The asset coverage ratio determines a company’s capacity to pay its debt through its assets. The ratio indicates specifically how much of these assets will be needed for the company to settle its debts. The asset coverage ratio offers a glimpse into a business's financial state by measuring all its assets side by side with its financial obligations. Through this ratio, investors can predict how much the company will earn in the future as well as its chances of going bankrupt or insolvent.

Put simply, it’s a solvency ratio that measures a company’s ability to settle its short-term debts using its assets. If the business owns more assets than it has short-term debt and liabilities, lenders are more at peace with it, knowing it can well repay its debt, whether or not this is covered by the borrower’s earnings. Essentially, the higher the company’s asset coverage ratio, the more capable it is of paying its debt. Hence, a business with a high asset coverage ratio is considered less risky to creditors and investors compared to one with a low asset coverage ratio.

When companies issue shares of stock or equity for funding, they need not return the money to investors. But when they issue debt through a bond offering or seek financing from banks and other providers, they are required to pay the money back in a timely manner until the loan amount is returned in full. Because of this, banks and investors will always want to know if a company’s earnings are enough to pay for its future debts, and what will probably happen if its profits suffer.

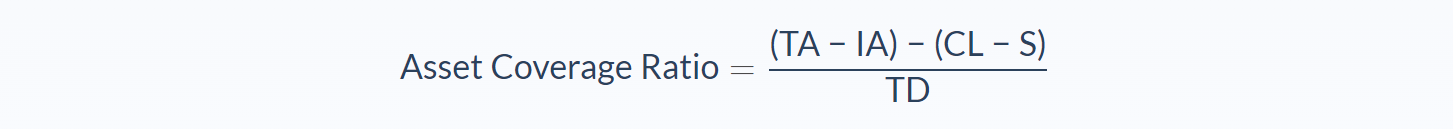

Asset Coverage Ratio Formula

- TA = total assets

- IA = intangible assets

- CL = current liabilities

- S = short-term debt

- TD = total debt

The formula uses tangible assets, which are the total assets less the intangible assets (assets with no physical form, like intellectual property or goodwill).

It also subtracts the short-term debts that must be paid within a year from the total current liabilities.

The resulting liabilities value is then subtracted from the tangible assets and divided by the total debt amount to give us the asset coverage ratio value.

In most cases, a company defines the minimum asset coverage ratio it should maintain to keep it from incurring debt outside a preset limit. The company can avoid the temptation of borrowing too much money, reducing the possibility of bankruptcy. An asset coverage ratio of 1.5 is considered acceptable for utility companies and 2 for industrial and publicly held companies.

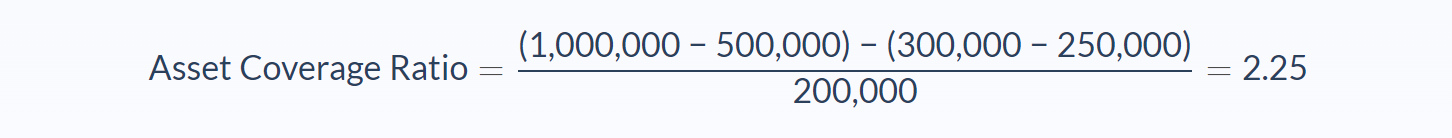

Asset Coverage Ratio Example

The investment firm, EV Ventures, would like to assess its solvency by using several financial metrics, including the asset coverage ratio. The financial statements show the following: it finds that its tangible assets (total assets – intangible assets) amount to $1.175m, its current liabilities are worth $435m, its short-term debts total $312m and finally, its total debt is $450m. What is the company’s asset coverage ratio?

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Total assets: $1,000,000

- Intangible assets: $500,000

- Current liabilities: $300,000

- Short-term debt: $250,000

- Total debt: $200,000

We can now apply the values to our variables and calculate the asset coverage ratio:

In this case, EV Ventures would have an Asset Coverage Ratio of 2.25.

An asset coverage ratio of 2.25 indicates that EV Ventures is capable of settling its debts based on its assets. Investors want a ratio of at least 2, which is the standard for investment firms. In general, an asset coverage ratio of more than 1x is a positive sign. But the industry directs what is considered acceptable. For instance, for utility companies, 1.0x-1.5x is already good enough, but for capital goods companies, the desirable range is 1.5x-2.0x.

Asset Coverage Ratio Analysis

If a company’s earnings fall short of covering its company’s financial liabilities, the business may have to generate cash by selling some of its assets. The asset coverage ratio shows how many times the company can pay its debts through its assets in case its earnings become insufficient.

However, there are a few flaws of the asset coverage ratio that must be considered by anyone who uses it. One is the fact that the ratio is based on a company’s ‘book value’. This means the ratio could be higher than it appears and may offer an unrealistically optimistic picture of the company and its capacity to settle its obligations.

According to analysts, this can be remedied by valuing assets at their actual depreciated value, which easily provides a more realistic reflection of the company’s ability to cover its debt through its assets.

Another way to prevent skewed results is to compare the company’s ratio with the ratios of other companies that are in the same industry. This makes the result more reliable as it is based on a more comprehensive body of data. Like other financial metrics, the asset coverage ratio is not helpful enough and may even provide a false picture when used standalone.

Also, this ratio will likely be more informative and useful to businesses when used with many other performance and coverage ratios to provide a more solid and accurate view of the company and its debt-paying abilities. Helpful as it is, the asset coverage ratio cannot offer helpful insight into a company’s true financial state unless taken during several periods, again for comparison purposes.

Asset Coverage Ratio Conclusion

- The asset coverage ratio shows how capable a company is of paying its debt through its assets.

- This formula requires five variables: total assets, intangible assets, current liabilities, short-term debt, and total debt.

- The asset coverage ratio is expressed as a number.

- A higher asset coverage ratio indicates a greater ability to settle a debt.

- High asset coverage ratio is considered to be less risky.

Asset Coverage Ratio Calculator

You can use the asset coverage ratio calculator below to quickly calculate how capable a company is of covering its debt through its assets by entering the required numbers.

FAQs

1. What is the asset coverage ratio?

The asset coverage ratio is the calculation of a company's ability to cover its liabilities with its assets. The asset coverage ratio offers a glimpse into a company's overall financial stability and debt-paying abilities.2. How is the asset coverage calculated?

The asset coverage ratio is calculated by using the following formula:Asset Coverage Ratio = (TA−IA)−(CL−S) / TD

where:

TA = total assets

IA = intangible assets

CL = current liabilities

S = short-term debt

TD = total debt

3. What does the asset coverage ratio show us?

The asset coverage ratio shows how capable a company is of paying its debt through its assets. The higher the number, the more capable the company is of covering its liabilities.4. What is a good asset coverage ratio?

There is no definitive answer when it comes to what a good asset coverage ratio is. This number will vary depending on the company and the industry it is in.However, most analysts agree that a ratio of 1.0x-1.5x is already good enough, but for capital goods companies, the desirable range is 1.5x-2.0x or even higher.

5. What are the problems with the asset coverage ratio?

The asset coverage ratio has a few flaws that must be considered before using it. One is that it is based on a company's book value, which can be misleading. Another issue is that the ratio may not be relevant when compared to companies in other industries.Additionally, this ratio should not be used in isolation and should be combined with other performance ratios to get a more accurate picture of the company's overall financial state.