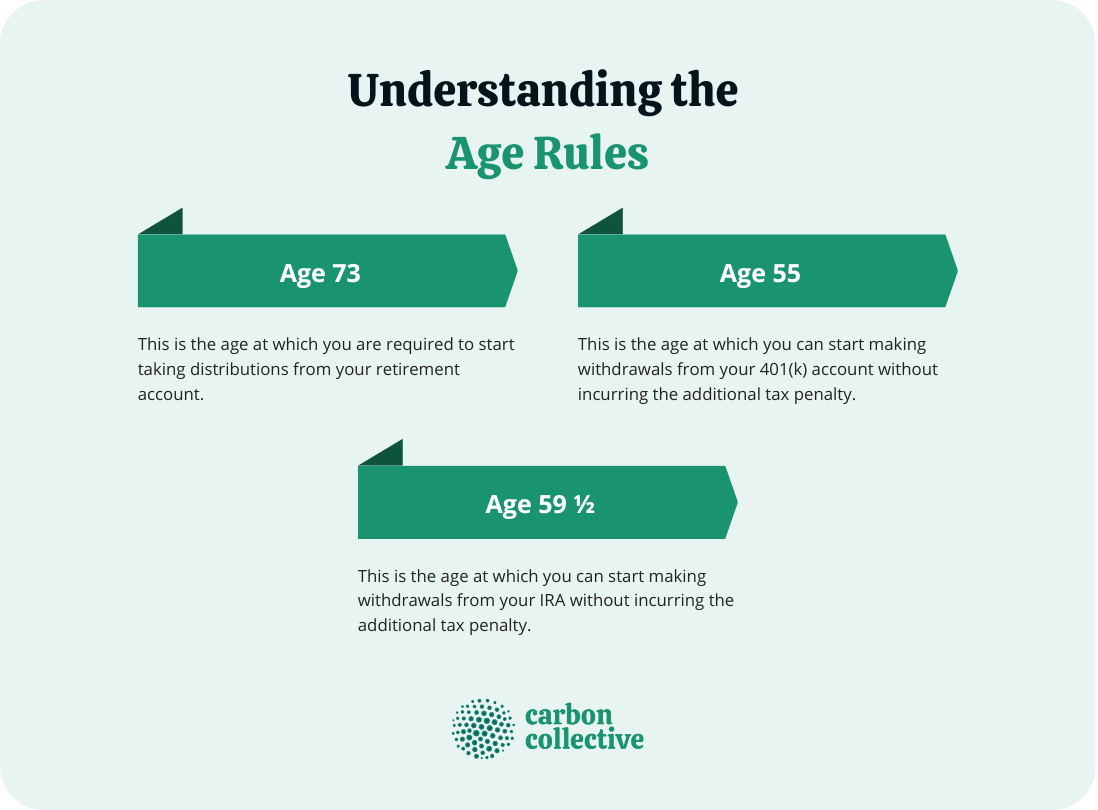

Understanding the Age Rules

Aside from the early withdrawal and the age 59½ rule, other age restrictions apply to your retirement accounts. Below explains the other age restrictions:

- Age 73. This is the age at which you are required to start taking distributions from your retirement account. The amount that you must take out will depend on the type of account you have and how it is set up.

- Age 59 ½. This is the age at which you can start making withdrawals from your IRA without incurring the additional tax penalty.

- Age 55. This is the age at which you can start making withdrawals from your 401(k) account without incurring the additional tax penalty.

Keep in mind that this age restriction only applies to those who were laid off, fired, or quit their job after age 55 but before age 59 ½.

If you left your job for any other reason, you will not be eligible to take early withdrawals from your 401(k) account.

Each retirement account has its own age restrictions, so be sure to consult a tax professional to find out what applies to your specific account.

The Bottom Line

The age 59½ withdrawal rule is an important one to understand if you are thinking about withdrawing money from your retirement account.

There are a few exceptions that allow you to take withdrawals without incurring the additional tax penalty, but most people will need to wait until age 59½.

If you do not qualify for one of the exceptions, you may have to pay a penalty in addition to income taxes on the withdrawal amount.

Be sure to consult a tax professional about additional age restrictions that pertain to your specific retirement account and state laws.

As an alternative to taking a withdrawal from your IRA, you may want to consider taking a loan from your 401(k) account. This option allows you to borrow money from your retirement savings without having to pay the additional tax penalty.

You will still have to pay income taxes on the amount that you borrow, but you will not have to pay the additional tax penalty. If you qualify, this can be a good option for those who need money quickly and do not want to wait until age 59½.

In addition to the early-withdrawal and age 59½ rules, there are other age-related restrictions you should take into consideration when thinking about your retirement accounts.

FAQs

1. I am 56 and want to retire. Do I have to start taking distributions from my retirement account at age 73?

No, you do not have to take distributions from your retirement account at age 73. The amount that you must take out will depend on the type of account you have and how it is set up.

2. What age can I start taking withdrawals from my IRA without incurring the additional tax penalty?

You can start making withdrawals from your retirement account at age 59 ½. This age restriction applies to both traditional and Roth IRAs. However, some exceptions allow you to make early withdrawals without incurring an additional tax penalty.

3. I am 55 and want to make early withdrawals from my 401(k). Will I have to pay a penalty?

Yes, if you withdraw money from your retirement account before age 59 ½, you may be subject to an additional tax penalty. However, age 55 is the age at which you can start making early withdrawals from your 401(k) without incurring an additional tax penalty.

4. I am 59 and want to retire. Can I take money out of my retirement account without having to pay a penalty?

Yes, you can make a withdrawal from your retirement account at age 59 ½. This age restriction applies to both taxable and tax-deferred accounts. However, some exceptions allow you to make early withdrawals without incurring an additional tax penalty.

5. I am 55 and want to retire, but I need money for living purposes. Can I withdraw money from my retirement account without penalty?

There are a few exceptions that allow you to take withdrawals from your retirement account before age 59 ½. However, most people will need to wait until age 59 ½. If you do not qualify for one of the exceptions, you may have to pay an additional tax penalty on top of income taxes on the withdrawal amount.