What Is an Asset?

An asset can be used to generate value for a business or individual. The word asset is derived from the Latin ad satis, which means "to sufficiency."

It is important to note that not all assets are liquid, meaning they cannot immediately be converted into cash.

Assets are important because they can be used to generate revenue or reduce expenses. They can also be used as collateral for loans or investments.

How Do Assets Work?

Assets are either on the balance sheet or off the balance sheet. On the balance sheet assets are those the company owns outright and appear as a line item on the balance sheet.

Off-balance sheet assets are those the company does not own outright but has some sort of financial stake. These assets are not reflected on the balance sheet but may be included in other financial statements.

Different Types of Assets

There are many kinds of assets, but they can generally be divided into two categories: physical and intangible.

Physical assets, such as land, buildings, machinery, vehicles, and inventory are tangible.

Intangible assets are those that do not have a physical form, such as patents, copyrights, trademarks, and goodwill.

Examples of Assets

Here are a few examples of assets:

- Cash: This is the most liquid asset, as it can be immediately converted into other assets or used to pay debts.

- Accounts receivable: This is money that is owed to the company by customers for goods or services that have been delivered.

- Inventory: This is the raw material, work-in-progress, and finished goods that a company has on hand.

- Prepaid expenses: This is money that has been paid for expenses that have not yet been incurred.

- Investments: Money invested in stocks, bonds, or other securities.

- Property, plant, and equipment: This includes land, buildings, machinery, vehicles, and furniture.

- Intangible assets: This includes patents, copyrights, trademarks, and goodwill.

Classifications of Assets

Assets can also be classified as either current or noncurrent.

Current assets are those that will be converted into cash within one year. These assets are important because they help a company pay its short-term liabilities.

Examples of current assets include cash, accounts receivable, and inventory.

Noncurrent assets will not be converted into cash within one year. These assets are important because they help a company finance its long-term growth.

Examples of noncurrent assets include property, plant, and equipment, as well as intangible assets such as patents and copyrights.

Relationship Between Assets, Liabilities, and Equity

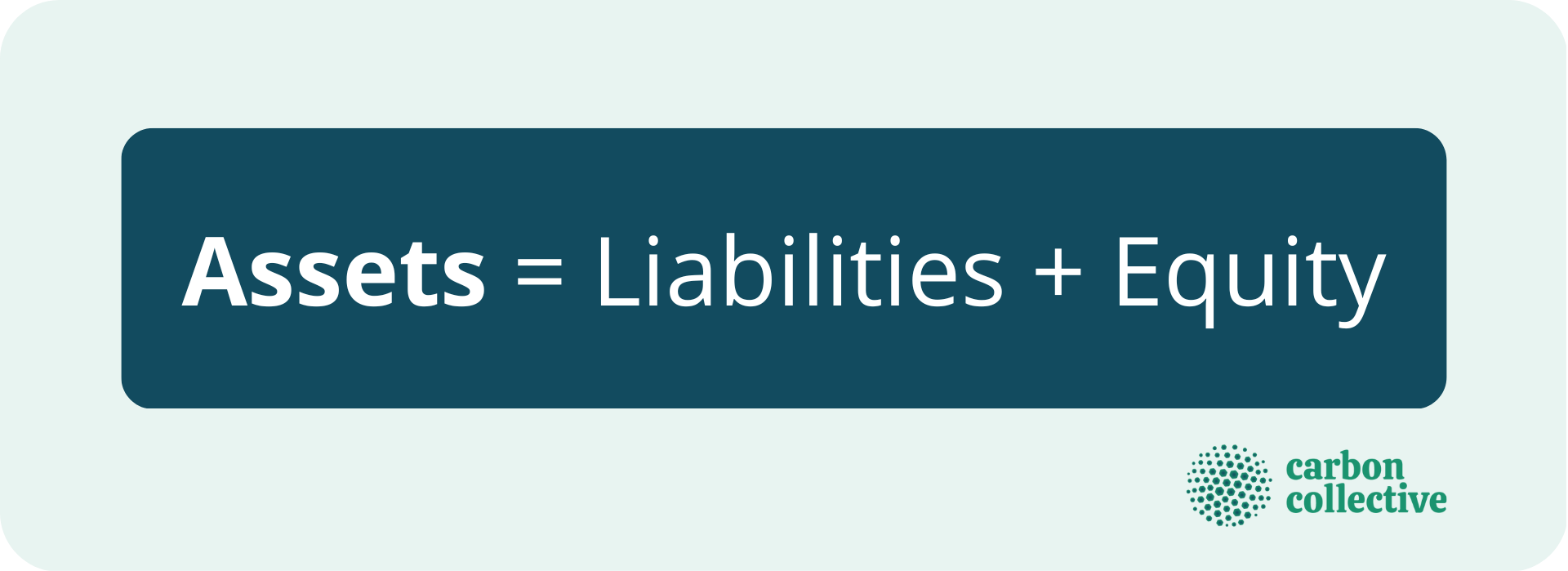

The relationship between assets, liabilities, and equity is known as the accounting equation. This equation states that assets are equal to the sum of liabilities and equity.

This equation is important because it shows that either debt or equity finances a company's assets.

Debt is represented by liabilities, while equity represents the owners' investment in the company.

The accounting equation is expressed as follows:

The Bottom Line

An asset can generate value for a business or individual. Assets are either on the balance sheet or off the balance sheet.

There are many different types of assets, but they can generally be divided into two categories: physical and intangible.

Examples of assets include cash, accounts receivable, inventory, prepaid expenses, investments, property, plant, and equipment, and intangible assets such as patents, copyrights, trademarks, and goodwill.

Assets can also be classified as either current or noncurrent. Current assets will be converted into cash within one year, while noncurrent assets will not be converted into cash within one year.

The relationship between assets, liabilities, and equity is known as the accounting equation. This equation states that assets are equal to the sum of liabilities and equity.

FAQs

1. What is an asset?

An asset is anything that can generate value for a business or individual. Assets are either on the balance sheet or off the balance sheet.

2. What are the different types of assets?

There are many different types of assets, but they can generally be divided into two categories: physical and intangible.

3. What is the difference between a current and noncurrent asset?

A current asset is an asset that will be converted into cash within one year, while a noncurrent asset is an asset that will not be converted into cash within one year.

4. What is the relationship between assets and liabilities?

The relationship between assets and liabilities is known as the accounting equation. This equation states that assets are equal to the sum of liabilities and equity.

5. What is the importance of assets?

Assets are important because they can be used to generate revenue or reduce expenses. They can also be used as collateral for loans or investments.