The average collection period is an estimation of the average time period needed for a business to receive payment for money owed to them. This is particularly useful for companies that sell products or services through lines of credit. The average collection period is also referred to as the days to collect accounts receivable and as days sales outstanding.

Essentially, when you set out to find the average collection period, you are looking for the number of days it takes for the company to collect on their accounts receivable. So, if a company allows a customer to purchase an item using a line of credit, how long does it take them to get paid for that product?

Some businesses, like real estate, for example, rely heavily on their cash flow to perform successfully. They need to be aware of how much cash they have coming in and when so they can successfully plan. This can also be a helpful tool to compare the performance of one business to another. You can compare their average collection periods in contrast with the terms they set for their clients to determine how successful they are at collecting on debts.

Average Collection Period Formula

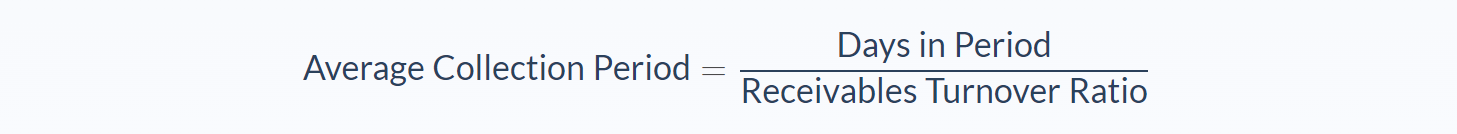

If you know the accounts receivable turnover ratio for the business, you can use the following, simplified calculation.

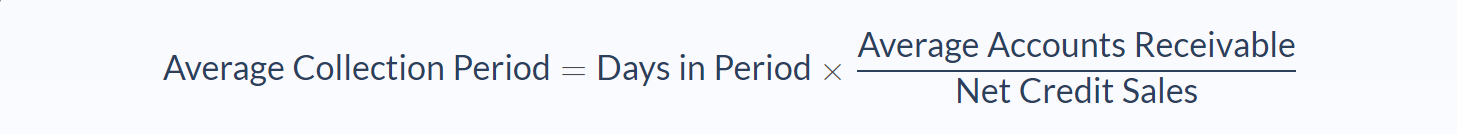

However, if you do not know the turnover ratio, you can use this formula instead:

If you are using a period of 1 year, you should be using 365 days in the period.

Also, remember that there is a difference between net sales and net credit sales. While net sales look at the total sales after returns, allowances, and discounts. Net credit sales also subtract the number of cash sales. Since we are focusing on credit collection, this would not apply to cash sales.

Typically, the lower the number, the better it is for the company. It means they would be getting paid at a faster rate. However, a rate that’s too low might deter customers. The repayment terms of the collection might be too soon for some, and they would go looking for credit options that had a longer repayment period.

If a company can collect the money in a fairly short amount of time, it gives them the cash flow they need for their expenses and operating costs. However, the longer the repayment period, the more energetic the company might need to become to collect the cash they need. This calculation is closely related to the receivables turnover ratio, which tells a company’s success rate in collecting debts from customers.

Average Collection Period Example

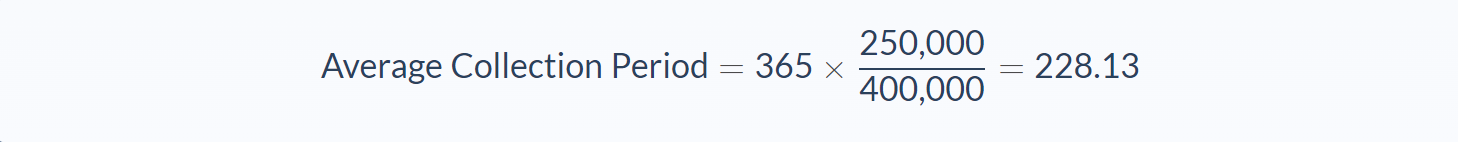

Becky just took a new position handling the books for a property management company. The business has average accounts receivable of $250,000 and net credit sales of $400,000 with 365 days in the period. Because their income is dependent on their cash flow from residents, she wants to know how the company has been doing with its average collection period in the past year.

Let’s break it down to identify the meaning and value of the different variables in this problem.

- Average Accounts Receivable: 250,000

- Net Credit Sales: 400,000

- Days in the period: 365

We can apply the values to our variables and calculate the average collection period.

In this case, the company has an average collection period of 228.13 days.

Using this same formula, Becky can do an estimate of other properties on the market. If her result is lower than theirs, then the company would probably be doing a good job at collecting rent due from residents. This is, of course, as long as their collection policies don’t turn away too many potential renters.

On the contrary, if her result is higher than the local market, she might want to think about adjusting the terms of payment in their lease to make sure they are paid in a more timely manner.

Average Collection Period Analysis

The average collection period is a great analytical tool to measure the efficiency of a company that allows credit lines as a method of payment.

One example of the need for this formula is in banking. Since bank services are focused almost completely on lending and receiving money from their customers, it is extremely important for them to have a consistent collection period for their financial security.

Additionally, since construction companies are typically paid per project (without a steady revenue stream), they also depend on this calculation. Since payments on these projects can fund other projects, they need to make sure clients are paying on time and in the correct amounts.

Property management and real estate companies would also need to be constantly aware of their average collection period. In property management, almost their entire cash flow is done on credit and dependent on tenants paying their rent monthly. If they are not able to successfully collect from their residents, it can affect the cash flow they have to purchase maintenance supplies, cover operating costs, or pay employees.

Average Collection Period Conclusion

- The average collection period estimates the average time it takes for a business to receive payments on the money owed to them.

- The lower the average collection period, the better for the company because they will be recouping costs at a faster rate.

- If the average collection period is too low, it can also be a deterrent for potential clients.

- With the accounts receivable turnover ratio, the average collection period formula involves only one additional ratio: days in the period

- Without it, the formula involves three variables: average accounts receivable, net credit sales, and days in the period

Average Collection Period Calculator

You can use the average collection period calculator below to easily estimate the time it takes for a company to collect on accounts receivable by entering the required numbers.

FAQs

1. What is an Average Collection Period?

The average collection period is the amount of time it takes a company to receive payments on the money that is owed to them. It is usually measured in days.

2. How is the average collection period calculated?

The average collection period is calculated by taking the average amount of time it takes a company to receive payments on their accounts receivable (AR) and dividing it by the net Credit Sales.

3. Why is the average collection period important?

The average collection period is important because it measures the efficiency of a company in terms of collecting payments from customers. A low average collection period is good for the company because they will be recouping costs at a faster rate. However, if the average collection period is too low, it can also be a deterrent for potential clients.

4. Is a lower average collection period better?

A lower average collection period is better for the company because it means they are getting paid back at a faster rate. This allows them to have more cash on hand to cover their costs and reinvest in the business.

5. What does it mean when the average collection period of a company is high?

When the average collection period is high, it means that the company is taking a long time to receive payments from their customers. This can be due to a number of factors such as slow-paying clients or the lack of credit terms offered to clients.