What Is an Annuity?

An annuity is an investment where you agree to make a set payment, or series of payments, to an insurance company in return for regular income payments. These payments are usually made over a set period, such as five or ten years.

Insurance companies have created a new class of financial products around the concept, which combines long-term investment with a payment stream. Products like annuities are unique because they offer a payment stream to investors for the rest of their life.

Wealthy individuals can typically live comfortably off the income from their assets. What remains of these investments then tends to pass to their heirs or charitable organizations.

For people not so fortunate, an annuity can offer them peace of mind. Annuities can be a great solution for people who live off the income from their investments but might run out before passing on.

Annuities are a good investment for people looking for a way to save for retirement and want to have a steady stream of income. It mostly benefits individuals in their 50s and 60s since they are closer to retirement.

It is like having money that never dividends or withdraws from its original deposit - it just sits there and grows over time! This is perfect for those wanting to leave something behind when they pass on after providing years upon decades of contributions in return.

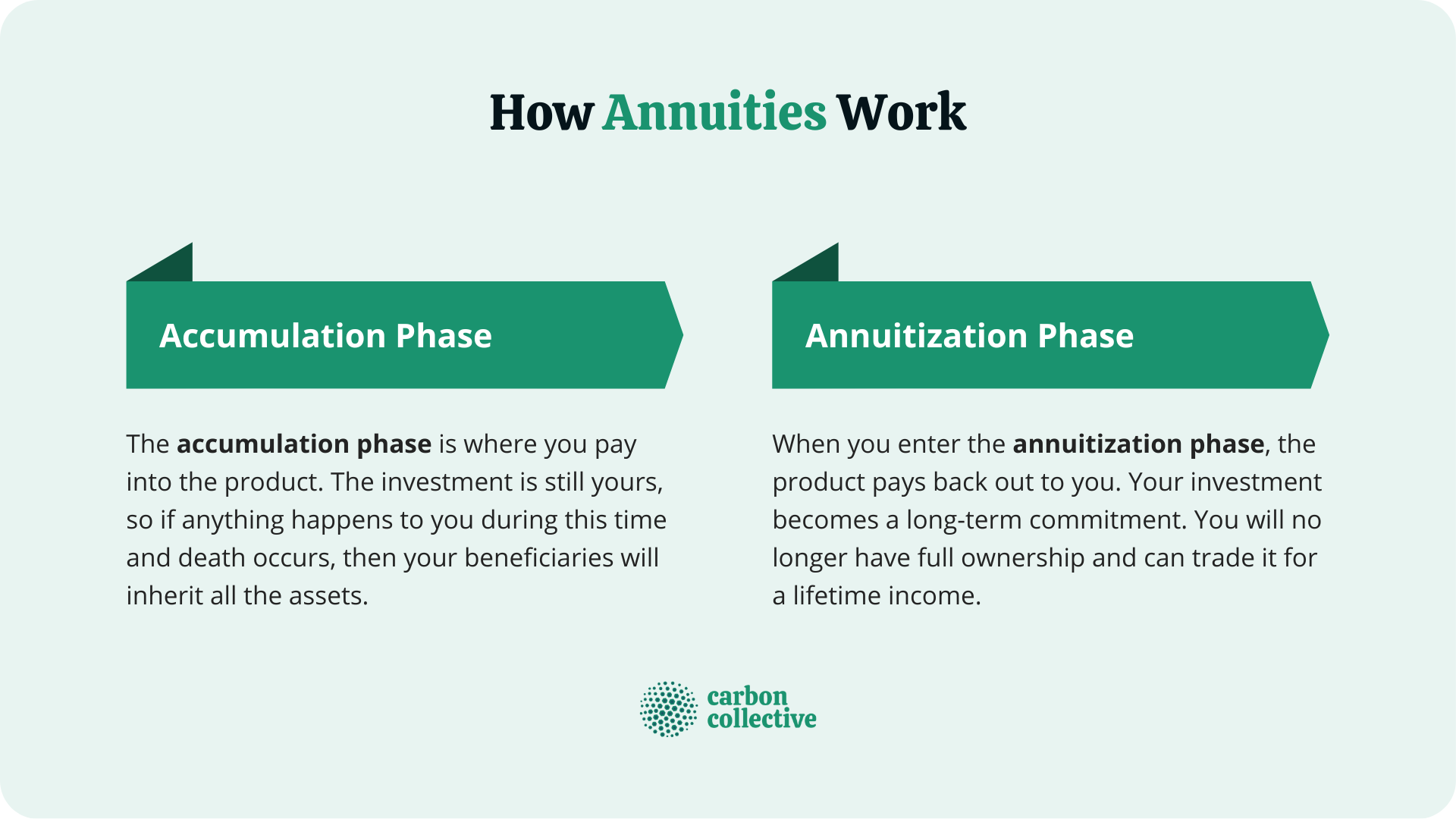

There are two basic components to an annuity: investment and payout. In insurance jargon, they are called the accumulation and the annuitization phase.

What makes them unique is the payout, which distributes all investments and their earnings back to investors as fixed streams of payments for as long they live.

This is the only investment product that works this way. Stocks and bonds may offer streams of revenue, but they do not include the principal on those payments.

This investment plan is like betting on how long you will live. If the individual lives beyond their average life expectancy, they continue to receive income, but if they die sooner, nothing will remain from that investment.

How Annuities Work

An annuity is a contract between an investor and insurance company that contains options and parameters specific to your agreement, coupled with a great deal of legalese. Some key terms include:

- Accumulation Phase

The accumulation phase is where you pay into the product. The investment is still yours, so if anything happens to you during this time and death occurs, then your beneficiaries will inherit all the assets.

In addition, your investment grows on a tax-deferred basis.

Investors have the choice of when they want to proceed from the first phase into the second one. But the longer you wait, the larger your investment grows.

It means that when it is time for annuitization - paying out of all those investments over many years with interest - then there will be even more money coming back.

- Annuitization Phase

When you enter the annuitization phase, the product pays back out to you. Your investment becomes a long-term commitment. You will no longer have full ownership and can trade it for a lifetime income.

If you die during this period, no one gets anything further from your account. That is because it all goes towards fulfilling your obligations (inherited risk). Also, distributed income during this phase is at least partially taxable.

What Is Annuity Income?

Your annuity income is like a monthly cash flow for life. You receive this payment from the insurance company once you have purchased your contract, and it is usually provided in perpetuity or until death.

Qualified vs Non-Qualified Annuities

With the passage of new tax legislation, annuities are now fundable with pre-tax or post-tax money. When an annuity is funded with pre-tax money, it is qualified, and when funded with post-tax money, it is non-qualified.

Surrender Period

When you invest in an annuity, there will typically be a surrender period during which investors are subject to high charges. It can be as long as six to eight years, and the penalties are expensive. This is because it is considered an early withdrawal, and investors could face penalties as high as 10% for this reason.

Riders

Riders are contract add-ons that can be added to an existing basic annuity. The typical rider might provide guaranteed minimum income or death benefits during annuitization.

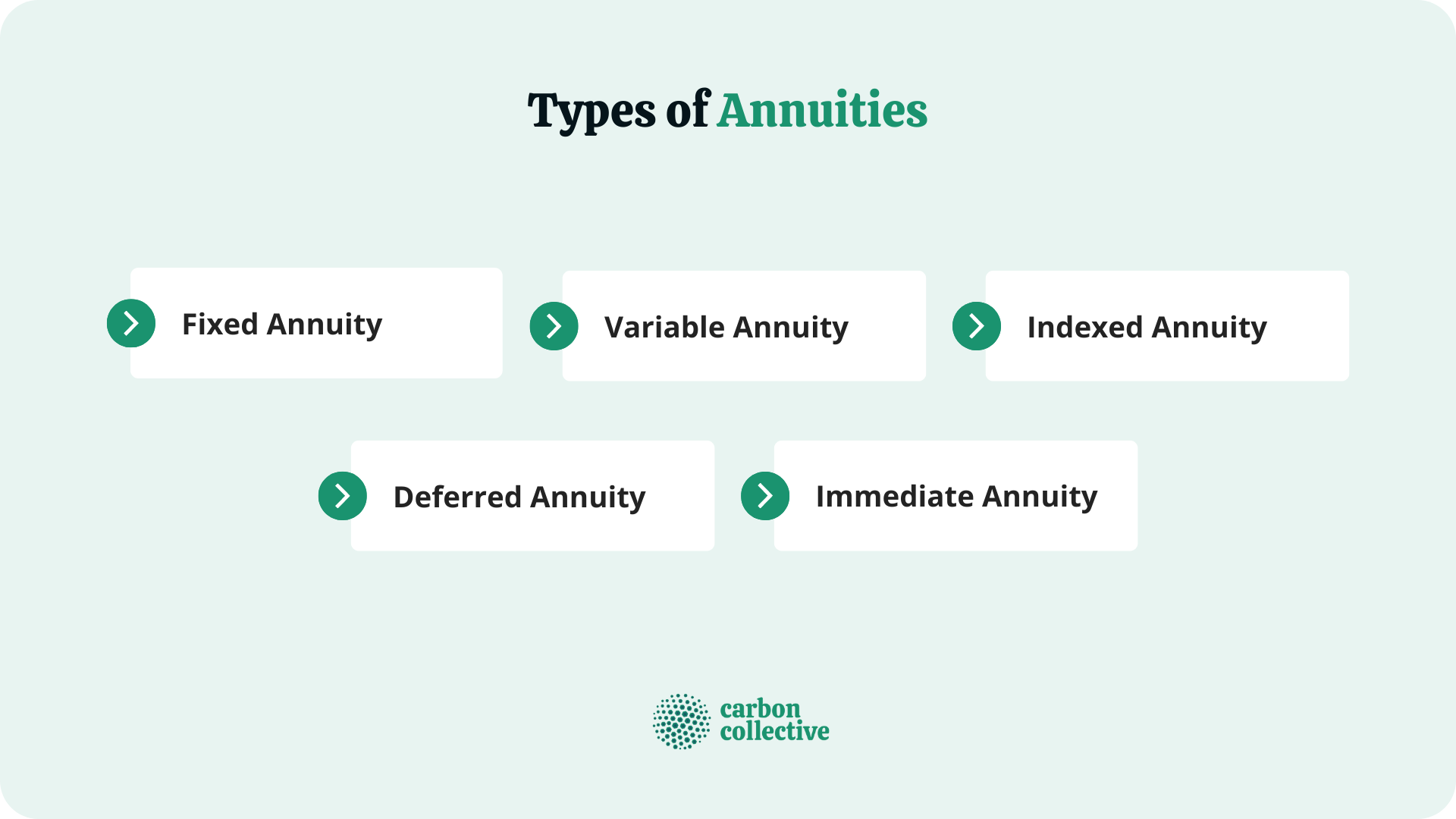

Types of Annuities

The annuity is a great way to diversify your investments and enjoy a steady income. There are different types of annuities, and they all have their own set of options.

Each one offers unique features and benefits, so it is crucial for you to know which ones fit your needs best before making any decisions. An individual can choose one or a combination of the following:

- Fixed Annuity

When you buy a fixed annuity, your investment is guaranteed to earn an agreed-upon rate of return throughout the accumulation phase.

- Variable Annuity

Variable annuities provide an opportunity for investors to earn a rate of return commensurate with the performance in financial markets during the accumulation phase.

- Indexed Annuity

Indexed annuities are a hybrid of fixed and variable rates, with characteristics from both. They will usually have a minimum return that cannot go below what is guaranteed by an index, such as the S&P 500 Index, so it protects your money even more.

- Deferred Annuity

With a deferred annuity, you can invest money into the contract at any time during an accumulation phase. This is a great way to save for retirement if you are not yet ready.

- Immediate Annuity

You might be interested in an immediate annuity if you have accumulated assets on your own and who want to convert those funds immediately into a lifetime of savings.

For example, a person liquidating their 401(k) plan for retirement might select this type, as they are still able-bodied at age 65.

Annuity Withdrawal, Taxes, and Beneficiaries

Annuities can be a great way to supplement other sources of retirement income, but it is important to understand how they work before you purchase one. This includes understanding how annuity withdrawals and taxes work, as well as how your beneficiaries can receive payments from an annuity after you die.

Annuity Withdrawals

Generally, you can begin withdrawing money from an annuity at age 59 1/2. However, if you withdraw money before age 59 1/2, you may have to pay an early withdrawal penalty. Additionally, you will owe taxes on any money you withdraw from an annuity that has not yet been taxed.

If your annuity is an annuity for life, then you will continue to receive payments as long as you live, even if the account value runs out. However, if your annuity is not an annuity for life, then payments will stop once the account value is exhausted.

Taxes on Annuity Withdrawals

The IRS taxes annuity withdrawals as ordinary income. This means that you will pay taxes on any money you withdraw at your marginal tax rate.

Your beneficiaries will also owe taxes on any money they receive from your annuity after you die. However, if your beneficiaries are your spouse, they may be able to avoid paying taxes on the money by rolling it over into their own retirement account.

If you are over age 59 1/2 and have held the annuity for at least five years, you can elect to have a portion of each payment treated as tax-free return of principal. This can help reduce the amount of taxes you owe on your withdrawals.

Beneficiaries and Annuities

If you die, your beneficiaries can receive payments from your annuity. If you have designated a beneficiary, the payments will go to that beneficiary. If you have not designated a beneficiary, the payments will go to your estate.

Generally, you can designate any person or entity as a beneficiary. However, if you are married, your spouse may have to consent to the beneficiary designation in some cases.

It is important to keep your beneficiary designation up to date. If you do not, the payments from your annuity may go to someone you did not intend to receive them.

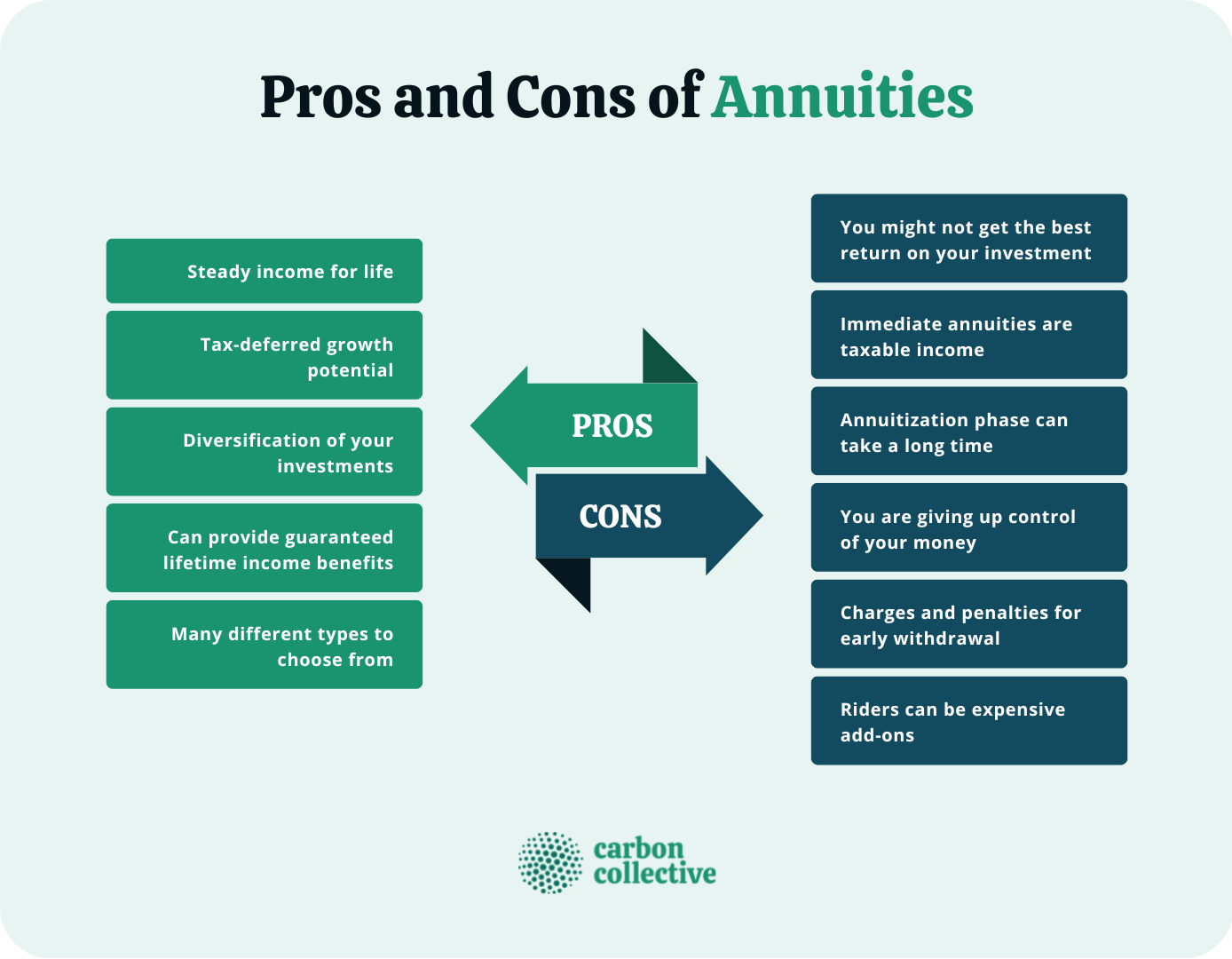

Pros and Cons of Annuities

Like any investment, annuities come with pros and cons. Let's take a look at some of the most crucial:

Annuity vs. Mutual Fund or ETF

There are a few key differences between annuities and mutual funds or ETFs.

First, annuities are insurance products, while mutual funds and ETFs are investment products. This means that annuities come with certain guarantees, such as a death benefit, that mutual funds and ETFs do not offer.

Second, annuities are typically more expensive than mutual funds or ETFs. This is because annuities come with fees for things like the death benefit and other guarantees.

Third, annuities typically have higher investment minimums than mutual funds or ETFs. This is because they are designed for long-term investing, and the insurance company wants to make sure you can commit to that.

Fourth, annuities have a different tax treatment than mutual funds or ETFs. With an annuity, you pay taxes on the money when you withdraw it, while with a mutual fund or ETF, you pay taxes on the gains as they occur.

Finally, annuities and mutual funds or ETFs can be used for different purposes. Annuities are typically used as a retirement income product, while mutual funds and ETFs can be used for a variety of purposes, including but not limited to saving for retirement.

The Bottom Line

Annuities are a great way to save for retirement and can provide a steady stream of income. There are many types available, so it is important to do your research before making any decisions.

Be sure to weigh the pros and cons before investing in an annuity. Consult a trusted advisor if you must.

FAQs

1. What happens to my annuity if I pass away?

If you die in the accumulation phase, your beneficiaries will inherit all the money or assets agreed in the contract. If you die during the annuitization phase, your beneficiary will receive nothing, although some annuities offer life insurance as an add-on.

2. Why invest in an annuity instead of a mutual fund or ETF?

Annuities are designed to provide a steady stream of income for life, while mutual funds and ETFs are not. Annuities also offer tax-deferred growth potential, which can prove beneficial if you are looking to save for retirement.

3. Can you cash in an annuity at any time?

Yes, but there are penalties for withdrawing money from an annuity before you reach the age of 59 1/2. Some annuities also have surrender charges assessed for early withdrawal.

4. Who is the best candidate for buying an annuity?

Annuities are a good investment for people looking for a way to save for retirement and want to have a steady stream of income. It mostly benefits individuals in their 50s and 60s since they are closer to retirement.

5. Will a beneficiary have to pay taxes on the annuity?

Yes, annuities are taxable income. The amount of taxes you will pay depends on the type of annuity you have and your tax bracket.